Gold Safe haven as US Dollar Under pressure on Recession Concerns

Commodities / Gold & Silver Oct 03, 2007 - 08:55 AM GMTBy: Gold_Investments

Gold

Gold

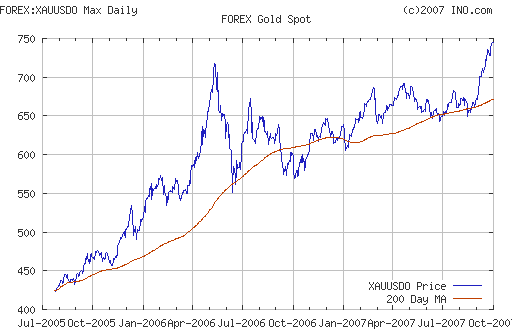

Gold took a well earned and well signposted breather yesterday after its recent large rally. Gold was down 2.4% from $747.40 to $729.70.

It recovered towards the end of trading and rose in the New York Access Market and in early trading in Asia.

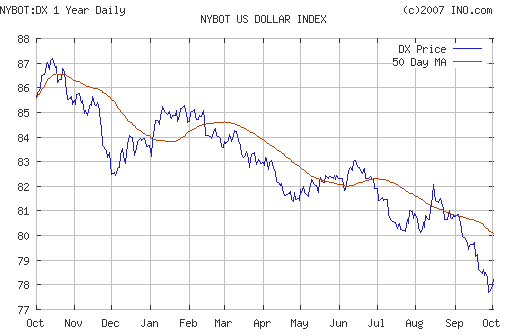

The financial and economic news remains very poor and there are increasing signs that the U.S. is on the verge of recession which will put further pressure on the U.S. dollar and lead to safe haven support for gold.

Support for gold at $726 was breached interday yesterday which could lead to a gold retreading lower ground at strong support at previous resistance at $690 to $700 and the 50 day moving average at $693.

The ramifications of Citigroup's latest report on gold "Gold: Riding the Reflationary Rescue" written by Citigroup analysts John H. Hill and Graham Wark continues to be digested. They wrote: "We believe that the policy resolution to the credit crunch will take the form of a massive, extended 'Reflationary Rescue', in a new cycle of global credit creation and competitive currency devaluations. This could take gold to $1,000 an ounce, or higher."

The report says that central bank bullion sales earlier this year were "clearly timed to cap the gold price". "Despite the headlines, Central Bank sales are running dead flat with the low level of 2006, Hill and Wark said. "IMF sale speculation is ‘white noise.' This is a further endorsement of the Gold Anti-Trust Action Committee's (GATA) work in this regard and the Citigroup report, like its Credit Agricole Chevreux report before. It is important to take note when two important institutions such as Citigroup and Credit Agricole produce reports of this nature claiming that Central Banks may have been manipulating the gold price lower. Ultimately, free markets always overcome artificial interventions by governments and central banks and once this transpires we are likely to witness markedly higher gold prices.

Forex and Gold

Talk of a rescue package for Northern Rock saw the pound rise to a two-week high against a basket of currencies this morning. Sterling was last at 2.0398 against the dollar and 1.4392 against the euro. And the dollar was at 0.7053 against the euro and 115.96 against the Japanese yen.

The dollar continued to rise yesterday from the record lows reached on Monday morning, as traders booked profits on recent gains. Overnight, it edged slightly lower. The modest bounce in the dollar is largely technical as it recovers from oversold conditions and extended short positioning ahead of key U.S. economic data due over the second half of the week.

Silver

Spot silver was trading at $13.33/13.35 (1200 GMT).

PGMs

Platinum was trading at $1348/1352 (1200 GMT).

Spot palladium was trading at $348/354 an ounce (1200 GMT).

Oil

Oil rose above $80 a barrel on Wednesday as investors expected weekly U.S. data to show crude stocks declining and raising the prospects for a winter supply crunch.

U.S. crude gained 23 cents to $80.28 a barrel by 0903 GMT. Prices had fallen close to $3 from a near record high late last week on concerns the global credit crunch would stymie U.S. and European economic growth. Brent crude was off 7 cents at $77.31.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.