U.S. Housing 10% Below Fundamentals, BubbleOmics Says Must Drop 15% More

Housing-Market / US Housing Aug 15, 2010 - 04:51 AM GMTBy: Andrew_Butter

From Felix Salmon today: The government does need to get the housing market going, because the alternative is unthinkable: if the government just kicked away the housing market’s multi-trillion-dollar scaffolding overnight, as Santelli suggests it should, then the entire banking system would become insolvent, and we’d soon be reminiscing wistfully about how painless and shallow the 2008 financial crisis was, compared to the one of 2011. http://seekingalpha.com/..

From Felix Salmon today: The government does need to get the housing market going, because the alternative is unthinkable: if the government just kicked away the housing market’s multi-trillion-dollar scaffolding overnight, as Santelli suggests it should, then the entire banking system would become insolvent, and we’d soon be reminiscing wistfully about how painless and shallow the 2008 financial crisis was, compared to the one of 2011. http://seekingalpha.com/..

Bravo, the penny finally drops!!

But it’s the wrong penny. The point is that the banks ARE insolvent and unless American taxpayers collectively (i.e. via the government), take on a load more debt to pay them for their stupidity; at some point someone is going to find out.

Outside of the government handing out $50,000 tax credits, or the latest idea which is just to forgive a couple of trillion dollars (that’s Keynes on LSD speaking), there is little anyone can do to reverse the relentless grind of reality.

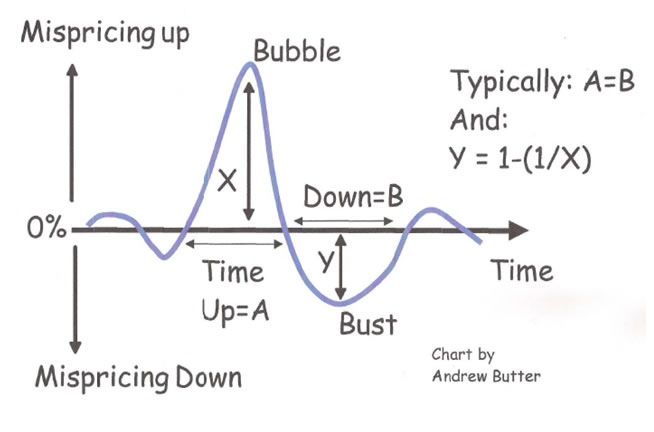

This is the reality of a bubble:

When you are creating a bubble with tax-credits, and facilitating loans with a repayment that is half what the inflation in the “market” for the assets class the government is providing what Felix Salmon calls a “multi-trillion-dollar-scaffolding” for, the “bubble-masters” can do no wrong.

But sorry guys – post pop, when the realization starts to sink in that all the bubble did was create one the largest transfers of wealth from the poor to the rich in the history of mankind, the “tools” that were so effective before (easy-cheap credit and government support of lunatic lenders), doesn’t work anymore.

In the game of the bubbles, like surfers catching waves, timing is everything, catch it right any you have magic, miss the wave and you get gobbled and you end up in a white-out of foam bouncing along the reef trying to figure out which way is up, and wondering how long you can hold your breath. Like right now.

The reason that trying to turn the tide is a pointless at this point, like King Canute’s Big Idea, is because just as ordinary folks were “pressurized” to buy houses they could not afford in a rising market, because they felt they would never be able to own a house if prices kept on rising; ordinary folks are now pressurized by the reality of the market-place, to sell or to walk away. And the “qualified” buyers have the luxury of just sitting back, and watching them bleed.

If the government wants to buy all those houses at still-inflated prices, (reference the dynamics of a bubble bursting); well they can. But that would be as much of a waste of money as spending $700 billion to make sure that Iraq had no WMD. Of course it’s possible, there are indeed 101 ways to shoot yourself in the foot; but America and Americans are running out of ammo when it comes to subsidizing minority special interest groups (the military, banks, and over-extended borrowers).

WHY?

It’s all about the “fundamental”, the line in the chart is the “mispricing” from the fundamental, so if that’s $100,000 on average and houses are selling at $140,000 that’s 40% mispricing.

It would appear that none of the economic bubble-masters who created the current disaster, know this, but the fundamental price of a house in USA, UK, Germany, Hong Kong, China, Australia, Dubai; France…you name it, is exactly and precisely equal to:

PRICE = C x (Nominal GDP per house) divided by a function of the 30-YearYield

Where “C” is a constant that is the same in UK, USA, everywhere; the function of the 30 year is an “S” Curve that is more or less linear from 3% to 6%.

The reason for that is that “fundamentally”, people spend a certain proportion of their income on “shelter”, and that percentage (distorted sometimes by taxes and incentives, but fundamentally), that does not change whether you live in Bogota or Beverly Hills.

So the amount of money that gets paid out every year for the utility of “shelter” (and no I’m not talking about “investment” plays, or how that’s geared), the amount that goes to the “shelter” utility is a constant x nominal GDP.

Divide that by the number of houses and that’s the “income” of the house. Once you have the income you can do an income capitalization valuation to get to the fundamental at that moment in time (rule-of-thumb divide by the yield or a function of it).

That’s sounds too simple to be true…right? Surely if that was right at least one of the talking-head Noble Prize winners who populate the air-waves with one grand theory after another, would have figured that out?

Try this:

There is no “cheating” in that model; just one simple line of numbers divided by another, what it says is (a) that 98.8% of changes in house prices from 1900 to 2000 can be explained by that simple algorithm; (b) regardless of how “overpriced” housing might become, that overpricing will be followed by an equal degree of “under-pricing” and (c) on average, over time, the price will oscillate around the “fundamental”.

The reason the model runs only to 2000 is that from 2001 to now there was a bubble unfolding, you have to measure from the start of the bubble to the finish to work out the fundamental, that bubble started in 2001, it cut through the fundamental (end of the up cycle) in 2008, so there are five more years of “under” to endure, that stops when the forced foreclosures stop.

In “Valuation Speak” (according to International Valuation Standards (IVS)), the red line (loosely called the “fundamental”) is called the “Other than Market Value” which is by definition, what the price “ought” to be if the market was not in disequilibrium.

Not to be confused with “Market Value” (under IVS there are only two options), which approximates to “Fair Value” or “Mark to Market”, which is by definition the price that you can sell the house to someone dumber than you, today.

Confuse those two types of valuation at your peril.

If you are a banker lending out money and your only recourse is the house, then the price you need to be interested in is the “Other Than Market Value”, which is (if you like – you can specify) an estimate of the minimum you can reasonably expect to sell your collateral for (in case the lender does a “jingle-mail”), some time in the future.

In other words, what the genius bankers “might” have been able to sell the houses they advanced loans against, in 2006, is pretty much irrelevant, in 2010.

Of course it’s a lot harder (read more expensive) to do an Other-Than-Market valuation, than to do “mark-to-market”, you can’t buy that sort of valuation for $50 on the Internet. I remember getting a comment when I was trying to explain that to a guy in a $3,000 suit once, he told me “bankers can’t afford to do that sort of valuation”.

That was five years ago, in my humble opinion, if bankers could “afford” to NOT do that type of valuation, why are they asking for bail outs, now?

But memories are short:

It looks like the lenders who handed out 100% LTV non-recourse loans in 2006, have already forgotten, that there was a bubble then, and that house prices in USA were 45% over-valued (on average).

That was a BIG bubble, and you can’t expect to wake up one morning and the effect of that to have just washed away with the rain.

Market clearing will only really get going when prices are 1/1.45 = 69% of the “fundamental”. Now they are about 90% of the “fundamental”; there is a little way to go.

OK low long-term interest rates and some nominal GDP growth (read jobs) will help by pushing up the fundamental, but until the stories of banks holding back inventory and letting defaulters live rent-free for two years, stop making the rounds; the pressure of the inevitability of flushing out what the “Austrians” call the malivestments; will continue.

What Can the Government Do?

A recent announcement from PIMCO (the guys who were going to buy all of Geithner’s toxic debt under PPIP (remember that stroke of genius)), was that they won’t buy private sector debt where the LTV of the loan is more than 70%.

That’s rich, the bond dealers were quite happy to buy that sort of garbage in 2006 (admittedly not PIMCO (they say)), but the situation is different now; so long as GDP growth splutters along in three years time, the price of housing will be either the same as, or higher than it is today.

So where’s the risk?

It’s not as if house prices are likely, according the experience of 100 years of history (or a thousand years if you add-in the experience of all the other bubbles), to be 30% less in three years time, which was the case in 2006.

So now’s the time to write 90%...100%...110% LTV mortgages; and if the morons who wrote those sorts of mortgages three and four years ago, can’t see that, then it’s time to pull the plug on them, because they are no use to anyone.

Translate PIMCO’s statement into English, what they are saying is that they didn’t know how to do a proper valuation then, and they still don’t know.

The idea of handing out trillion-dollar “get out of jail free” cards to the banks was that they would (a) wise-up, and (b) lend money (into housing and small businesses).

If they can’t do either of those then that was a colossal waste of money. So let them step up to the plate or let them bleed to death, if they can’t do their job without the taxpayer cleaning up their mess after them, they have no useful function in a free-market economy.

And please PLEASE, no more talk about the government “controlling” the market by clever incentive dreamed up by self-important economic geniuses, markets existed before government, and they will exist after them. Government is just the flea on the back of the dog of the market-place.

And here’s some news, the dog bites!!

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe; currently writing a book about BubbleOmics. Andrew Butter is managing partner of ABMC, an investment advisory firm, based in Dubai ( hbutter@eim.ae ), that he setup in 1999, and is has been involved advising on large scale real estate investments, mainly in Dubai.

© 2010 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.