The Great Collapse of the Carbon Trading Chicago Climate Exchange

Politics / Climate Change Sep 06, 2010 - 02:19 PM GMTBy: Submissions

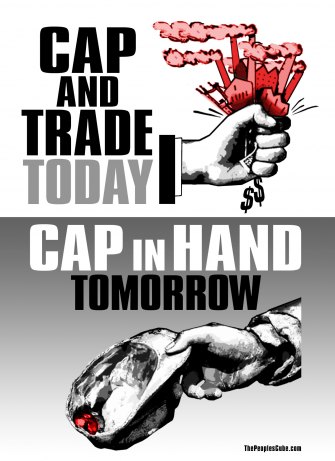

Patrick Henningsen writes: Plagued by a free fall in carbon emissions prices and the perennial failure of Washington to pass any binding Cap and Trade Bill, it seems that the Chicago Climate Exchange is on its last leg, announcing that it will be scaling back its operations.

Patrick Henningsen writes: Plagued by a free fall in carbon emissions prices and the perennial failure of Washington to pass any binding Cap and Trade Bill, it seems that the Chicago Climate Exchange is on its last leg, announcing that it will be scaling back its operations.

Chicago Climate Exchange or CCX, is North America’s sole voluntary, legally binding greenhouse gas trading and carbon “offset” projects in North America and Brazil. Rueters reported on Aug 11th that Intercontinental Exchange Inc, the operating body who purchased the struggling CCX in May this year, will be scaling back major operations this month, a move that includes massive layoffs. This is likely due to the complete market free-fall of their only product… carbon emissions.

Anthony Watts from the climate watchdog website Watts Up With That posts a graph from the CCX which shows carbon prices dropping like a stone, bottoming out this week at the embarrassingly low figure of 10 cents per tonne. Compare this to trading prices during its brief hay day in May and June 2008 where market highs reached $5.85 and $7.40 respectively, and you can say that most investors will be evaluating carbon as one of today’s more worthless commodities.

What a difference a year makes. It’s been nine months since the world watched the bottom drop out of a much-hyped UN Climate Summit in Copenhagen back in Dec 2009, with its neo-colonial and UN Global Government taxation agenda exposed within the first days of the summit. One of the keystones of the Climate Change alarmist movement was its audacious attempt to create a functioning market by monetizing the atmospheric trace gas known as CO2. Since last year, a number of scandals like Climategate have penetrated mainstream conversation, putting a rather awkward limp in the once nimble Man-Made Global Warming movement. Hence, apocalyptic frenzies and fears have dissipated and carbon prices around the world have continued to be pummelled by the market.

Monetizing CO2: the carbon neutral dream that no country could ever afford.

A Financial ‘Boondoggle’

Unlike most real markets, the carbon market was created by banks and governments so that new investment opportunities could seamlessly dovetail with specific government policies. It’s a fantasy casino based on a doctrine of pure science fiction. Certainly, gaming the system has always been at the top on the agenda of the new green eco-trader. Most people, investors included, might innocently ask the fundamental question, “what’s the point of having a CO2 commodities market?” The answer to that question should be obvious by now, and you can certainly look to the initial stakeholders in the various international climate trading bodies for a ‘Who’s Who’ list of individuals that have actively been pushing the global warming concept from its inception.

As American’s own CCX nears total collapse, climate alarmists and their vested partners are pinning their hopes on Europe and Climate Exchange Plc. With most European countries happily singing from the same EU song sheet, institutional investment in the carbon market has seen a slightly more sustained existence. Europe’s socialized historical habit of subsidizing anything and everything means that it has been a better safe haven for something as radical as a carbon market. Many financial analysts would say that carbon requires a relatively steady price of around €40 a tonne in order to spur industrial investment in cleaner technologies, but unfortunately, Copenhagen failed and the announcements of emissions cuts are not coming as expected. Perhaps the reality gap is beginning to set in between governments’ political capital in climate change and the peoples’ ability to believe in global warming. Either way, the market will not be able to deliver such lofty figures, which is why real investors are getting out of the carbon market in 2010.

The front end of this game of ‘supply and demand’ is heavily reliant on governments making lofty announcements about future emissions targets. The logic here is that cutting emissions increases demand for carbon allowances. In the absence of such a restriction of the market, it was expected that the price would fall, and naturally that’s exactly what happened. In 2008, it cost European traders €31 to pump out a tonne of CO2 into the atmosphere, but today it will set you back about half that at €15. You will be hard pressed to find any financial wizard/pundit giving a sermon on a bullish carbon market in the near future- it’s just not happening anymore.

On the back end of the game, things are a bit shadier to say the least- some might call it a recipe for corruption. The industrial monopoly power giants and other green businesses who are ‘well connected’ are of course, being allocated free EU Carbon Allowances until 2012, but from 2013 some sectors will have to pay for 20% of their allowances (those with weaker political influence in Brussels), rising each year to 60% in 2020. Many government/power company ‘green initiatives’ will automatically result in high energy price to consumers, which naturally means guaranteed profit increases for those same corporations (see Enron).

Off-set scam

Carbon trading is underpinned by an equally dodgy product called ‘carbon off-sets”, most of which are taken on face value by the buyer. Not based on an actual ton of carbon emitted, rather governing agencies are issuing certificates for a fictional commodity of emissions not emitted. A rather wild concept. Worse than this however, it is near impossible to verify which of these thousands of so-called off-set projects in the developing world are actually legitimate. In the coming years, we will no doubt see or read a number exposes detailing the depths of this fantastic green scam.

Get in early and then get out

The formula: create an investment vehicle, hype the new commodity, buy low, watch share prices rise, sell high. The result is money, lots of it. In some cases it’s been about driving up the share prices of companies Gore’s group has already invested in. The fact that the original shareholders of the CCX have already bailed out with their sale to Intercontinental Exchange Inc. for a modest $600 million earlier this year only reinforces the reality that its creators have already lost faith in their elaborate invention. Likewise, the self-styled leaders of the climate change crusade Maurice Strong and Al Gorehave already cashed in carbon fortunes already, whilst other active politicians like US President Barrack Obama, and United Nations IPCC Chief Rajendra K. Pachauri(the world’s wealthiest retired railway engineer) are engaged in similar play with their own financial interests in the Carbon Markets.

Like all government rigged quasi-commercial schemes, the only real beneficiaries are the initial shareholders- a special inner circle who are naturally ahead of the curve knowing about legislation and policy before it comes into existence. They are sometimes called the great and the good, the in-crowd, or the smartest men in the room (again, see Enron). Of these, almost all have jumped ship out of the market while their preferred shares- or in the case of the larger energy and manufacturing monopolies, their gratis “carbon allowances” given to them free by their governments- are still worth something. If you’re on the inside, it’s simple: get in early, make money and then get out.

If you are in any doubt as to the level and expense of climate change propaganda, just watch this promo for Copenhagen.

Climate change based on science fiction

Pointing out the obvious is always a painful thing in the world of human affairs. The real reason for the complete and total failure of the concept behind trading an atmospheric gas like CO2 is something few within the green block will dare to even mention now, and it’s the same reason why the whole movement will go down in history as one of the most flamboyant efforts in the history of economics. It’s not just hubris. The whole idea behind making CO2 a commodity was to make it expensive and thus reduce the amount produced, which would (they hoped) reduce the effect of anthropogenic(man-made) global warming, or ‘climate change’ as it’s now commonly referred to. There was only one massive problem with this equation- there has been no global warming since 1998. So despite the hundreds of millions, perhaps billions spent on research and computer models addressing this possibility, no scientist or body has been able to show that man’s CO2 contribution has had any effect on the global temperature. Another massive blind spot for climatists is their almost religious denial that the sun might have any effect on the earth’s climate (studies show that it does, of course)- a major sore spot in any debate on global warming.

Placed in its proper historical context, we can see that the man-made global warming movement was a classic merger of radical Collectivist ideas and huge financial opportunities. Men like Maurice Strong looked for their moral positions to be anchored by a small group of hand-picked ‘scientific authorities’, a latter day technocracy if you will. On the opportunist side we also see those same scientists who have made their careers, many millions of dollars over the last decade alone, on grants to prove that global warming was somehow happening. Other financial opportunists will include Al Gore, scores of companies like Carbon Fund and a multitude of charities soliciting millions in donations to save the planet, all of whom were hoping to cash in on this non-event until its financial opportunities eventually die out.

To date, the timeline of the planned green economy has moved at an impressive pace. If you step back and marvel at the timing and combination of the climate change movement and carbon trading business it’s enough to make you dizzy. Advanced positioning promised fortunes for those with inside knowledge before the global warming PR cycle went orbital in 2006. Never has the world seen a more stunning collusion between government(include the UN here) and big business, a tango that makes fascist enterprises like Mussolini’s Italy or Franco’s Spain look like mere student internships.

Still hoping for some silver lining in this otherwise cloud of failure, most diehard green activists are laying the blame on governments for giving away too many free carbon coupons in recent years. Certainly there is a valid economic point there, but greens were all too eager to get into bed with Wall Street and the Fabian Socialists in order to realize their dream of a new utopia. The current color-blind global financial system based on derivatives, futures and sub-prime gambling products will eventually take down the carbon market altogether, as speculators prey on untapped markets, selling more worthless paper to an ever decreasing naive minority. In the wake of the dot com boom and the housing boom, Wall Street certainly tried to make environmentalism sexy and trendy for investors, but we can see now that the results speak for themselves- CO2, a penny stock for kids. “Roll up, roll up. Anyone want a tonne of CO2 for 10 cents?”

In the end it’s just another age-old tale of big business, grovelling academics, power politics… and easy money(see also: slush fund). So it doesn’t require an expert to tell you that the carbon market was doomed to fail from the beginning. Let’s just hope it doesn’t require another Wall Street-style bailout.

—-

IN CASE YOU MISSED IT: EXCLUSIVE VIDEO REPORTS FROM COPENHAGEN 2009

SHORT FILM: “HOPENHAGEN”

—-

About the author: Patrick Henningsen is a writer, filmmaker, communications consultant and managing editor of 21st Century Wire.

Contact: pj.henningsen@gmail.com

© 2010 Copyright Patrick Henningsen - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.