The Unlimited Power of Suppressing the Interest Rate

Interest-Rates / Economic Theory Jul 27, 2010 - 11:01 AM GMTBy: Thorsten_Polleit

Under today's fiat-money regimes, central banks, as a rule, control short-term interest rates. They do so by setting the interest rates on short-term loans extended to commercial banks (typically with maturities of one day, one week, two weeks, or one month).

Under today's fiat-money regimes, central banks, as a rule, control short-term interest rates. They do so by setting the interest rates on short-term loans extended to commercial banks (typically with maturities of one day, one week, two weeks, or one month).

By determining short-term interest rates, a central bank exerts a strong influence on longer-term interest rates (such as, for instance, 10-year bond yields). The expectation theory of the term structure of interest rates explains why this is the case.[1]

By determining short-term interest rates, a central bank exerts a strong influence on longer-term interest rates (such as, for instance, 10-year bond yields). The expectation theory of the term structure of interest rates explains why this is the case.[1]

In its simplest version it says that a long-term interest rate such as, for instance, the 10-year bond yield, is a weighted average of short-termed interest rates expected over the maturity of the credit contract.

An investor should, at a given point in time, be in a position either to make N consecutive investments in 1-period notes or to purchase a N-period bond, and both types of investment should yield the same return.

So the theory of the term structure of interest basically says that if and when the central bank governs market agents' expectations regarding the future path of short-term rates, it actually determines the longer-term interest rate.

However, a more elaborate version of the expectation theory of the term structure of interest rates assumes that, in addition to expected future short-term rates, risk premiums, inflation-expectation premiums, and liquidity premiums also determine the level of long-term interest rates.

If these premiums are constant over time, the central bank can still determine long-term interest rate via changing (market agents' expectations regarding future) short-term interest rates. However, if the premiums change abruptly and move erratically, the central bank's grip on long-term yields is weakened or, in an extreme case, breaks down.

This is what seems to happen as a consequence of the so-called "international credit-market crisis." Investors become increasingly concerned about borrowers defaulting on their liabilities or central banks starting to monetize outstanding debt. Such expectations have the potential to decouple the link between short- and long-term interest rates.

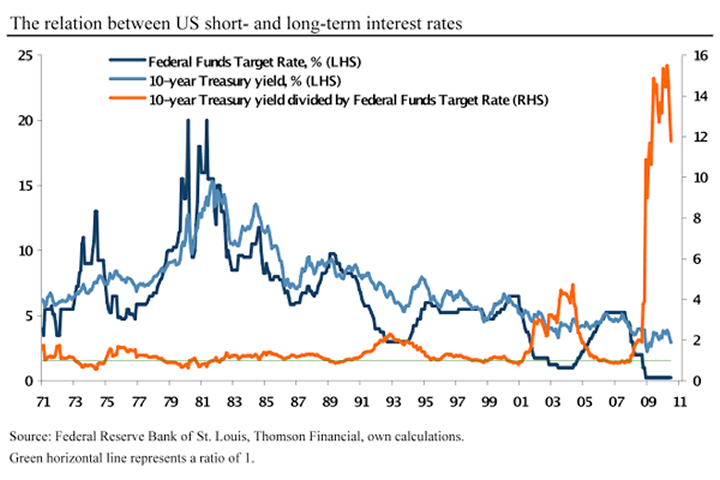

To illustrate the point, the graph below shows US short- and long-term interests in percent from January 1971 to July 2010.[2] Interest rates remained, on average, closely aligned until the end of the 1980s, as indicated by the ratio between 10-year and short-term interest rates.

The relation changed in the first half of the 1990s, as evidenced by a noticeable increase in the ratio. The ratio between the 10-year rate and the short-term rate increased further in the period 2002 to 2004, and even more so starting at the end of 2008.[3]

In fact, the latest episode illustrates a rather dramatic example of a fundamental change in the relation between long- and short-term interest rates, suggesting that the US Fed's grip on longer-term interest rates, if anything, may have been weakening substantially.

Controlling Market-Interest Rates Directly

Such a development spells trouble for a highly indebted government: rising default and inflation premiums clearly have the potential to push up market yields (sharply), thereby increasing debtors' funding costs.

Borrowers would not only have to cope with higher interest payments but also with rising fund costs that would make the economies' credit pyramid — which has been erected through a relentless rise in bank-circulation credit, through which fiat money is created — come crashing down.

In fact, rising market-interest rates would presumably bring the credit-boom period to a shrieking halt — and usher in an adjustment period in which the economic production structure is brought back towards equilibrium.

However, such a process would be costly, at least in the short-term — and politically undesirable for many powerful parties concerned. This may explain why central banks have taken bold action to regain control over borrowing costs.

Central banks in many countries have started purchasing government and even mortgage bonds with longer-term maturities, thereby directly influencing bond prices and, uno actu, long-term interest rates.

The uncomfortable truth is this: central banks, as monopoly producers of base money, have the capacity to enforce any yield level they wish to see in credit markets. A simple example may explain this conclusion.

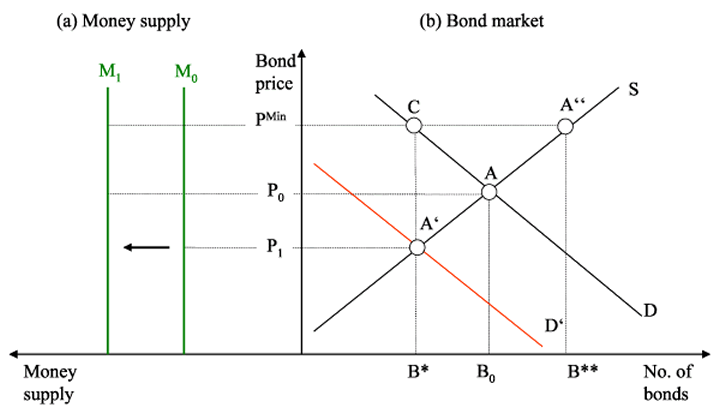

In the graph below, the bond market is at equilibrium at point A, at the intersection of the supply of bonds, S, and the demand for bonds, D. The market-clearing price is P0, the amount of bonds traded is B0, and the money stock is M0.

Investors reduce their demand for bonds as they become increasingly concerned about the possibility of borrowers defaulting on their debt. As a result, the demand schedule moves to D', and the bond price falls to P1 (and the yield of the bond rises accordingly).

If the central bank steps in and increases its demand for bonds, it moves the demand schedule to the right, back toward point A. Such a policy increases the base-money stock from M0 to M1, as the central bank pays for its purchases with newly created base money.

Now consider the case in which the central bank wants to establish a bond price that is above the market equilibrium price; in fact, the central bank is then pursuing a minimum price policy for bonds.

If the central bank wants to establish, say, PMin as implied by point A'', which exceeds P0, it creates a supply surplus of bonds (namely B** — B*), which has to be taken up by the central bank. Again, these purchases increase the money stock from M0 to M1.

What will the consequence be? It is not too far-fetched to expect that rising bond purchases by the central bank will stoke up inflation fears, and this would presumably lower the "fair values" investors ascribe to bonds.

As a result, the demand schedule for bonds would move to the left, lowering bond prices and thereby increasing the supply surplus even further — which will have to be monetized by the central bank if bond prices are to be kept at PMin.

So if the central bank keeps (i) increasing its demand for bonds in response to investors selling their bonds, or (ii) trying to establish a minimum price for bonds that exceeds the market equilibrium price, a strong rise in the money supply — and thus high inflation, or even hyperinflation — will be the inevitable result.

The Policy of (Hyper)inflation

Mainstream economists may argue that if the central bank purchases bonds from banks, only banks' excess reserves would rise, but it would not affect the money stock in the hands of private households and firms, and so there won't be inflation. However, such a conclusion is economically false.

First and foremost, a rise in the money stock necessarily leads to an impairment of the purchasing power of a money unit — compared with a situation in which the money stock remains unchanged. In that sense, inflation is a rise in the money stock.

Second, an increase in banks' excess reserves helps to keep financial-asset prices at prevailing levels, preventing them from adjusting to lower levels, which would be realized had the base-money supply remained unchanged.

Furthermore, banks will, sooner or later, put their excess reserves to use in terms of lending or purchasing interest-yielding assets. Banks have to generate earnings, as they have to pay interest and redeem their liabilities vis-à-vis nonbanks.

If banks start lending or purchasing assets from nonbanks, the money stock (in the form of M1 and M2) increases. And a rise in the money stock will necessarily impair the exchange value of money — either by raising prices or by preventing prices from falling.

However, what if banks use their increased excess reserves to pay down their debt vis-à-vis their clients? In this case the central bank — by increasing excess reserves — would de facto monetize commercial bank liabilities and thus increase the outstanding stock of money.

If central banks purchase bonds sold by nonbanks (pension funds, insurance companies, private households, etc.), the money stock increases directly: the central bank would transfer money into nonbanks' accounts that are held with commercial banks, thereby adding to M1 and M2.

These examples show that a policy of suppressing long-term interest rates may signal that central banks, trying to cover up the damage done to the economies by the chronic increase in fiat money through a relentless expansion of bank-circulation credit, are about to turn to a policy of very high inflation.

The ensuing debasement of the currency is the economically devastating outcome of central banks' unlimited power to suppress the interest rate. This, in turn, is the result of the government taking full control over money production.

Notes

[1] For an explanation see, for instance, Poole, W. (2005), "Understanding the Term Structure of Interest Rates," Federal Reserve Bank of St. Louis Review 87 (5), pp. 589–95.

[2] See in this context Thornton, D. L. (2007), "The Federal Funds and Long-Term Rates," MonetaryTrends (May), Federal Reserve of St. Louis.

[3] Generally speaking, such an observation is open to interpretation. For instance, bond investors may simply have considered the Fed's sharp lowering of short-term rates as being temporary in nature, so that it did not have a noticeable impact on longer-term yields. However, it could also suggest the expectation of permanently low short-term rates, accompanied by rising inflation expectations.

Thorsten Polleit is Honorary Professor at the Frankfurt School of Finance & Management. Send him mail. See Thorsten Polleit's article archives. Comment on the blog.![]()

© 2010 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.