Where Is QE2 Taking Us?

Interest-Rates / Quantitative Easing Mar 28, 2011 - 09:36 AM GMTBy: Robert_Murphy

Five months into the second round of quantitative easing — "QE2" — it is useful to take stock of what it has, and has not, accomplished. In short, the monetary base is way, way up, price inflation is up, long-term interest rates are up, and bank lending is down. QE2 has thus begun to deliver on all the dangers of which the critics warned, but not the alleged benefits.

Five months into the second round of quantitative easing — "QE2" — it is useful to take stock of what it has, and has not, accomplished. In short, the monetary base is way, way up, price inflation is up, long-term interest rates are up, and bank lending is down. QE2 has thus begun to deliver on all the dangers of which the critics warned, but not the alleged benefits.

Defining QE2

Defining QE2

On November 3 last year, the Fed satisfied the expectations of many analysts by promising another round of asset purchases:

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to expand its holdings of securities. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month. (emphasis added)

Five months later, we can assess some of the major results so far. Of course, just because something occurred after QE2 doesn't mean it was the result of it, but it will be instructive to test the claims of the Fed's apologists.

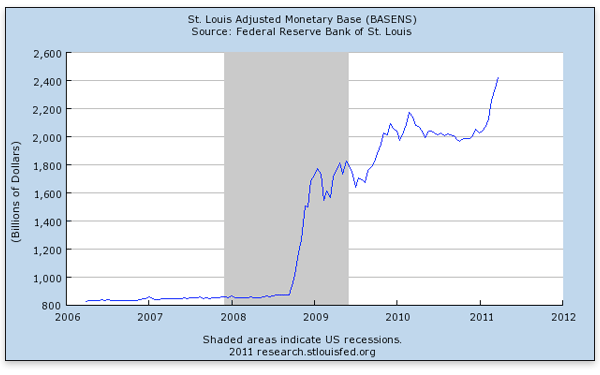

The Monetary Base Has Exploded Yet Again

The Fed was true to its word: It promised it would (electronically) print new money with which to buy government bonds, and it did so. The monetary base has once again zoomed upward since the implementation of QE2:

In the chart above, the monetary base (which I define in this article) surges three times: first in late 2008 when the crisis hit, then in March 2009 with the initial round of quantitative easing, and finally in late 2010 with QE2.

The explanation here is quite simple. Since the onset of the crisis, the Federal Reserve has added more than $1.5 trillion in net assets to its balance sheet. Bernanke didn't get the money from his piggy bank. On the contrary, the Fed simply created new electronic money "out of thin air" by writing checks on itself when purchasing the assets.

It is this infusion of new base money that has many people worried about crashing the dollar. In normal times, commercial banks would create new loans of many multiples of the Fed's injections. Defenders of Bernanke say that he can change course on a dime, and that he has several "exit options" available when the time is right, but I have my doubts.

Price Inflation Is on the Rise

The Austrians have a sophisticated critique of central-bank intervention, arguing that it distorts interest rates and the capital structure, fueling the boom-bust cycle plaguing modern market economies. In contrast, when the man on the street learns of Bernanke's unprecedented money-pumping, his immediate fear is "inflation!"

Since the beginning of the Fed's intervention, some prices (such as gold and other commodities) began rising sharply. Over time, the price hikes have filtered out into a broader field. Gasoline prices are currently at a record high for this time of year. The Producer Price Index (PPI) for all commodities grew by 4.8 percent in the four months since QE2 was launched (the latest data are from February), which translates into an annualized increase of about 15 percent. Even the relatively tame Consumer Price Index (CPI) grew by 1.1 percent in the four months after the start of QE2, which works out to an annualized growth rate of 3.6 percent.

Ironically, the people who praise QE2 for "working" simultaneously claim that it raised inflation expectations while not causing inflation (by which they mean "rising prices"). See for yourself in this recent Bloomberg article criticizing Ron Paul:

The next time Federal Reserve Chairman Ben S. Bernanke appears before Congress, here are a few visual aids he can use to show critics that quantitative easing is working:

The Standard & Poor's 500 Index of stocks has climbed 18 percent since he said Aug. 27 that additional asset purchases might be warranted.

The risk premium on high-yield, high-risk bonds has narrowed to 5.16 percentage points from 6.81 percentage points, Bank of America Merrill Lynch index data show.

Inflation expectations have jumped by 44.4 percent. …

So much for 2008 Republican vice-presidential candidate Sarah Palin's assertion that the "dangerous experiment" wouldn't "magically fix economic problems."

Quantitative easing "was a key factor in taking deflation risk off the table," said Peter Hooper, chief economist at Deutsche Bank Securities Inc. in New York. "It certainly helped bolster longer-term inflation expectations. …"

The Fed's Nov. 3 decision to buy $600 billion of Treasury securities through June … sparked the harshest political backlash against the central bank in three decades, with Republican lawmakers warning the additional stimulus risked causing a surge in prices. So far, they were wrong. (emphasis added)

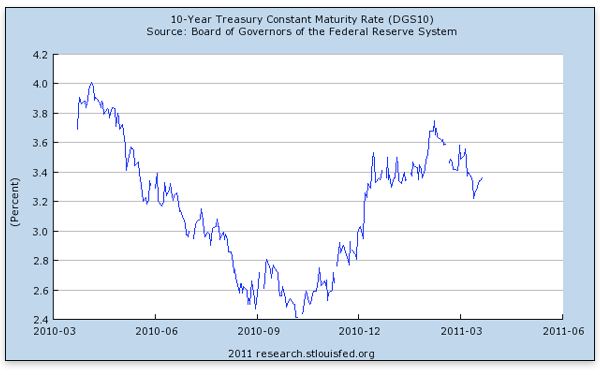

Long-Term Interest Rates Didn't Fall

Although there is some debate among economists over whether a "successful" QE2 would have led to falling or rising interest rates, it's definitely true that the conventional financial-press account runs like this: by buying longer-term bonds, the Fed would push down interest rates even further out on the yield curve, thus providing more stimulus to the economy even as short-term rates were smack against the zero bound.

If that is indeed the rationale for QE2, it's hard to reconcile with the actual course of the yield on 10-year Treasuries, which seemed to do just about the opposite:

As the chart indicates, the yield on 10-year Treasuries was steadily declining until QE2 was launched, at which point it marched steadily upward for several months before dipping again.

It's true that in economics there are always a million things changing simultaneously. For example, the surge in interest rates could reflect investor optimism about economic growth after the election returns (perhaps because they expect a divided government after the Republican shellacking). Or, the budget deal between Republicans and Obama — with its huge increase in the federal debt — may have been the chief culprit in the surge in interest rates.

But even so, it is important to realize that long-term interest rates did not fall after the formal announcement of QE2.

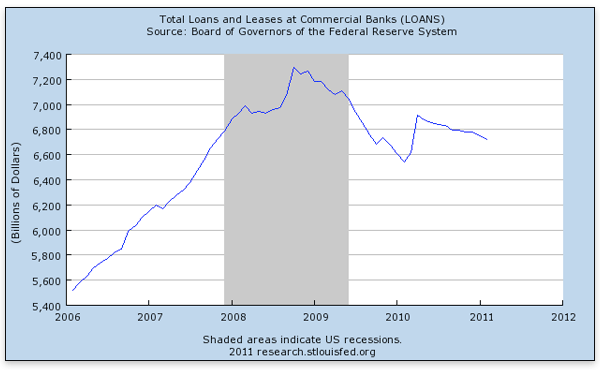

Bank Loans Are Still Falling

We come now to the last (popular) justification for QE2: that it would loosen the credit markets and get banks lending again. Here too the data tell a different story:

As the chart shows, total lending actually peaked in late 2008 (right when TARP and the Fed's "rescue" programs kicked in), and has fallen ever since.

The apparently sharp upswing in early 2010 is an illusion, due to a Fed change in accounting for consumer loans.

Admittedly, if we just focus on business loans, they bottomed out and slowly began rising after QE2 was launched, but the continued decline in consumer loans more than offset this rise.

Conclusion

With job creation remaining scandalously sluggish, and housing sales still on the skids, about the only thing we can say with confidence is that QE2 has stuffed hundreds of billions into the pockets of the friends of Bernanke.

Robert Murphy, an adjunct scholar of the Mises Institute and a faculty member of the Mises University, runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to Man, Economy, and State with Power and Market, the Human Action Study Guide, and The Politically Incorrect Guide to the Great Depression and the New Deal. Send him mail. See Robert P. Murphy's article archives. Comment on the blog.![]()

© 2011 Copyright Robert Murphy - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.