Third Hinderburg Omen Signals Stock Market Crash

Stock-Markets / Financial Markets 2010 Aug 22, 2010 - 07:51 PM GMT FDIC Friday back on the job.-

The FDIC Failed Bank List announced eight new bank closures this week. My count suggests 118 on August 20th. ShoreBank Corp., the Chicago lender operating under a Federal Deposit Insurance Corp. cease-and- desist order for 13 months, will be shut and most of its assets will be bought by Urban Partnership Bank, two people with direct knowledge of the matter said.

FDIC Friday back on the job.-

The FDIC Failed Bank List announced eight new bank closures this week. My count suggests 118 on August 20th. ShoreBank Corp., the Chicago lender operating under a Federal Deposit Insurance Corp. cease-and- desist order for 13 months, will be shut and most of its assets will be bought by Urban Partnership Bank, two people with direct knowledge of the matter said.

European Stocks Retreat for Second Consecutive Week Amid Slowdown Concern

European stocks posted the biggest weekly decline in seven weeks as economic reports from the U.S. and Japan heightened concern that the global economic recovery may be stalling. The benchmark Stoxx Europe 600 Index fell 1.3 percent to 252.15 this past week, the biggest drop since July 2, as reports showed U.S. jobless-benefit claims climbed to the highest level in nine months and Japan’s economy grew at the slowest pace in three quarters.

Second Hindenburg Omen Confirmation In As Many Days, Third H.O. Event In One Week

(ZeroHedge) Longs may be forgiven if they are sweating their long positions over the weekend: not only did we just have a second, and far more solid Hindenburg Omen confirmation today, with 82 new highs, and 94 new lows, but the Saturday is the day when Iran launches its nuclear reactor, and everyone will be very jumpy regarding any piece of news out of the middle east. As for the H.O., the more validations we receive… the greater the possibility for a meltdown. Furthermore, with implied correlation at record levels (JCJ at around 78), any potential crash will be like never before, as virtually all stocks now go up or down as one, more so than ever before.

The VIX broke out from below its 10-week M.A.

--The VIX broke above its 10-week moving average and made a new high for the month this week. It had a successful reversal pattern and the Model target is now 37.50.

--The VIX broke above its 10-week moving average and made a new high for the month this week. It had a successful reversal pattern and the Model target is now 37.50.

The NYSE (weekly) Hi-Lo index fell this week to -18, down 102 points for the week.

SPX is positioned to finish its Head & Shoulders Pattern.

-- The decline during options week in SPX may have been a bit of a surprise for traders. The traditional spike rally into the close of options was noticeably absent. In addition, the largest decline occurred on Thursday, a POMO day. A survey of 60 POMO days in 2009 showed that the average daily gain through the year was .20%, while the gain was .25% on a POMO day. It appears that POMO days may have been front-run by traders, since the gain on the day before was .29%, but overall, the POMO appears to be more of an exercise in the use of the bully pulpit more than anything else. This time the bully pulpit didn’t seem to work at all.

-- The decline during options week in SPX may have been a bit of a surprise for traders. The traditional spike rally into the close of options was noticeably absent. In addition, the largest decline occurred on Thursday, a POMO day. A survey of 60 POMO days in 2009 showed that the average daily gain through the year was .20%, while the gain was .25% on a POMO day. It appears that POMO days may have been front-run by traders, since the gain on the day before was .29%, but overall, the POMO appears to be more of an exercise in the use of the bully pulpit more than anything else. This time the bully pulpit didn’t seem to work at all.

The NDX remained below tis 10-week moving average.

--The NDX remained below its 10-week moving average this week. The upcoming third wave decline has an average target of 1672, which activates the Head & Shoulders pattern. Since there are two degrees of a third wave, the likelihood of an extension is even greater.

--The NDX remained below its 10-week moving average this week. The upcoming third wave decline has an average target of 1672, which activates the Head & Shoulders pattern. Since there are two degrees of a third wave, the likelihood of an extension is even greater.

Two weeks ago I had mentioned that, 50 may be the top for the momentum indicators during most of a wave 3 or C decline. You may observe that is almost precisely what happened this week.

Gold takes one more stab at the trendline.

-- Gold may have used some of the POMO money to take another stab at its two-year trendline. On Thursday it made its high for the week just as the POMO liquidity made its way into the markets. A reversal is not yet evident. The next Trading Cycle low is due in mid-September.

-- Gold may have used some of the POMO money to take another stab at its two-year trendline. On Thursday it made its high for the week just as the POMO liquidity made its way into the markets. A reversal is not yet evident. The next Trading Cycle low is due in mid-September.

The target for gold is 1000-1050.

$WTIC broke below support.

-- $WTIC broke below support and appears to be heading for a challenge of its Head & Shoulders neckline. Elliott Wave relationships corroborate the Head & Shoulders target shown on the chart. The average target is 50.87, before extensions.

-- $WTIC broke below support and appears to be heading for a challenge of its Head & Shoulders neckline. Elliott Wave relationships corroborate the Head & Shoulders target shown on the chart. The average target is 50.87, before extensions.

The Federal Reserve Bank of Philadelphia’s general economic index dropped to the lowest reading since July 2009. Total U.S. inventories of crude and oil products reached the highest in at least 20 years, Energy Department data showed earlier this week.

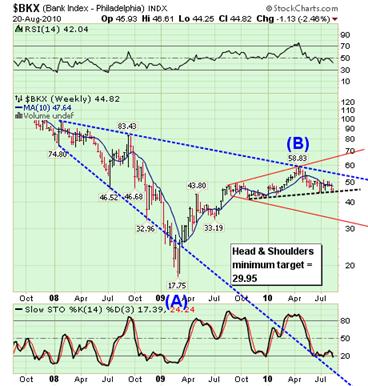

The Bank Index skirmishes with its neckline.

--The $BKX has been challenging its neckline this week. It briefly went below its prior neckline low at 44.39 on Friday before closing just above it. Piercing the neckline brings it in line to challenge its Orthodox Broadening Top formation, which is near 33.00.

--The $BKX has been challenging its neckline this week. It briefly went below its prior neckline low at 44.39 on Friday before closing just above it. Piercing the neckline brings it in line to challenge its Orthodox Broadening Top formation, which is near 33.00.

The multiple bearis patterns suggest the potential of a runaway train-wreck in the banking index. The Cycles suggest that it has already begun and has another two months to run.

The Shanghai Index made a new high.

--The Shanghai Index made a new high this week that may qualify as a completed impulse. The cycles suggest the next weekly move in $SSEC may be a decline. Should it remain above 2319.73 by the end of August, we may see another rally to match its wave iii in size. $SSEC did not quite reach its mid-Cycle Support/Resistance at 2750 so there may be some bullishness left before it pulls back. This index may be the recipient of much of the money flowing out of equities in the U.S., Japan and Europe.

--The Shanghai Index made a new high this week that may qualify as a completed impulse. The cycles suggest the next weekly move in $SSEC may be a decline. Should it remain above 2319.73 by the end of August, we may see another rally to match its wave iii in size. $SSEC did not quite reach its mid-Cycle Support/Resistance at 2750 so there may be some bullishness left before it pulls back. This index may be the recipient of much of the money flowing out of equities in the U.S., Japan and Europe.

$USB throws over its wedge.

-- $USB had a throw-over above its wedge this week, which is an exhaustion move. The POMO had some influence, since nearly the entire gain for the week occurred (after 10:00 am) on Thursday. Monday is a pivot day for bonds, which makes an ideal day for a reversal. Once the reversal is in, the next move will be to a Trading Cycle low in mid- September. Bullish sentiment is very high in Treasuries. This may catch a lot of traders off guard.

-- $USB had a throw-over above its wedge this week, which is an exhaustion move. The POMO had some influence, since nearly the entire gain for the week occurred (after 10:00 am) on Thursday. Monday is a pivot day for bonds, which makes an ideal day for a reversal. Once the reversal is in, the next move will be to a Trading Cycle low in mid- September. Bullish sentiment is very high in Treasuries. This may catch a lot of traders off guard.

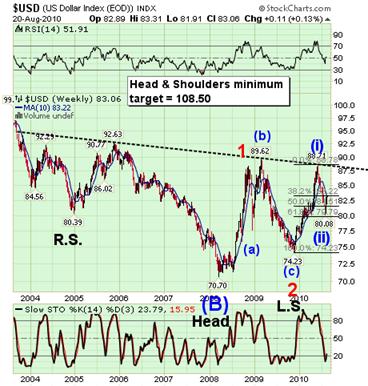

$USD challenges its 10-week moving average.

-- $USD challenged its 10-week moving average at 83.22 before closing below it. The next Cycle Pivot is due on Monday. I don’t expect $USD to remain below resistance after that. EW relationships suggest that this rally should go to 103.54, before extensions. If it follows its normal cycle pattern, we may see its top near election day.

-- $USD challenged its 10-week moving average at 83.22 before closing below it. The next Cycle Pivot is due on Monday. I don’t expect $USD to remain below resistance after that. EW relationships suggest that this rally should go to 103.54, before extensions. If it follows its normal cycle pattern, we may see its top near election day.

I hope you all have a wonderful weekend!

Regards,

Tony

Anthony M. Cherniawski

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.