Gold and Deflation

Commodities / Gold and Silver 2010 Aug 16, 2010 - 12:27 PM GMTBy: Frank_Holmes

I have been speaking and writing about gold’s appeal in a deflationary environment – this is a concept that opposes the conventional opinion that the gold price will not rise without inflation.

Those who cling to that singular gold-inflation relationship have not examined the history of gold as money. Whenever there is substantial inflation or deflation, governments tend to either be too slow to react or they overreact with policies, and this is typically good for gold.

Interest earned on 90-day Treasury bills below the inflation rate is a signal for governments to try to stop deflation and reflate the economy. When this happens, gold becomes attractive. We are in such an environment now.

During these periods, governments usually need to increase their deficits by escalating their borrowings to support the economy. This also supports gold as safe money in addition to its beauty as jewelry.

The twin engines of negative real interest rates and government deficits tend to make gold a very attractive investment. Recent research supports our historical findings on what drives gold.

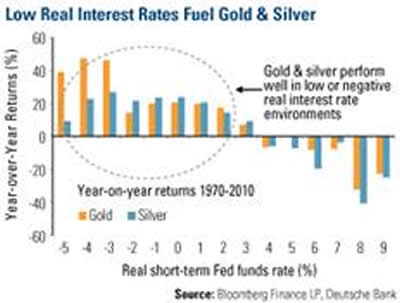

This chart from Deutsche Bank shows that for the past four decades gold (and silver) have performed well in a country’s currency when that country has low or negative real interest rates.

The Federal Reserve’s main interest rate is near zero and inflation is a little over 1 percent, so we now find ourselves in a negative real interest rate situation. The Fed has made it clear that it has no plans to tighten money by raising that key rate any time soon because of the sluggish economy and soft housing market (mortgages are now at a 21-year low), so this condition is likely to endure.

“The decline in core inflation from 2.5 percent two years ago to under 1 percent today will sustain market fears of deflation and hence a more rapid depreciation of the U.S. dollar to arrest any deflationary pressures,” Deutsche Bank’s analysts wrote. “We believe that the road map to resolve deflation is therefore bearish for the U.S. dollar and another factor which will propel gold prices to new highs.”

The Fed this week plotted part of that road map – it said it will pump more money into the system to try to kick up economic activity. As the 2010 midterm election draws closer, there is also a growing call for another round of stimulus spending to try to pull down the 9.5 percent unemployment rate.

Such a move would widen the federal budget deficit, which is already estimated at nearly $1.5 trillion for this year and will roughly be the same in 2011. The U.S. dollar is not only our currency, it is also the world’s reserve currency. Deficit spending puts downward pressure on the dollar, and when the dollar falls, investors tend to turn to gold.

When you add the interest rate and deficit scenarios to the gold seasonality trend – September is historically the best month of the year for both bullion and gold equities – the conditions now appear promising for gold.

We discuss What’s Driving Gold in an interactive presentation – click on the chart to learn more about these critical drivers.

Browse Our What’s Driving Gold Matrix

By Frank Holmes, CEO , U.S. Global Investors

Frank Holmes is CEO and chief investment officer at U.S. Global Investors , a Texas-based investment adviser that specializes in natural resources, emerging markets and global infrastructure. The company's 13 mutual funds include the Global Resources Fund (PSPFX) , Gold and Precious Metals Fund (USERX) and Global MegaTrends Fund (MEGAX) .

More timely commentary from Frank Holmes is available in his investment blog, “Frank Talk”: www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.