Stock Market Daring us to Buy Those Dips Again

Stock-Markets / Stock Markets 2011 Feb 16, 2011 - 03:38 AM GMTBy: PhilStockWorld

Should we be concerned?

Should we be concerned?

As Doug Short points out in his EEM chart from our Chart School, while Egypt may be "fixed," emerging markets are not. We had a pretty ridiculous discussion in Member Chat last week on whether we should take our quick 300% profits on our EDZ hedges or wait for the full 500% and we decided to wait because, like Doug and Captain Kirk - we do not believe the trend is the friend of Emerging Markets at the moment.

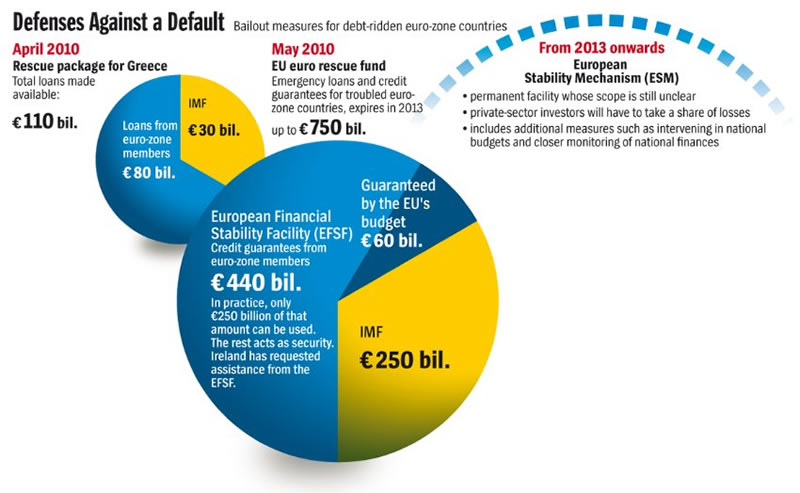

Sure any one of them could be toppled tomorrow by a popular uprising like Egypt, Tunisia or Algeria or they could be swamped by runaway inflation like China (4.9% AFTER adjusting food inflation to a much lower weighting) or, well, EVERYBODY but the US, where we have no inflation because The Bernank said we don't. UK inflation rose to 4% in January and BOE Governor King now expects the trend to rise to 5% in the coming months. That's not very good for a Central Bank with a target rate of 2%. This MIGHT be a temporary situation because German Q4 GDP was actually 20% lower than expected, at 1.6% vs. 2% hoped for. Europe is still a major mess and the EU finance ministers just agreed to double the "Permanent Rescue Fund" from $332Bn to $675Bn.

That news helped knock the dollar back to 78.4, boosting the pre-market futures this morning as the US has no such fund for its member states, who are twisting in the wind at the moment and, of course, no one has a fund to rescue the US, which spent $675Bn while I was writing this post! Of course part of the $675Bn we spent is right in that IMF slice of the pie as the US funds about 20% of that 250Bn Euros ($330Bn so there's a quick $66Bn we pledged to bail out Europe this morning!).

This is a great, great scam because we spend dollars we don't have, devaluing the Dollar, to prop up the EU and that strengthens the Euro - devaluing the Dollar again! It's a double hit on the Dollar in one morning and we haven't even seen the rotten Housing Numbers yet! We have seen the rotten Retail Numbers as ICSC Retail Store Sales showed a 1.4% drop last week but, of course, weather will be blamed and we will ignore them again. See, we're getting right into the spirit of things now! We get the Jan Retail Sales Report at 8:30 and, hopefully, that will give us some better insights into what is going on with the economy.

This is a great, great scam because we spend dollars we don't have, devaluing the Dollar, to prop up the EU and that strengthens the Euro - devaluing the Dollar again! It's a double hit on the Dollar in one morning and we haven't even seen the rotten Housing Numbers yet! We have seen the rotten Retail Numbers as ICSC Retail Store Sales showed a 1.4% drop last week but, of course, weather will be blamed and we will ignore them again. See, we're getting right into the spirit of things now! We get the Jan Retail Sales Report at 8:30 and, hopefully, that will give us some better insights into what is going on with the economy.

8:30 Update: As expected, January Retail sales were 50% less than expected at +0.3% vs. +0.6% forecast by the people's who's job it is to get these things right. That's OK though, because Import Prices were 100% MORE than expected by our expert analysts (the same ones The Bernank likes to cite when he tells us inflation is "not on the horizon"), coming in at 1.5% higher than December vs. 0.8% expected and, interestingly enough, ex-energy this time we have almost a triple - at 1.1% vs. "just" a 0.4% monthly increase in the December survey.

Sorry but I'm laughing while I'm writing this because now I'm looking at the February Empire State Manufacturing Survey, which shows 15.43 vs. 15 expected. Wow! That's cool! Things must be picking up, right? Was it the employment component that gave us a lift? No, sorry, employment was 3.61, down from 8.42 in December. Then it must have been New Orders, right? No, sorry again, new orders fell to 11.8 from 12,39. Well, no prize now as, obviously it must have been PRICING and yes, prices jumped 6.8% in the last 30 days from 15.79 in January to 16.87 this month. So rising prices overrode the declining employment and orders to give us a 3.3% gain. Isn't this BRILLIANT - almost 50% of our inflation drops down to the bottom line. I'll bet if we can get inflation up over 100% then we can pop the markets a good 50% - what do you say? Who's with me? Yes, Ben - you can put your hand down, I was already counting on you....

Speaking of things we count on. Last June, the Fed's NY Branch (who do the Empire Survey) asked the question (page 8 on the report): "Please indicate your best estimate of your total capital expenditures for last year (calendar year 2009) and the expected amount for this year (calendar year 2010)" and the answer was $3.38Bn in 2009 and $4.3Bn planned for 2010. This is a major metric on which the Fed then determines their outlook. Well, they are asking that question again this year and guess what was actually spent in 2010? $2.87Bn. That would be 32% LESS actual spending than planned. We often talk about survey bias at PSW and this is a great example of how asking business owners how they think business will be is not the best way to base your long-range economic forecast models.

Even so, for 2011, NY Manufacturers now PLAN to spend just $3.5Bn, that's down 20% from last year's PLAN but UP 20% from last year's actual so guess what the title of the Fed's report is? How about "Firms Plan to Spend More On Equipment"? I brought up 1984 yesterday so I'm not going to belabor the point but RTFM, my friends! It's in the public domain, I got it on my IPad for free and it's not even a long book but it is, unfortunately, the best description of what is going on in our World these days...

I have said we would hold our bearish stance into this week's data (and option expiration) as we thought this might be too much to bear. It's not about the data itself - anyone who is not an "expert analyst" could have told you prices are flying and sales are falling. The question is whether or not the new and very aggressive round of POMO for the next 30 days can roll over the bad data and keep taking the markets higher (see Stock World Weekly for details). The jig may indeed be up for The Bernank as Net Foreign Purchases of Long-Term Securities dropped 37% in December from $64.6Bn in November to $41.8Bn meaning Bernanke's $120Bn of POMO purchases constituted 75% of all security purchases. Once we get to 100% and that's still not enough, then what?

Like all other bad news in the market - IT JUST DOESN'T MATTER! Take FDX, for example: Yesterday, FDX dropped guidance by 25%, from $1.04 to .75 "due to the severe winter storm season and higher than expected fuel costs (that are not inflationary)." Bad news, right? Not according to UBS's, who are playing the role of Tripp (see video) and telling the campers: "We think this profit warning is at least partly priced in already, with the stock underperforming recently" and maintaining their CONVICTION BUY rating on the stock, which is up 200% from the bottom at $33 in 2009 and trading at just under the all-time high. This makes, according to UBS: "A very compelling entry point...especially ahead of what we expect to be bullish guidance around fiscal 2012."

So ignore the company's ACTUAL guidance - we EXPECT that NEXT YEAR, they will be in a better mood. I could talk about the weakness in oil or the upcoming housing numbers or the 10 am business inventories but - why bother? It's all about whether or not the Fed and their pet IBanks can goose the S&P over that magic 1,332 line today. As to the bad news, as Tripp tells us - IT JUST DOESN'T MATTER!!!

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.