Stock Market Continues to March Higher After Election

Stock-Markets / Stock Index Trading Nov 04, 2010 - 07:40 AM GMTBy: Chris_Vermeulen

With the election over and congress divided, it may be difficult for the president to get much done. None of this will take affect until the near year but traders are asking the big question… Will the government work together as a team or will it be a stalemate?

With the election over and congress divided, it may be difficult for the president to get much done. None of this will take affect until the near year but traders are asking the big question… Will the government work together as a team or will it be a stalemate?

Today’s whipsaw action after the FOMC statement shook things up as it always does. We saw gold, silver, the dollar, SP500 and bond prices go haywire. It took about 30 minutes for the market to digest this news in that time a lot of people lost money because of the wide price swings. Trading around news, I find, is a net losing trade over the long run and I advise never to do it. Rather wait for a trend to form and trade any low risk setups that come your way.

I truly believe that the market has already priced in most news and events which unfold, and that news tends to agree with the overall trend of the market. Of course there will be short term blips on the charts from the news, but they tend to be minor setbacks in the underlying market trend. That being said, the trend is our friend, and while so many are trying to pick a top in the equities market it makes me cringe because they are fighting the trend and the Fed.

Successful trading is done by trading the trend, and during choppy times you may get roughed up a bit and need to alter your strategy for shorter term momentum play, but overall you gotta’ stick with the trend until proven wrong. Once the trend reverses and confirms, only then can you start shorting the market.

Last week we took another long position near the lows on the SP500 as it dipped down to key support with the market internals confirming our entry. This low risk setup gets us into a market at an extreme, meaning we are in the money usually within hours of entry and the market tends to keep well above our entry point until its ready for another surge higher or a break down.

I agree with those of you who think the market is WAY over bought and due for a strong pullback, and I find myself squirming in my chair when I take another long position way up here in the lofty SP500 prices. But over the years I have found that if it’s hard to pull the trigger, then it should be a good trade if all the trading rules have been met, and if it’s a clear chart setup (meaning an easy looking trade) you better watch out!

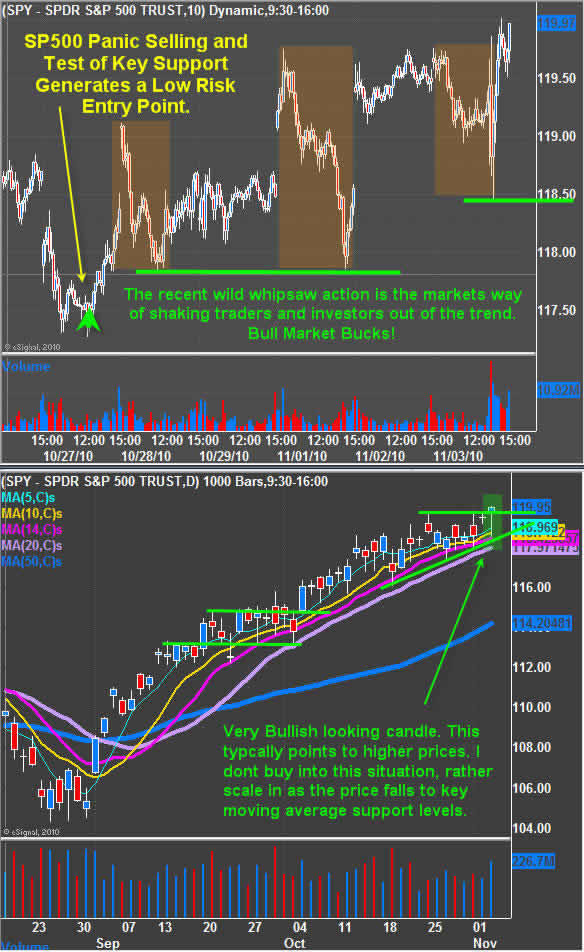

SPY – SP500 ETF Exchange Traded Fund

This chart shows two charts. One of the 10 minute intraday chart covering 6 trading sessions. It shows where we had our recent entry point and also shows how the stock market tries to buck traders off a bull market.

The bottom chart shows the daily chart and today strong reversal candle closing at a new multi month high. Again, the market is way over done and I never recommending chasing a stock, commodity or index, but to wait for a pullback to support before getting on the bull.

Mid-Week Trading Conclusion:

In short, the market is still trending up so stick with the trend for now and DO NOT, for any reason, chase the market just because you want in. Wait for an intraday dip on the 30 minute chart if you’re dieing to get involved.

The average bull market lasts about two years and the Fed plans on pumping money into the market long enough to make this a 2 year bull market. I’m not saying we get higher prices for that long, but that’s more or less what plan for the guys manipulating the market up. So when it does fall there is plenty of room so hopefully the 2009 low is not broken which would not be good.

I’d like you to have my ETF Trade Alerts for Low Risk Setups! Get them here: http://www.thegoldandoilguy.com/specialoffer/signup.html

Also Follow Me on Twitter in Real-Time: http://twitter.com/GoldAndOilGuy

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.