Stock Market Advances on Bad Economic News

Stock-Markets / Stock Markets 2010 Jul 31, 2010 - 01:06 AM GMT U.S. Economy Grew 2.4% in Second Quarter, Below Forecast

U.S. Economy Grew 2.4% in Second Quarter, Below Forecast

Growth in the U.S. slowed to a 2.4 percent annual rate in the second quarter, less than forecast, reflecting a larger trade deficit and an easing in consumer spending.

The increase in gross domestic product compared with a median forecast of 2.6 percent of economists surveyed by Bloomberg News and follows an upwardly revised 3.7 percent pace in the first quarter that showed a jump in inventories, according to figures from the Commerce Department today in Washington. Business investment climbed at the fastest rate since 1997.

Recession in U.S. Was Even Worse Than Estimated, Revisions Show

The worst U.S. recession since the 1930s was even deeper than previously estimated, reflecting bigger slumps in consumer spending and housing, according to revised figures.

The world’s largest economy shrank 4.1 percent from the fourth quarter of 2007 to the second quarter of 2009, compared with the 3.7 percent drop previously on the books, the Commerce Department said today in Washington. Household spending fell 1.2 percent in 2009, twice as much as previously projected and the biggest decline since 1942.

ECRI Leading Indicator Plunges Deeper Into Double Dip Territory

The ECRI Leading Indicator has just moved further into certain recession territory, hitting -10.7 for the most recent week (the previous revised number is -10.5).

The market advances on bad news.

--Investment Company Institute reported that domestic equity (stock) funds reported their 12th sequential outflow of $1.5 billion last week. While the market rallied by 10% over the last three weeks, retail investors pulled out slightly under $10 billion, as the current sentiment seems to be saying, “No thanks” to the increased volatility. For more info, contact us.

--Investment Company Institute reported that domestic equity (stock) funds reported their 12th sequential outflow of $1.5 billion last week. While the market rallied by 10% over the last three weeks, retail investors pulled out slightly under $10 billion, as the current sentiment seems to be saying, “No thanks” to the increased volatility. For more info, contact us.

Treasury bonds may have violated their uptrend.

-- Treasury bonds appear to have violated their uptrend line. From a technical view, that puts bond investors on high alert. Investors believe that as long as the economy weakens, bonds will strengthen.

-- Treasury bonds appear to have violated their uptrend line. From a technical view, that puts bond investors on high alert. Investors believe that as long as the economy weakens, bonds will strengthen.

That has been the case for quite a while, but there is also a limit on how much money the Treasury can borrow without alarming the bond vigilantes or China.

Hope springs eternal for gold investors.

--Today’s rally in gold is stirring hopes that investors will be motivated to buy more of this precious metal at this lower price. However, buying has remained muted over the last month. Nonetheless, investors are hoping that this downturn will be temporary.

--Today’s rally in gold is stirring hopes that investors will be motivated to buy more of this precious metal at this lower price. However, buying has remained muted over the last month. Nonetheless, investors are hoping that this downturn will be temporary.

There now seems to be speculation about gold’s performance in a deflationary environment.

Nikkei sold off at resistance…again.

--Japanese stocks fell after industrial production dropped unexpectedly and consumer prices declined more than estimated, raising concerns the nation’s economic recovery will stall.

--Japanese stocks fell after industrial production dropped unexpectedly and consumer prices declined more than estimated, raising concerns the nation’s economic recovery will stall.

The Nikkei 225 Stock Average dropped 1.6 percent to 9,537.30 at the 3 p.m. close in Tokyo, the most among Asian equity indexes.

The Shanghai index may have legs.

-- I have observed that July 1 may have been an important cyclical low for the Shanghai Index. There seems to be talk about the index getting ahead of itself, and there may be the need for a pullback before it can advance further. Today the index declined, starting a potential pullback for the next week or so.

-- I have observed that July 1 may have been an important cyclical low for the Shanghai Index. There seems to be talk about the index getting ahead of itself, and there may be the need for a pullback before it can advance further. Today the index declined, starting a potential pullback for the next week or so.

However, this recent rally may have broken the down-trend in the price action.

The dollar has formed a bullish wedge pattern.

-- The dollar touched a level below 86 yen for the first time this year and headed for a second straight monthly loss as a government report showed U.S. economic growth slowed in the second quarter.

-- The dollar touched a level below 86 yen for the first time this year and headed for a second straight monthly loss as a government report showed U.S. economic growth slowed in the second quarter.

However, even with investor perception as bleak as it is, the dollar may be making a “seasonal low” and prepared to make new highs. Note the “bullish wedge” formation.

The threat of “sidelined” home sellers.

-- How many homeowners have been sitting on the sidelines during the housing downturn, waiting for massive price plunges to pass? The prospect of home-price stabilization is raising that question in some of the nation’s housing markets, say real-estate agents, who report an uptick in listings from “sidelined” sellers testing the waters. Over the past year, there’s been plenty of speculation about if and when banks will begin to list more foreclosed homes for sale. But these sidelined sellers represent another potential source of “shadow” inventory.

-- How many homeowners have been sitting on the sidelines during the housing downturn, waiting for massive price plunges to pass? The prospect of home-price stabilization is raising that question in some of the nation’s housing markets, say real-estate agents, who report an uptick in listings from “sidelined” sellers testing the waters. Over the past year, there’s been plenty of speculation about if and when banks will begin to list more foreclosed homes for sale. But these sidelined sellers represent another potential source of “shadow” inventory.

Gasoline prices are slipping, but no new lows yet.

--The Energy Information Agency weekly report observes, “The U.S. average price for regular gasoline increased about three cents to $2.75 per gallon, $0.25 higher than a year ago.”

--The Energy Information Agency weekly report observes, “The U.S. average price for regular gasoline increased about three cents to $2.75 per gallon, $0.25 higher than a year ago.”

Natural gas prices are declining.

--. The U.S. Energy Information Administration reports, “Natural gas prices fell at the majority of market locations since last Wednesday, while a significant number of market locations posted gains on the week. Price declines were generally located in the western and eastern regions of the lower 48 States, while the northeast and Florida regions posted declines in the east. These declines were likely the result of warm temperatures easing somewhat in these regions during the report week.”

--. The U.S. Energy Information Administration reports, “Natural gas prices fell at the majority of market locations since last Wednesday, while a significant number of market locations posted gains on the week. Price declines were generally located in the western and eastern regions of the lower 48 States, while the northeast and Florida regions posted declines in the east. These declines were likely the result of warm temperatures easing somewhat in these regions during the report week.”

Drip after drip of deflation data

(Ambrose Evans-Pritchard) Today’s release on manufacturing activity by the Richmond Fed is pretty ghastly, as you would expect given that the effects of fiscal stimulus are now wearing off at accelerating pace – before the happy handover to the private sector is safely consummated – and given that the structural East-West imbalances that lay behind the global crisis are getting worse again.

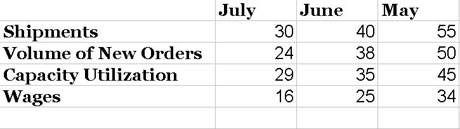

The expectations index for the US 5th District is crumbling:

This follows yesterday’s horrendous fall in the Texas business activity index from the Dallas Fed, which fell from -4 in June to -21 in July. “Thirty-one percent of firms reported a worsening of activity, up from 22 percent in June,” said the bank.

Why isn’t our media reporting this???

The job machine grinds to a halt

(Washington Post) The problem isn't merely the greatest downturn since the Great Depression. It's also that big business has found a way to make big money without restoring the jobs it cut the past two years, or increasing its investments or even its sales, at least domestically.

In the mildly halcyon days before the 2008 crash, the one economic outlier was wages. Profit, revenue and GDP all increased; only ordinary Americans' incomes lagged behind. Today, wages are still down, employment remains low and sales revenue isn't up much, either. But profits are the outlier. They're positively soaring.

Among the 175 companies in the Standard & Poor's 500-stock index that have released their second-quarter reports, the New York Times reported Sunday, revenue rose by a tidy 6.9 percent, but profits soared by a stunning 42.3 percent. Profits, that is, are increasing seven times faster than revenue. The mind, as it should, boggles.

Banks In Ninth District Blame Unwillingness To Lend On Obama Policies.

(ZeroHedge) The latest and most damning confirmation that it is none other than the president and his errant policies that are the primary cause for the credit crunch spreading among individuals and small and medium businesses like a paperborne version of the plague, comes direct from the Minneapolis Fed, where in a paper titled "Come and get it--please: Banks and credit unions say they have money to lend, but credit markets are still struggling for a variety of reasons" the Ninth Fed district puts the blame for the credit freeze flatly where it belongs: the president himself, and more specifically his destructive economic advisors. "The most-cited reasons—though only by a small margin—were organizational uncertainty about future financial system reforms and regulatory restrictions on bank lending. A Minnesota institution stated flatly, “The regulatory environment has impacted our willingness to make loans.”

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.