U.S. Dollar Makes New Lows, Inflation Unplugged

Stock-Markets / Financial Markets 2010 Oct 15, 2010 - 12:16 PM GMTBy: PhilStockWorld

The dollar is making new lows.

The dollar is making new lows.

As I’ve been saying all week(s) that is the story that is driving the market. Still people interview me and ask me how high I think the markets can go which is kind of silly because, as I keep trying to explain, the markets aren’t going anywhere, the only variable is the currency they are priced in. Why do people not get this? Why do financial writers not get this? Why do TA guys not get this? Why does nobody talk about this in the MSM?

Sure they talk about the weak Dollar or the strong Yen (but rarely the strong Pound or Euro, because it is contrary to the average viewer’s vision of America and we don’t want to upset the viewers, do we?) but who ever shows you a simple and obvious chart of the S&P or any other index priced in a foreign currency? How hard is this to understand?

So, if you are a Japanese investor, watching your US equities, THIS is how they are performing. It’s not much different from an EU perspective, where we FAILED the 200 DMA on 9/21 and the 50 DMA made a death cross last week. Yet I still see chart guys running out on CNBC telling us their TA tells them we can go to the moon. Sure, we can go to the moon. Price your stocks in Hungarian Forints and suddenly the S&P is at 240,000 - all we have to do is ignore the fact that the currency has changed - JUST LIKE WE DO WITH THE DOLLAR - and we are rich, Rich, RICH!

Yes, that would be ridiculous. Almost as ridiculous as a bunch of grown men, who make a living analyzing the markets, acting as if the underlying value of the currency we are pricing things in doesn’t matter. Do you know what the World’s hottest market was in 2007? Zimbabwe! That sucker would gain 500-1000% in a single day - invest over there and you made money hand over fist. Howard Stern had a game called "Who Wants to be a Turkish Millionaire" and he would give away a Million Turkish Lira and the joke was how excited the contestants were and how much they would be willing to humiliate themselves for what they did not realize was about $6.

Yes, that would be ridiculous. Almost as ridiculous as a bunch of grown men, who make a living analyzing the markets, acting as if the underlying value of the currency we are pricing things in doesn’t matter. Do you know what the World’s hottest market was in 2007? Zimbabwe! That sucker would gain 500-1000% in a single day - invest over there and you made money hand over fist. Howard Stern had a game called "Who Wants to be a Turkish Millionaire" and he would give away a Million Turkish Lira and the joke was how excited the contestants were and how much they would be willing to humiliate themselves for what they did not realize was about $6.

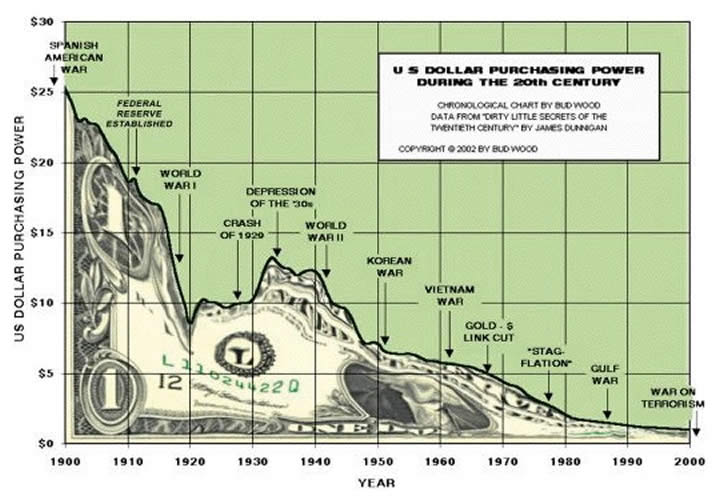

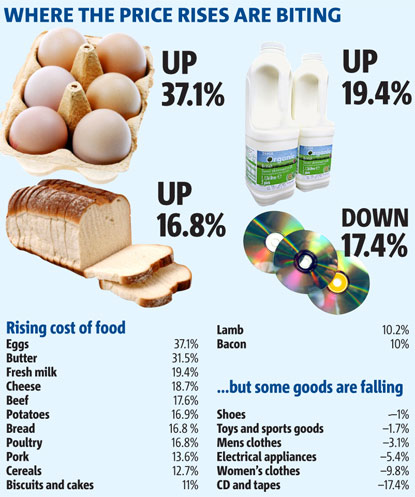

That’s the con that is being played on American investors by the Fed. It’s a game called hyperinflation and in the early stages, it does seem like a lot of fun as your investments go up 10% while your savings devalue by 10% and the stuff you buy goes up 10%. So what do you do, you cash a little of your investments so you can buy more stuff and - WOW! - the Government’s plan is working,, you are spending money in the economy! But now you have more stuff (and the food and fuel you consume, so that’s gone) and your savings are still down 10% and you withdrew 10% of your investments but, not to worry, the investments go up another 10% and mask your next 10% drop in hard assets. And meanwhile, at the Hall of Unintended Consequences…

This cycle continues until your saving are worthless and you have used up all of your investments paying for day to day living and then the whole thing collapses in a giant meltdown when, like Zimbabwe, the government finally revalues the currency by cutting some zeros off of all the notes. As I’m writing this, Bernanke is giving an "inflation is good" speech. I like inflation, I think the US should inflate it’s way out of debt but the kind of inflation Ben is giving us is the wrong kind. QE inflation DEVALUES what you have and makes things you want more expensive. Stimulus inflation drives more cash through the workforce and demand drives up the price of goods so everybody benefits. It’s a BIG difference…

Who makes out well when we have hyperinflation without wage inflation to match? The investing class, of course - and that’s us. As I said yesterday, we have been making long selections and holding our noses as we buy but it’s the only sensible thing to do when the Chairman of the Federal Reserve is on a mission to cause inflation.

"The topic of this conference–the formulation and conduct of monetary policy in a low-inflation environment–is timely indeed" says Ben. Wow, really?!? What an amazing coincidence. Who could have imagined that the topic of the Speech you give on options expiration day with the dollar making new lows would just so happen to drive the dollar even lower and squeeze the markets higher - that is just a gosh-darn freaky coincidence!

But, is Ben promising enough to feed the market beast that’s already grown $5Tn in the past 30 days? Can he possibly dump enough money on the economy to fill this gaping value hole or is the whole thing going to blow up in our faces? We report, you decide…

As I said yesterday, I vow to spend this weekend destroying as many brain cells as possible in order to try to shut down my brain and join the party. As a fundamentalist, I have to lose many, many brain cells in order to buy into this nonsense but, as a guy who’s been around a while, I also know that being a fundamentalist in 1999 meant you missed almost daily doubles in anything that had a dot com attached to it. Right now we have a commodity bubble as if you can charge whatever you want for copper, oil, tin, wheat, corn and, of course gold without affecting global demand despite the fact that global wages are in decline, global standards of living are in decline and close to 20% of the people on the planet aren’t even working.

Goldman Sachs says "Fuhgeddaboudit" in their latest report, where they have now DOUBLED their predictions on commodities, now projecting a 30% rise for the year. This too reminds us of 2008, when GS goosed the markets with their almost weekly upgrades of oil and drove it up 40% as wave after wave of suckers came into the market, driving oil up to $140 a barrel - right before it crashed to $35 by the end of the year.

At $120 in May of 2008, Goldman’s target was $200 for oil and, at the time, I wrote "$200 Oil - Who’s Going to Pay For It?" That did not stop oil from rising another $20 (15%) before it crashed but I could say the same thing now about copper and corn and wheat and silver and platinum. Gold can go up to $5,000 because gold isn’t actually used by anyone and there’s not all that much of it so idiot speculators can make up prices on their shiny bits of metal the same way they pay $100M for a painting - when money is that meaningless, it’s hard to understand the real value of it.

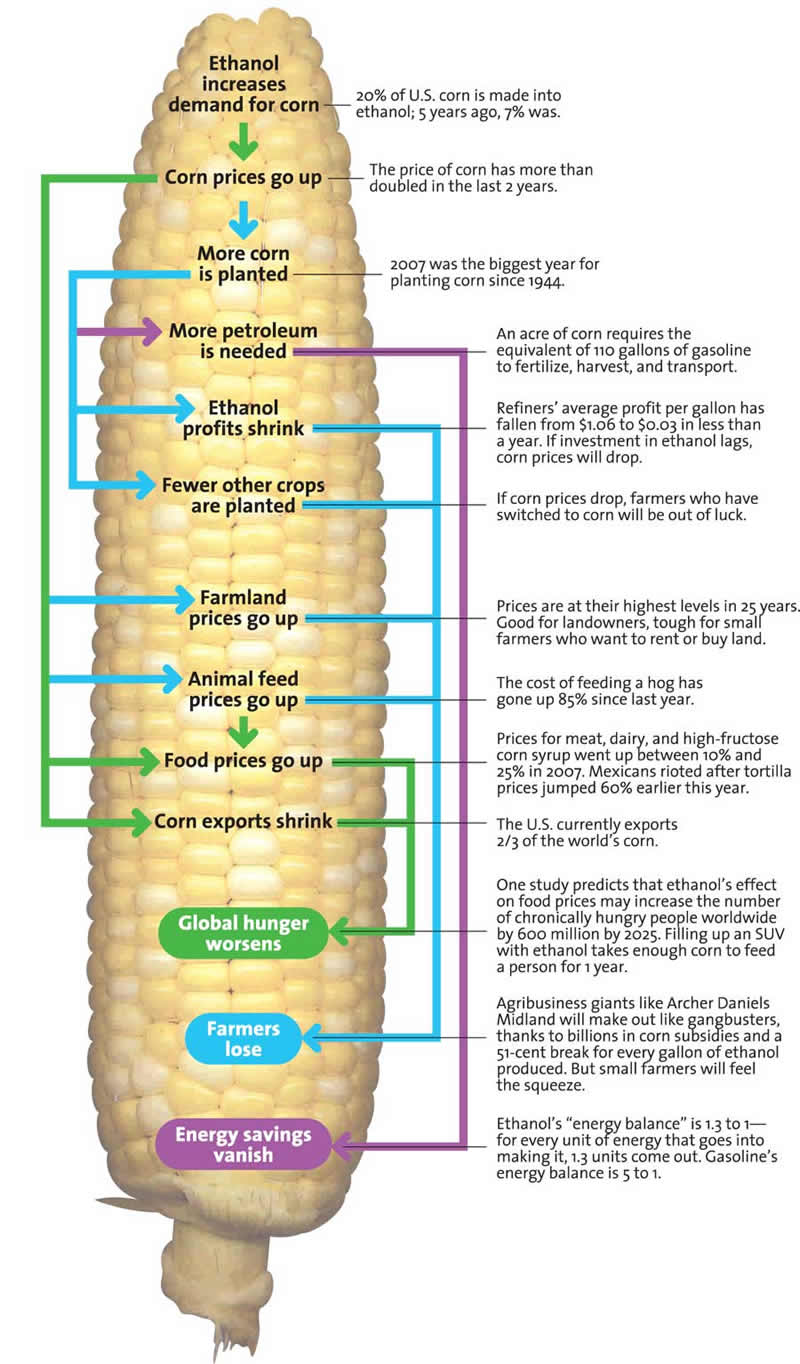

That brings me to the ethanol scam. Hopefully I can get out of my preachy mode after this week but shame, shame, shame on Obama and this administration and every single member of Congress for perpetuating this nonsense. Corn is NOT an efficient fuel. It takes as much corn to fill up an SUV with fuel as it does to feed a person for an entire year. Just because something can be done, doesn’t mean it should be done!

There are 62M people who die of hunger each year on Earth including 15M children. Can filling up 15M tanks of gas be worth their lives? This is just total BS and needs to be stopped, maybe even more than Bernanke needs to be stopped:

It’s just one insane policy after another these days but, as I said, we will just have to go with the flow, no matter how stupid that flow may be. ADM, who spends millions of dollars buying politicians to push this ethanol nonsense, is going to be a great buy at $33. Heck, they were over $50 in 2008 and happy days are here again for the commodity pushers but you’d better make your 40% gains quickly as the dollars you will get back won’t be worth much if you wait too long…

Have a great weekend,

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.