Value of Gold? (vs. currency, oil and stocks)

Stock-Markets / Financial Markets 2011 Feb 06, 2011 - 08:06 AM GMTBy: Richard_Shaw

Let’s look at the possible value of gold from three angles:

Let’s look at the possible value of gold from three angles:

- real money — replacing all paper currency in the world

- energy equivalent value — how much oil can gold buy?

- stock market value — how many S&P 500 index shares can gold buy?

These are overly simplistic measures, but you have to start someplace. Saying the value is what anybody is willing to pay doesn’t lend itself to any kind of informed estimate. Surely in a shear panic the price could go to the moon for a short period, but in a calmer period, what is the exchange value of gold in a world that is still functioning?

Gold has no established method of approaching a fair value other than auction, but what might lurk in the minds of men when they select their auction bids. What gold can buy is one reasonable approach.

Gold does not have earnings or interest payments that can be capitalized the way they can for stocks and bonds, for example. In fact holding gold has negative earnings — no interest earnings; and transportation, storage and insurance costs if held in large quantities (“cost of carry”).

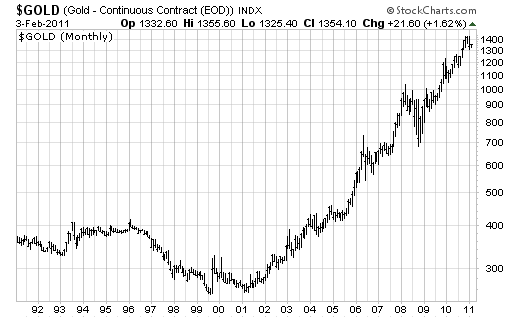

Gold Prices:

As of this writing, the price of gold (proxies GLD and IAU and SGOL) is $1354.

Real Money:

In a recent article we prepared for SeekingAlpha ( How Much Is Gold Worth? – Seeking Alpha ), we did a “real money” estimate of the value of gold. In that article we asked basically what would the price in dollars be for all of the above ground gold in the world, if all of the currency in the world were paid in exchange. After that, there would be no currency and all gold in whatever form would be “money”.

The amount of currency in the world was estimated based on the world GDP and the turnover of currency within the GDP. That showed a long-term history in the US (presumed to be similar globally) of 10 to 25 times. At that turnover rate, gold would have an exchange value of from $530 to $1325 per Troy ounce.

By this crude “real money” metric, gold is at the top of an historically justified range.

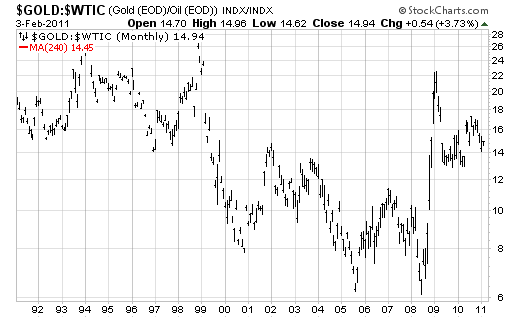

Gold for Oil:

The current ratio of the price of gold to the price of a barrel of West Texas Intermediate (Sweet) Crude Oil is 14.94. The 20-year average based on month-end prices is 14.46. That might be considered about fairly valued.

The extremes over 20 years were approximately 28 times and 6 times. That could, of course, be due to gold or oil rising or falling separately or each moving in an opposite direction.

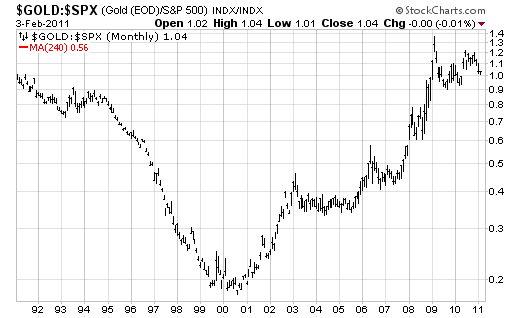

Gold for Stocks:

The 20-year average ratio of the price of gold to the price of the S&P 500 index is 0.56. The current ratio is 1.04. By that indicator, gold is a bit expensive (or stocks are a bit cheap). The extremes over 20 years are approximately 1.4 to 0.2. The low was during the height of the “everybody gets rich” stage of the dot.com bubble. The high was during the depths of fear caused by the 2008 financial crash.

Possible Conclusions:

Gold is either fairly valued to somewhat overvalued, or gold is fairly valued and stocks are cheap.

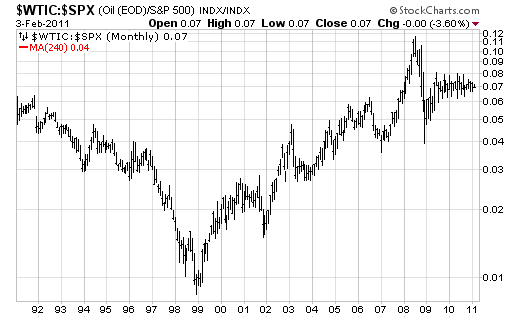

What About Oil to Stocks?

The current oil to stocks price ratio is 0.07. The 20-year average is 0.04. The extremes over 20 years are about 0.12 to 0.01 — again corresponding in time with the dot.com bubble an the 2008 crash.

Proxies for the S&P 500 are SPY, IVV and VFINX.

Possible Conclusions:

Maybe oil is overvalue too, but then again the data for gold to stocks and oil to stocks tends to push us in the direction of those who feel stocks are undervalued. That runs counter to other thoughts we have about stocks, and does nothing to shield stocks from event risks such as the Egyptian revolt, or rolling events such as the European debt crisis, or prospective events such as the possible credit rating downgrade of the US for excessive debts, or the macro-economic reality of inflation emerging markets or rising interest rates in the US.

Nonetheless, these indicators lend some support to the Bulls, at leas for now.

Back to the topic of the article, we’d be inclined to think that gold is roughly fairly valued at the moment.

Securities Mentioned In This Article: GLD, IAU, SGOL, SPY, IVV and VFINX

Holdings Disclosure: We hold GLD and SPY in some but not all managed accounts as of the publication date of this article.

Disclaimer: This article is not personal investment advise to any specific person for any particular purpose. This article is presented subject to the full disclaimer found on our site available here.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2011 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.