The Wall Street Buttonwood Gathering - View from the Top

Stock-Markets / Financial Markets 2010 Oct 26, 2010 - 01:31 PM GMTBy: PhilStockWorld

This was an interesting event!

This was an interesting event!

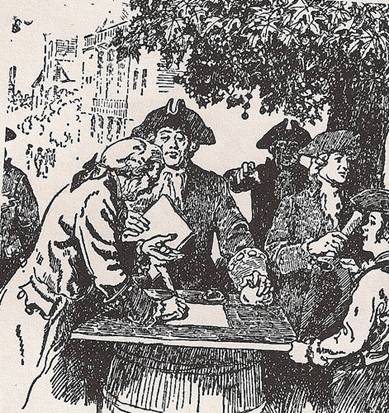

On May 17th 1792, twenty-four stock brokers met under a buttonwood tree outside 68 Wall Street and agreed to set up the New York Stock and Exchange board. The tree was a symbol of Wall Street, but also, it was where people originally met to trade, to discuss and to argue.

The Economist has done an excellent job of keeping the tradition alive by bringing together top global financial executives, policymakers, global regulators and opinion leaders to discuss and debate proposed guidelines for the financial community, seeking to bridge fundamental financial issues with macroeconomic and geopolitical viewpoints.

The Economist has done an excellent job of keeping the tradition alive by bringing together top global financial executives, policymakers, global regulators and opinion leaders to discuss and debate proposed guidelines for the financial community, seeking to bridge fundamental financial issues with macroeconomic and geopolitical viewpoints.

As I mentioned yesterday, I usually don't like conferences but not only did I find myself sitting between BOE Governor Mervyn King and Nobel Prize winner Joseph Stiglitz but we got to watch my favorite economics rap video together and even met the guys who created it from EconStories, who have lots of good videos on their site (of a more serious nature).

The conference itself does not take itself too seriously. Even Nassim Taleb was able to make a few jokes while explaining to us why the financial system is irrevocably screwed up unless we give it a major overhaul. Taleb's main points were:

- People are inherently greedy.

- The Financial Crisis was caused by and increase of hidden risks that was encouraged by the rules set forth in Basel II

- Multiple exposure to low-probability, high-risk events accumulate to high probability of bad outcome (Taleb's "Black Swan").

- Bonus packages and compensation encourage very bad risky behavior. Stock options that offer potential upside and no downside encourage the maxing of risk-taking by potential beneficiaries.

- This leads to a banking system where all the traders get rich and all the investors become poor.

- There is a general,.chronic underestimation of risk and business schools reinforce this bad behavior.

- Regulation gives investors a false sense of security.

- Capitalism must be symmetrical - bonus without penalties (clawbacks, etc.) must be eliminated.

When I am at one of these conferences, I like to watch the audience reaction to what is being said. Here we have a gathering of the World's movers and shakers and sometimes the reaction to what is being said is more important than the thing that is said. For instance, my note on Taleb's comment that regulations give investors a false sense of security is that Mervyn King laughed and nodded on that one. That's pretty telling.

When I am at one of these conferences, I like to watch the audience reaction to what is being said. Here we have a gathering of the World's movers and shakers and sometimes the reaction to what is being said is more important than the thing that is said. For instance, my note on Taleb's comment that regulations give investors a false sense of security is that Mervyn King laughed and nodded on that one. That's pretty telling.

Of course, King made his own point quite well in what was called "The Bagehot Lecture" - kind of the keynote for the conference. While I was sitting there, I complained in my live comments to Members that King was giving a fairly dull overview of modern banking but now that I have taken the time to look up what a Bagehot Lecture is supposed to be - I will apologize to Governor King, who actually nailed it.

Once he got past the overview, King really got going and pointed out some scary points like liquid assets held by the banks are now 2% of their assets, which is down from 33% of their assets in decades past. That means, according to one of the most powerful bankers on Earth, that "small movements in asset valuations are enough to render banks insolvent" and that "banks are much riskier than commonly believed as an investment" with only implicit Government subsidies making investments in modern banking rational.

My comment to Members while King was making these remarks was: "Wow, not what I expected King to say. Blank stares from audience. This is not news to them…" I don't know what the Governor expected as a reaction but the audience was full of the very same people who take those risks and reap those rewards and the commentary had about the same effect as attending a con man convention and telling them that 3-Card Monte is a rigged game.

My comment to Members while King was making these remarks was: "Wow, not what I expected King to say. Blank stares from audience. This is not news to them…" I don't know what the Governor expected as a reaction but the audience was full of the very same people who take those risks and reap those rewards and the commentary had about the same effect as attending a con man convention and telling them that 3-Card Monte is a rigged game.

King wants to see a strong Basel III accord but he pointed out that the best-qualified bank under Basel II was Northern Rock because, at the time, the assumption was that mortgages were the safest asset class. Under Basel III, the World's Central Bankers have learned their lesson and banks will now be rated by how much Priceline stock they hold, followed by Netflix, Chipolte and First Solar (just kidding about that last part).

"Of all the ways to organize Banking, the system we have today is by far the worst." - BOE Governor, Mervyn King

Citigroup's Vikram Pandit said he welcomed regulation, as long as all banks were treated equally. The flaw in that logic was pointed out by Nassim Taleb, who said he used to be in the trading game and the advantage of regulations goes to the guys with the lawyers who are best at finding loopholes to exploit so of course it benefits the big players to call for harsh regulations that stifle potential competitors. Pandit also said, after being asked repeatedly about the bank's willingness to lower credit-card fees to 10%, that new rules and lower fees will simply mean that serving the less affluent will be less economically viable and banks will pull out of less profitable communities leaving some without access to banking.

I have to say I think this is BS and Pandit should know better as there are banks in India, where the average person earns less than $2,000 a year and Americans rush to invest in them, don't they? While big banks may see no profit in working for poor people, other banks will be happy to fill the gap, perhaps based on a new model that will one day put Mr. Pandit out of business...

Pandit also warned that the global financial sharks are still circling the US and Japan and praying for an opportunity to take down those economies. As we saw from the last crisis, the shorts can make ridiculous amounts of money in a crash and toppling a liquid market like ours or Japan's makes for much safer and MUCH BIGGER betting opportunities than knocking down a small economy like Greece or Dubai but, hey, you have to practice somewhere, right?

The Freudian slip of the day award went to Mr. Pandit, who said: "I think all the progress that has been made against consumer protection is heading in the right direction."

An unintended comedy of errors was performed by a panel that included Robert Rubin, Josh Bolten, Larry Meyer and other top financial advisors who participated in a simulation of a financial crisis hitting a major US state. It took them just over an hour to go through a series of well-intentioned decisions that resulted in the collapse of the US economy (simulated of course, the real collapse is taking a little longer). Glenn Hubbard was on the panel and you can see why the title of his book is: "Seeds of Destruction: Why the Path to Economic Ruin Runs Through Washington."

All in all, it was a great conference, Members can read all my notes from yesterday's chat as these are but a sampling of what happened yesterday. On the whole, I got the impression that there is NOT a lot of enthusiasm for the economy. Several audience polls were taken and an audience filled with the Global economy's top movers and shakers believe one or more EU states will default, that unemployment remains elevated for the next two years at least and that we have 3-5 years of sub-par growth ahead of us.

There was a fair amount of gallows humor regarding the economy being tossed about, also discouraging and I'm sorry I won't be able to attend day two live, attending events like this is a great way to gain perspective but, I'm sorry to say, it hasn't improved my outlook (see last week's Stock World Weekly newsletter for more on that subject) - simply reaffirmed what I've been saying as we top out on our trading range.

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.