FOMC Policy Statement, Fed on Watch-and-Wait Mode

Interest-Rates / US Interest Rates Dec 15, 2010 - 03:04 AM GMTBy: Asha_Bangalore

The Fed is essentially on a watch-and-wait mode. The asset purchase plan of $600 billion of longer-term Treasury securities, known as QE2, was left intact and the program is set to expire in June 2011. The Fed made small modifications to the November policy statement. The pace of economic recovery is now seen as "insufficient to bring down unemployment" vs. a more amorphous description in November that output and employment conditions are "slow." The Fed upgraded its view about consumer spending and depicted it as "increasing at a moderate pace," while in November, the Fed saw consumer spending as "increasing gradually." The retail sales report of November (see discussion below) justifies this modification. The Fed indicated in November that "housing starts continue to be depressed," which is now revised to read as the "housing sector continues to be depressed."

President Hoenig of the Kansas City dissented again on the grounds that the level of monetary accommodation "would increase the risks of future economic and financial imbalances and, over time, would cause an increase in long-term inflation expectations that could destabilize the economy."

Retail Sales - Impressive Gains in November and Noteworthy Upward Revisions of Prior Estimates

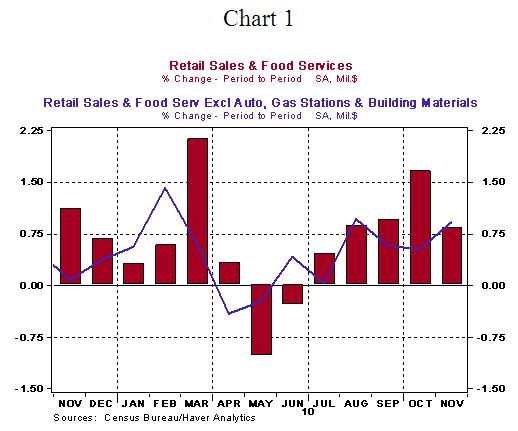

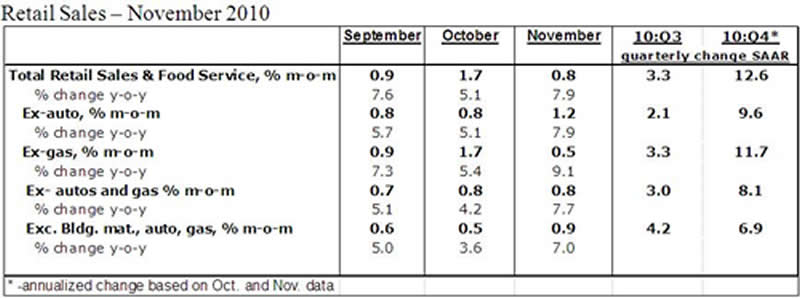

Retail sales rose 0.8% in November, following an upwardly revised gain of 1.7% in October (previously estimated as a 1.2% increase) and a 0.9% increase in September (earlier estimate was a 0.7% gain). The October-November data suggest more than a mild increase in consumer spending in the fourth quarter and headline real GDP growth could exceed the 2.5% mark of the third quarter. During November, sales of apparel (+2.7%) and general merchandise (+1.3%) advanced, unit auto sales held steady, and building materials were nearly unchanged.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.