Weekly Financial Markets Analysis - FedWatch: Why the Fed is still pumping Liquidity Into the Commercial Paper Market

Stock-Markets / Financial Markets Oct 06, 2007 - 06:55 AM GMT

The credit crisis is far from over. On Thursday the Federal Reserve lent another $28 billion at the Temporary Open Market Window . The total for this week was $43 billion. The pattern of lending is still very active, with many of the loans rolling over on a weekly or bi-weekly basis.

The credit crisis is far from over. On Thursday the Federal Reserve lent another $28 billion at the Temporary Open Market Window . The total for this week was $43 billion. The pattern of lending is still very active, with many of the loans rolling over on a weekly or bi-weekly basis.

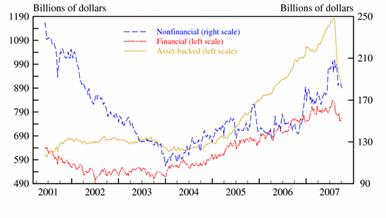

The reason for this activity is that the commercial paper market, which is the normal lifeblood of the banking business, is still contracting. The largest asset decline is the asset-backed category, where the subprime loans are. But the other categories are also declining (Source: Federal Reserve Release, October 4, 2007 ), signaling a general distrust among banks over where the subprime skeletons are hiding.

The reason for this activity is that the commercial paper market, which is the normal lifeblood of the banking business, is still contracting. The largest asset decline is the asset-backed category, where the subprime loans are. But the other categories are also declining (Source: Federal Reserve Release, October 4, 2007 ), signaling a general distrust among banks over where the subprime skeletons are hiding.

This dramatic contraction over less than two months is leaving banks with unwanted asset-backed loans with declining credit ratings. Those assets must be disposed of by whatever means possible. Granted, investors are starting to venture back into the commercial paper market. However, the $4.5 billion rebound in new money finding its way into the commercial paper market is being dwarfed by the almost $440 billion that is maturing this week.

In a more recent development, Citigroup is talking with Kohlberg, Kravis & Roberts (KKR) about a structured deal where it may sell its leveraged loans to a new hedge fund opened by KKR. “However, people close to the talks say the deal so far has proven hard to structure.” Citigroup may have to provide financing to KKR so that it can dispose of the leveraged assets.

What hath Bernanke wrought?

By allowing interest rates to stay low for so long, the Fed inadvertently lowered profit margins for banks. The outcome of this was that the banks sold much of their portfolios to Wall Street, where they were securitized and re-sold to hedge funds and mutual funds, often owned by the very same banks. In order to work with paper-thin profit margins, many banks lowered their lending standard s and went after larger clients. This is what sparked the leveraged buy-out boom in the stock market in the past several years.

The outcome of the lower underwriting standards was an acceleration of risk factors. After all, their intent was to sell these leveraged assets to investors, not own the assets themselves. Now that there is an investor backlash to the lower standards, many banks are finding themselves inadvertently owning assets they must sell at a discount .

Bank failures here and abroad.

The news about Northern Rock's recent bank run in the United Kingdom has hardly received mention here in the United States . Yet banking conditions here are no different. Many banks have taken risks beyond their means and have put depositors at risk. The FDIC is still insuring deposits up to $100,000, but those with deposits over the insured amount had better be certain of their bank's stability.

The most recent bank failures here in the U.S. are not making headlines, either. Last Friday, NetBank, the first and largest internet bank was closed by the FDIC. ING Direct, a Netherlands-based bank acquired some $1.5 billion of customer deposits. However the transition has not been without problems for customers. Miami Valley Bank (Ohio) was closed by regulators this week, leaving some $14 million of uninsured deposits in 269 accounts on the hook. This morning Washington Mutual and Merrill Lynch warned of large subprime losses.

Check your own bank.

I have recently contracted with Veribanc, Inc. to prepare a Watchlist of 38 mid-Michigan banks and credit unions as well as the four major banks dealing with the subprime debacle and a handful of banks doing business in Western Florida .

You may obtain the list directly from Veribanc, Inc. by writing them at P.O. Box 1610 , Woonsocket , RI 02895 or emailing them at service@veribanc.com . You may also call 1-800-442-2657 and ask for The Practical Investor, LLC Watchlist Report. There is a charge of $110.00 for this watchlist, which will be issued quarterly. If you are dealing with a single bank and want to know its credit score, you may call (517) 699-1554 or email me at tonyc@thepracticalinvestor.com . Only one bank score per client, please.

Japan 's Nikkei pauses for long weekend and more data.

From the Associated Press: “…many investors were reluctant to place big bets ahead of a three-day weekend in Japan and the release of widely watched U.S. employment data later Friday.

From the Associated Press: “…many investors were reluctant to place big bets ahead of a three-day weekend in Japan and the release of widely watched U.S. employment data later Friday.

Those figures could give investors a clearer idea about the outlook for the U.S. economy — a key export market for Japan — and the likelihood of another U.S. interest rate cut.”

All quiet out east?

There seems to be no market activity this week in Shanghai . Although I am not an expert on the Chinese culture, there is an Autumn Festival that takes place late in September and October 1 is National Day, commemorating the founding of the Peoples Republic of China . More market observations will follow next week.

Is the bull market deranged?

This week I wonder as the market rallied on Monday even after several major banks posted record losses. What gives? Mad Bull Disease? Ambrose Evans-Pritchard, of the London Daily Telegraph weighs in with his comments about the market. “ The relief rally since the Federal Reserve slashed rates half a point to 4.75pc is a moral hazard bet, based entirely on assumptions that Ben Bernanke will debauch the monetary system to boost asset prices.”

Downtrend in bonds resumed today.

The employment statistics today squashed the notion that another rate cut was in store for the bond market. Bond traders were quick to sell , since a stronger than expected economy would take pressure off the Federal Reserve to ease credit conditions soon. Fed funds futures, which measure the market's expectations of future rate cuts, plunged after the jobs report, according to Action Economics.

"Indeed, the data suggest the Fed overreacted to the preliminary weakness in the August data, and that further accommodation is not only not necessary, but bad policy, especially as the financial markets are much more stable than in August," the firm's analysts wrote in a note.

Think Housing's bad?…

… You ain't seen nothing yet . The Chicago Mercantile Exchange (CME) sells futures contracts on the U.S. housing market. From the current price levels of these futures, things do not look good going forward. Investors in the futures pits are anticipating an average price decline of 14% before prices begin to recover somewhat in 2011.

What do investors see in the U.S. Dollar?

There are two possibilities. The first is that the September hiring figures have been much improved over August, making our economy appear to be on a better footing. The second reason may be more interesting…that overseas investors are still looking at the U.S. as a safe haven for their capital. I wonder what they are seeing?

There are two possibilities. The first is that the September hiring figures have been much improved over August, making our economy appear to be on a better footing. The second reason may be more interesting…that overseas investors are still looking at the U.S. as a safe haven for their capital. I wonder what they are seeing?

Take profits in gold?

Time for caution because volatility works both ways in gold. This appears to be a classic reversal pattern and is being confirmed by the rising dollar this week. The last big surge in gold prices came on the heels of Mr. Bernanke's rate cut. If the employment situation recovers from the August hiring numbers, we could see the prospect of further rate cuts wither on the vine.

Time to take some off the table?

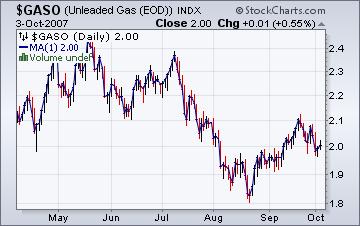

Midwest benefiting from lower gasoline prices.

The Midwest experienced the largest drop in the wholesale price of gasoline, according to the EIA's report this week. In the meantime, all regions in the country witnessed higher prices for diesel fuel. The stockpile of propane is at one of its lowest ebbs for this time of year. Even though propane in storage might be adequate for the winter heating season, any surprises in weather or unusual demand, such as the bumper crop of corn, which may need to be dried if weather doesn't co-operate, could send propane prices up sharply.

The Midwest experienced the largest drop in the wholesale price of gasoline, according to the EIA's report this week. In the meantime, all regions in the country witnessed higher prices for diesel fuel. The stockpile of propane is at one of its lowest ebbs for this time of year. Even though propane in storage might be adequate for the winter heating season, any surprises in weather or unusual demand, such as the bumper crop of corn, which may need to be dried if weather doesn't co-operate, could send propane prices up sharply.

Natural gas supplies are in good shape.

Yet another tropical storm has been disrupting new gas production and a persistent warm spell across the country is keeping demand high for air conditioning, says the Energy Information Agency . Current market conditions suggest that natural gas customers may pay the same for their heating bills as last year. Variations in costs will be dependent upon the weather, since last winter was warmer than normal.

Yet another tropical storm has been disrupting new gas production and a persistent warm spell across the country is keeping demand high for air conditioning, says the Energy Information Agency . Current market conditions suggest that natural gas customers may pay the same for their heating bills as last year. Variations in costs will be dependent upon the weather, since last winter was warmer than normal.

The death of investment.

Alan Newman's last report was titled, “A Record Setting Stock Market.” Did you wonder what the market would do for an encore? Here we are, three months later and “…not only have things changed, they have changed appreciably…and in all the wrong directions.” Read Alan's latest article carefully. He gives us some of the fundamental reasons why the market will not last. The technical view is that we are very close to the end, as well. When both sides are in agreement, watch out!

Back on the air again.

Tim Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. You may listen to our comments by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.