Global Stock Market Cycle Forecast 2011

Stock-Markets / Stock Markets 2011 Jan 09, 2011 - 08:24 AM GMT The job of a stock market cycle tracker and forecaster is far more difficult with trillions of dollars in government intervention and global central bank quantitative easing sloshing around global markets. The liquidity is bidding up everything from oil to coffee to corn, but the cyclical stock market picture is clearing up. There is both good news and bad news regarding global stock market cycles for 2011. It is always better to get the bad news off your chest first, so let’s dispense with the bad news, and move on to the good news.

The job of a stock market cycle tracker and forecaster is far more difficult with trillions of dollars in government intervention and global central bank quantitative easing sloshing around global markets. The liquidity is bidding up everything from oil to coffee to corn, but the cyclical stock market picture is clearing up. There is both good news and bad news regarding global stock market cycles for 2011. It is always better to get the bad news off your chest first, so let’s dispense with the bad news, and move on to the good news.

The bad news is that the global Kondratieff long wave and winter season could have ended in 2009. If it had, a global long wave spring season would now be underway. An orderly unwinding of bad debt, the closing of the overproduction lines, and the deflationary implications of the regular long wave global economic forces is as natural as the turning of the annual seasons from fall to winter. The fall season is beautiful and the air is crisp and fresh, but government has no business trying to make it last forever. A free market economy would unwind the excesses of the long wave cycle in a far more orderly fashion than the job the Keynesians are doing.

In The K Wave (1995), published by McGraw-Hill, I predicted a global banking crisis, real estate collapse, interest rate plunge and a deflationary unwinding of global long wave excesses, ending in 2009. The forecast was for the long wave to run its natural course and put in a long wave bottom, making the natural long wave turn from the winter season into a robust global economic spring. That call from almost 15 years out was looking interesting in early 2009, as global markets were in free fall. That call is actually even more interesting now, with the powerful global market rallies out of that low. The case presented was that emerging markets would lead the global economy out of the long wave winter season and into a new long wave spring season and global boom. The updated and expanded edition of the book is Jubilee on Wall Street (2009), and is available at Amazon, in the event you are interested in learning more about the long wave.

Unfortunately, something tragic happened on way to the long wave spring season. Government came to the rescue. Around the world, governments have run up trillions of dollars in debt, trying to stop the natural turn of the long wave seasons. They have created the greatest amounts of debt in human history trying to counter the Kondratieff long wave cycle, which they do not understand.

Beginning as far back as the 1980s and 1990s, aggressive government response to financial crisis, beginning with the Latin America debt crisis in the 1980s and then the savings and loan debacle in the early 1990s, has expanded the cycles. Debt was piled on top of debt; all in an effort to try to stop the natural long wave decline and letting bad debt fail. Japan was caught in a liquidity trap after their market top in 1989, due to the great debt pyramid created in the 1980s; they have been caught in the forces of a long wave decline every since, but have continued to pile debt on top of debt.

Bad credit risks, overproduction, ill-conceived ideas, and inefficient producers and suppliers going out of business and transferring capital from weak hand to strong hands should occur regularly in a market-based system. It is as natural as a winter snowstorm. It removes overproduction and restores pricing power so the deflation ends. Unfortunately, governments and central banks began stepping in with a massive effort to prop up the economy by ensuring and forcing the supply of credit to weaker and weaker hands, with taxpayer backstopped money. The final act should have been the government (taxpayer) insured and bailed out liar loans for 120% of value on delusional appraisals, but now we know that $9 trillion in loans to global enterprises have kept all the weak hands in the game. The last business cycle 2002-2009 was a monster, which is still haunting the global economy, a result of fiscal and monetary intervention.

There are those who believe the long wave crisis is behind the global economy and that a long wave spring has sprung. Unfortunately, when you pump money into the economy you expand the cycles and make them longer. All the effort by governments and central banks around the world have only served to lengthen the regular business cycles and the long wave. The global economy is now in the final business cycle of the long wave and the long wave is now on track to top in 2011 and then end with a bottom in late 2012. This will be in the wake of a global debt collapse, since all the debt has finally gotten too big for governments to manage.

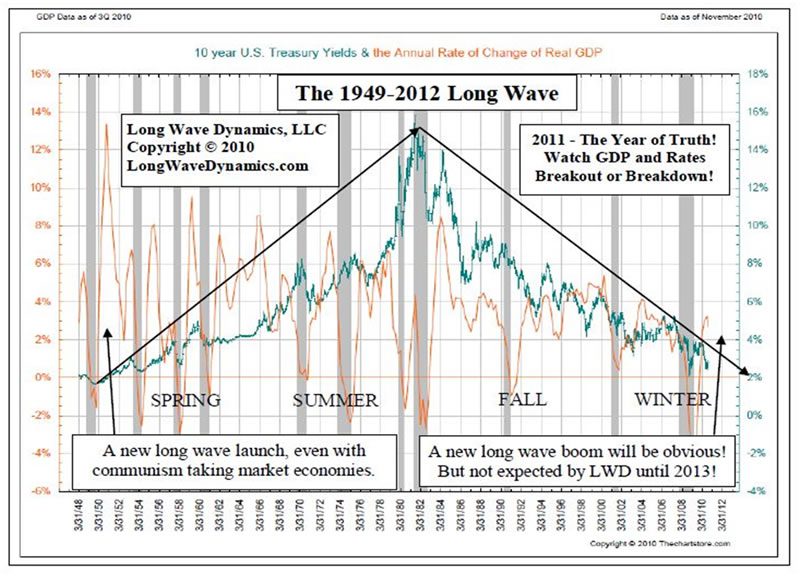

The take away here is global stock market Kitchin cycle top coming in 2011, and a final business cycle and long wave descent into late 2012, and possible into 2013 if governments go overboard to try and delay the inevitable day of Kondratieff long wave reckoning. If this updated call is wrong, and the call in The K Wave (1995) was correct, it will become evident on the chart below, as interest rates rally above the declining trend line and U.S. GDP booms, as it did at the start of the last long wave spring in the early 1950s. If this updated call is correct, the GDP recovery will top out shortly and interest rates will not break out over that declining trend line, but end their rise in 2011 and resume their decline into 2012. That ends the bad news.

Now for the good news that is central to the LWD 2011 stock market cycle forecast. The late great market timer PQ Wall was the first to recognize that every business “Kitchin” cycle subdivides into nine smaller cycles, known historically as the 20-week cycle. In The K Wave (1995) this cycle was rechristened the “Wall” cycle in honor of PQ Wall, since he also recognized that a Wall cycle is a miniature long wave, but that is another subject.

Those familiar with PQ Wall’s work will recall that he proposed that the nine Wall cycles in a regular business cycle come in three sets of three. These three sets of three Wall cycles often clearly appear on a market index chart. The rule of third last and weakest makes the third Wall cycle decline harder than the other two in the three sets and tends to show up clearly on a chart, which was what occurred on July 1, 2010. That outsized decline in the S&P 500 into July 1 clearly stands out as a third last and weakest Wall cycle.

Coming out of the Wall cycle bottom on July 1, 2010, Wall #4 has managed to make a new cycle high. The fact that global markets were able to make a new high, facing the undertoe of a global long wave debt collapse, is a very positive stock market cycle development. Sure, it was the most government sponsored and supported Wall cycle in human history. Government’s and central banks spent billions if not trillions in your money, your children’s money and your grandchildren’s money pumping and propping it up. It is running long. A large portion of the market rally is real. How much chaff and how much wheat are hard to determine, but the market did print a new high and took out the important 1228 target in the S&P 500.

Here in early 2011, global stock markets are now sitting atop the great rally from the Kitchin cycle lows in March 2009 and at the top of Wall cycle #4 from the July 1 low. This is good news from a cycle perspective, because it means that the U.S. S&P and most global markets got to new highs not just in the Wall cycle but in the second set of three Wall cycles (the 2nd Kitchin 3rd) in this final Kitchin cycle of this long wave. That is no small feat. This new high suggests the upcoming winter cycle bottom will be milder than it otherwise would be. If the final years of this long wave cycle were going to be a worse case long wave scenario, markets would not likely have been able to rally to a new high in this second set of three Wall cycles.

There is no doubt that the rising economic force of emerging markets are allowing global markets to rally to new highs this far into the final business cycle of a long wave winter season. Many of the S&P 500 companies and other developed countries major companies have a large and significant presence in emerging markets and are major exporters to the emerging markets. Emerging markets are real and powerful long wave spring forces. The end of the long wave winter was delayed, but the coming long wave spring that will be driven by emerging markets is itching to get going.

Most developed global markets will follow the direction and cycle trends of the S&P 500. The emerging market will stay one-step ahead of developed markets. It appears as if key emerging markets entered new Wall cycles between mid-November and mid-December, while developed markets have yet to bottom.

It would be wise for all investors and traders to ponder the rise of emerging markets. Just in the BRICs, a large majority of the 2.5 billion citizens are hardworking, capital forming, and aspiring global middle-class participants. The implications are truly staggering; they are and will radically change the world.

The smaller stock market cycles, specifically the Quarter Wall and Wall #4, is overbought and topping out. A sizeable correction is in store, likely into late January to mid-February, which will produce the bottom of Wall cycle #4. Out of this low Wall #5 has a chance to rally to new highs, because it is the second Wall cycle in the unfolding set of three. The second Wall cycle in a set typically rallies to a new high. The high of Wall #5 is expected around the May target, whether it is a new price high or not. That will likely be the final high in this final business cycle of the long wave. A rally to a new high in Wall #6 will be a run against the clock of the ticking global long wave debt bomb. When it goes off, it will drive the global stock market cycles down sharply into late 2012.

They are more than a few shoes that could drop and wipe out the rally of Wall #5, so stay tuned to the important price supports. The exact price and date targets of the cycles are reserved for subscribers to The Long Wave Dynamics Letter. One subscriber said the Fibonacci grid price targets, from the Level 1 grids down to intraday grids, are like reading sheet music. If interested, you can read What LWD Subscribers are Saying.

I would be remiss in not pointing out that the S&P 500 price target of 1278.95 is the inverse golden price target in the current Level 2 Fibonacci Dynamic Web price grid. These are the sort of targets used to indentify precise entry, exit and stop loss targets. Note that the top tick on Thursday the 6th was 1278.16, in Quarter Wall and Wall cycles that are overbought and topping.

In conclusion, the good news is that the rally in global markets in this final business cycle of the long wave is a gift from the hard working citizens of the emerging markets, who will lead the next long wave spring season advance. And of course the hard working central bankers of the world. Take this cycle topping opportunity to prepare your finances. Consider yourself warned. The long wave spring is coming, but a late long wave winter blizzard lies on the other side of this false spring season.

© 2011 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.