The Federal Reserve Casts Its Ghostly Shadow Over the Markets

Stock-Markets / Financial Markets 2010 Nov 01, 2010 - 02:43 AM GMTBy: Bob_Kirtley

This week will see the opening of Ben Bernanke’s Quantitative Easing box. Out of which will jump a giant stimulus rabbit along with a few difficult to interpret actions lightly disguised as helpful aids and more commonly known as the product of the printing press. Mark Wednesday, 3rd November 2010, 18:15 GMT in your diary as this speech is the most important speech of this year.

This week will see the opening of Ben Bernanke’s Quantitative Easing box. Out of which will jump a giant stimulus rabbit along with a few difficult to interpret actions lightly disguised as helpful aids and more commonly known as the product of the printing press. Mark Wednesday, 3rd November 2010, 18:15 GMT in your diary as this speech is the most important speech of this year.

QE2 as it is now called is here and the only unanswered question is just how much of it will be generated. This move has been well trailed to the market so their high level of expectancy is already priced into this move. Not to deliver would disappoint and send the markets into a tail spin. Not to deliver sufficient funds would also be a set back for the markets. And Ben believes that what he is doing is right, for him this is a real world opportunity to prove that his thesis, written many moons ago, was the work of pure genius. Putting his personal aspirations to one side we need to protect ourselves against the fall out of such actions that will be imposed on us like it or not.

As we see it there are three possibilities. Firstly he under shoots his target and the market groans. Secondly he shoots to please the consensus and gets a fairly muted response. Thirdly, this is his finest hour and he over shoots with some unexpectedly large amounts of stimuli. He wont disappoint he will come in on the high side to allow sufficient dollars to be printed so that they can be readily available to everyone.

Our opinion, for what it is worth, is that we are looking at a minimum initial package of around 800 billion dollars phased in over the next few months. This will be accompanied by words along the lines of; more can be added if required, we will do what it takes, we will respond as and when its necessary. And the recovery is in place, jobless though it may be.

This week could be a rocky one but do not be pushed into selling your core holdings, stick with them, otherwise you could be presenting someone else with the opportunity of a life time.

Taking a quick peak at the chart for the USD we can see that the cross of death signaled further deterioration of the dollar, however, the ‘77′ level appears to be holding just prior to the launch of QE2. The technical indicators are in the neutral zone at the moment and could easily go either way. Should the ‘77′ support level fail and we think it will, then the ‘72′ level could be hit in short order.

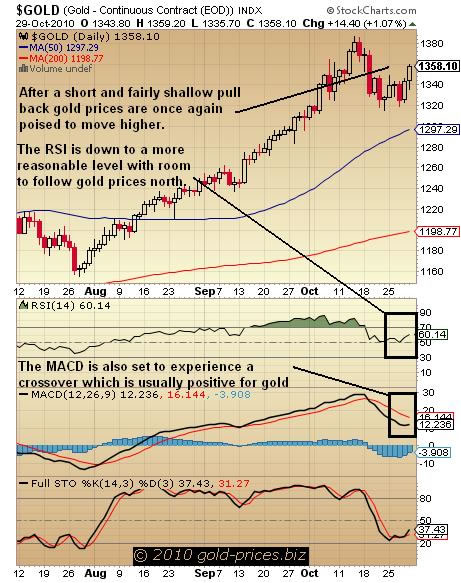

Taking a quick look at the chart for gold prices we can see that following a short and fairly shallow pull back gold prices are once again poised to move higher. The MACD is also set to experience a crossover, when the black line crosses through the red line in an upward motion, which is usually positive for gold and could come during the next few trading sessions. The RSI is down to a more reasonable level at 60.14 which has taken the steam out of the overbought position, so it now has the room to follow gold prices north.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.