The Math is Different at the Top

Stock-Markets / Financial Markets 2011 Mar 02, 2011 - 05:28 AM GMT It's Not Rocket Science.

It's just basic arithmetic. 2+2 = 4 ...

It's Not Rocket Science.

It's just basic arithmetic. 2+2 = 4 ...

Privately-owned central banks + discretionary monetary policy = systemic corruption/oppression.

If the Food & Drug Administration had 100% of its shares owned by private pharmaceutical companies, and, a few months after implementing some radical new regulatory directives, these companies began making record profits and their executives receiving record bonuses, then it wouldn't be too difficult to understand why.

Well, that's not necessarily a hypothetical as much as a sad representation of reality, but the connection is even more blatant in the case of the "Federal" Reserve. It's 100% owned by private financial institutions, which receive 6% annual dividends on their shares, and have enormous control over the selection of its Board of Governors, who in turn have enormous control over its Open Market Operations.

After the Fed launched its "QE1" and "QE2" programs in 2008 and 2010, the two most aggressive monetary directives ever undertaken in America (they will combine to total ~$2.5T in debt-asset purchases [1]), the banks have posted "their two best years in investment banking and trading".

For the five biggest institutions (Goldman Sachs, JP Morgan, Citigroup, Morgan Stanley, Bank of America), revenues generated in 2010 were only exceeded by those of one other year in history, 2009. [2]. These two years just happened to follow the onset of the worst economic depression the world has ever experienced, which is still right on track to surpass the global financial and social turmoil caused by the Great Depression. If you think that is an irresponsible exaggeration, then just stop and reflect on the fact that Germany and Japan did not have any access to nuclear or biological weapons of mass destruction back in the 1930s.

Moreover, the worst financial effects of the Great Depression were primarily limited to the Americas and Europe, while the latest credit bubble had stretched its tentacles to every single corner of the globe. North Africa and the Middle East have already descended into the belly of the financial beast, and it is highly likely that certain parts of Europe (i.e. Greece, Spain, Portugal, Italy) and Asia (i.e. Vietnam, Pakistan, Sri Lanka, etc.) will shortly (within the next year) follow their footsteps down the beaten path.

We must remember that the financial elites running the Fed and IMF are not only concerned with making vast sums of money, but also retaining and expanding their grip on the global levers of power. So is it a coincidence that many of these politically unstable countries had been targets of American imperialistic (financial) domination for years now, and that their sociopolitical deterioration presents glaring opportunities for outright regional intervention by the U.S. military-industrial complex?

We must remember that the financial elites running the Fed and IMF are not only concerned with making vast sums of money, but also retaining and expanding their grip on the global levers of power. So is it a coincidence that many of these politically unstable countries had been targets of American imperialistic (financial) domination for years now, and that their sociopolitical deterioration presents glaring opportunities for outright regional intervention by the U.S. military-industrial complex?Perhaps not, since the U.S. has often used economic catastrophe to direct economic and political policy in other countries and concentrate ever-more financial wealth in the hands of a few global corporations. Naomi Klein briefly outlines the dynamics of this process in the Introduction of her acclaimed book, The Shock Doctrine, under the direction of its most notorious proponent, Milton Friedman:

"Friedman first learned how to exploit a shock or crisis in the mid-70s, when he advised the dictator General Augusto Pinochet. Not only were Chileans in a state of shock after Pinochet's violent coup, but the country was also traumatised by hyperinflation. Friedman advised Pinochet to impose a rapid-fire transformation of the economy - tax cuts, free trade, privatised services, cuts to social spending and deregulation.

It was the most extreme capitalist makeover ever attempted anywhere, and it became known as a "Chicago School" revolution, as so many of Pinochet's economists had studied under Friedman there. Friedman coined a phrase for this painful tactic: economic "shock treatment". In the decades since, whenever governments have imposed sweeping free-market programs, the all-at-once shock treatment, or "shock therapy", has been the method of choice."

The invasion of Iraq was a more recent and brutal deployment of "shock therapy", which was premised on the existential threat of Saddam Hussein in possession of imaginary WMD, and this time the U.S. military was directly involved (and still is). So there is no lack of credible evidence and common sense to suggest that such "shock" tactics are now being focused on both developed and developing economies in an attempt to create a new global, neo-liberal financial order. However, the scope, scale and specific consequences of the latest financial crisis are not things which can be easily controlled by a few powerful institutions such as the Fed, IMF, World Bank or even the Pentagon, if they can be controlled at all.

Many of the existing power structures in the oil-rich Middle East are clearly targets of destabilization by the financial empire, but it is unclear whether Egypt's revolution was a part of the plan, since Mubarak has always been a tried-and-true ally of the financial elite, and surely the same is true of the House of Saud.

Mubarak's departure may very well be a non-factor for the economic/political realities faced by the Egyptian people, but it can definitely be viewed as a deeply symbolic event. As I alluded to before, the once-propagandized threats of "WMD" and "terrorists" in the region appear to have manifested themselves as actual forces of disruption to be reckoned with. Libya's Qadaffi has always been a stubborn thorn in the empire's side, so he would not be missed, but if he were to actually blow up the country's oil pipelines on his way out [3], the elites would probably not be very happy about it.

Then again, such a catastrophe could provide just the economic shock needed to justify more forceful intervention in the region, if any such justification is even needed at this point. The problem is that, while the original arithmetic is simple enough to understand, complex systems of nature always have a way of introducing unexpected variables into the equation. Are we just following the simple logic which dictates that every economic policy is crafted for the benefit of financial elites, or are we manufacturing an elaborate narrative in which every single event is a stepping stone towards a final pre-conceived destination? One thing we can be certain of is the fact that no complex network can be maintained without some level of integrity in its central hubs, where most of the activity takes place.

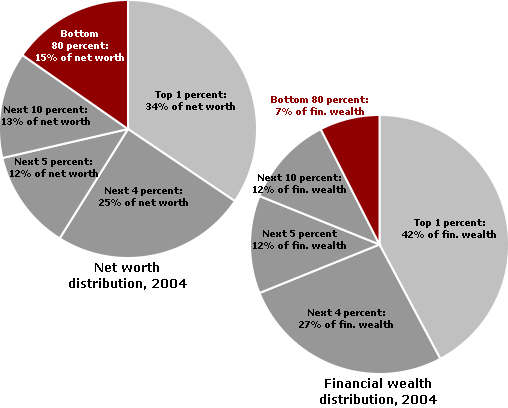

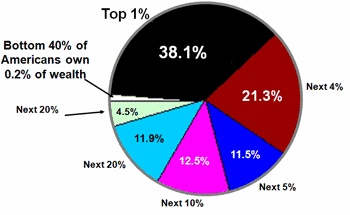

The major financial executives may be raking in record stacks of stolen dough, but average American and European citizens are intensely watching their wealth evaporate into thin air as they become increasingly desperate with every passing day. The same could be said of China and India, where there are enormous credit bubbles just itching to pop, and combined comprise more than 11% of the world's GDP and almost 40% of the entire world's population. [4], [5].

It will be increasingly difficult for any group of human beings, no matter how powerful, to maintain a global financial order as the masses wake up from their fleeting dreams of unbridled prosperity. Seated comfortably at my computer, writing about global financial trends marked by increasing wealth inequality, I can confidently say that two plus two always equals four. Sitting atop the ivory towers of Washington and Wall Street, the math is perhaps a bit more difficult and a bit less certain.

*Part II in this series will discuss the deterioration of ecosytems underlying the industrial/financial global economy, and how this dynamic introduces even more uncertainty for the financial elites.

Ashvin Pandurangi, third year law student at George Mason University

Website: "Simple Planet" - peakcomplexity.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2011 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.