Bernanke Reiterates January FOMC Policy Statement and Defends Fed’s Unconventional Monetary Policy

Interest-Rates / US Interest Rates Feb 04, 2011 - 03:23 AM GMTBy: Asha_Bangalore

Chairman Bernanke reiterated the main thrust of the January FOMC policy statement for the most part today. In addition, he defended the large-scale asset purchases that the Fed has undertaken. His remarks also included the fiscal policy challenges the nation currently faces.

Chairman Bernanke reiterated the main thrust of the January FOMC policy statement for the most part today. In addition, he defended the large-scale asset purchases that the Fed has undertaken. His remarks also included the fiscal policy challenges the nation currently faces.

Soft growth of payrolls continues to haunt the Fed. Bernanke noted that the "job market has improved only slowly" and underscored his concern with the comment which runs as follows: "Until we see a sustained period of stronger job creation, we cannot consider the recovery to be truly established." The translation would be that the Fed is unlikely to pull back from its accommodative stance anytime soon. He also noted that there is "increased evidence" of a self-sustained recovery. He presented an optimistic view of the future as follows: "Overall, however, improving household and business confidence, accommodative monetary policy, and more-supportive financial conditions, including an apparent increase in the willingness of banks to make loans, seems likely to lead to a more rapid pace of economic recovery in 2011 than we saw last year."

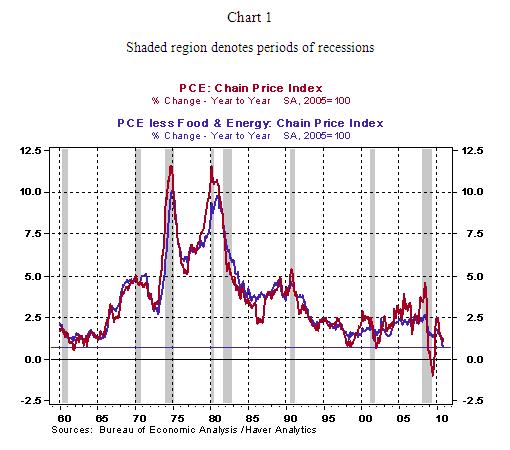

With regard to inflation, Bernanke attributed the recently visible jumps in commodity prices to demand from emerging markets and supply constraints in some cases. To drive home the point that inflation is benign in the U.S., he cited the latest overall inflation readings and core price measures which exclude food and energy (see Chart 1). The core personal consumption expenditure price index moved up only 0.7% in 2010 (year-to-year basis), the lowest on record and the overall personal consumption expenditure price index rose 1.2% in 2010, down from 2.4% in 2009.

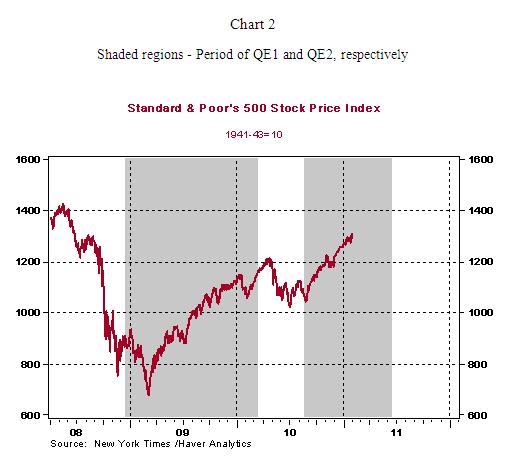

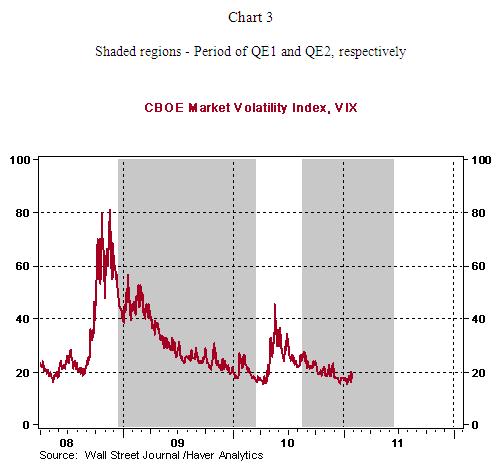

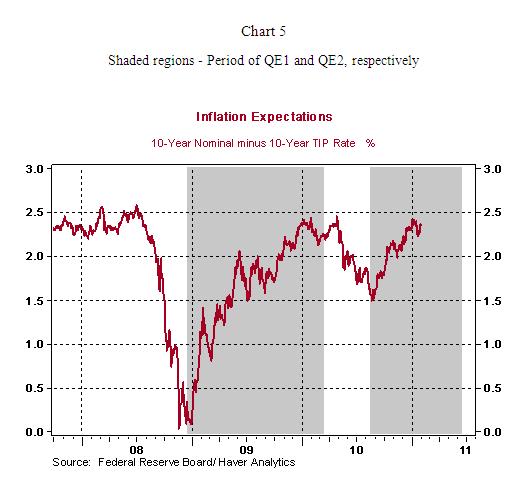

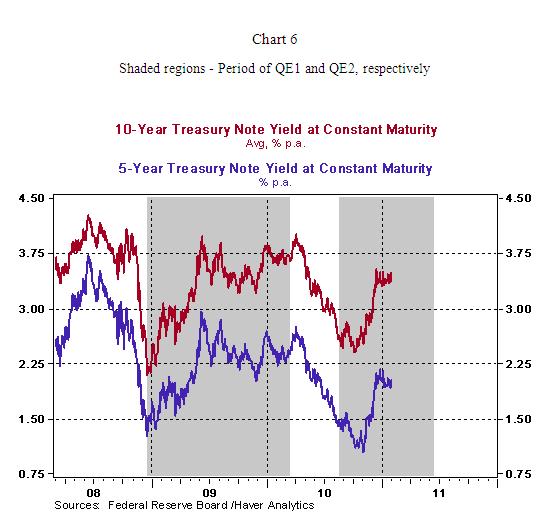

Bernanke's listed five market developments in defense of the Fed's two quantitative easing programs. Chart 2-6 illustrate each of the developments. The first round of quantitative easing (QE1) was in place from December 2008-March 2010 and the second round of quantitative easing (QE2) is currently underway and set to expire in June 2011. The Fed announced in August 2010 it would reinvest maturing securities and signaled considerations of the QE2 program; effectively the QE2 time span is August 2010-June 2011. The shaded regions in charts 2-6 denote the respective periods of large-scale asset purchases also known as QE programs. Bernanke noted that equity prices have risen and equity market volatility had dropped after announcements of the quantitative easing programs; charts 2 and 3 substantiate this claim

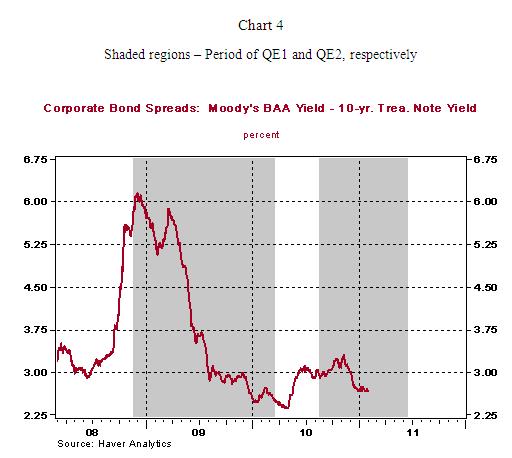

The narrowing of corporate bond spreads is another aspect that Bernanke cited to support the success of the Fed's large-scale asset program. Chart 4 presents Bernanke's case that corporate spreads narrowed as a result of the Fed's large-scale asset purchases.

The Fed has been successful via its quantitative easing program to gradually expel considerations of a deflationary situation by market participants. Inflation expectations, as measured by the spread between 10-year Treasury note yields and 10-year inflation-indexed security, have risen to normal levels, with readings close to zero recorded during the peak of the crisis (see Chart 5).

The last piece of market evidence the Chairman called upon is that fact that yields of 5-year and 10-year Treasury fell as the announcements of large-scale asset purchases were made but eventually advanced as investors became optimistic about economic growth. Chart 6 depicts this development.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.