U.S. Federal Budget, a Rerun of 1994-95 Episode or More?

Economics / Government Spending Apr 07, 2011 - 06:21 AM GMTBy: Asha_Bangalore

The continuing resolution, a temporary arrangement that is currently financing the operations of the federal government, expires on April 8, 2011. A federal government shutdown follows if Congress fails to authorize appropriations prior to this date. It is widely expected that a breakthrough in budget talks will take place prior to the deadline. However, there is uncertainty about whether a compromise will be reached at the appropriate time.

The continuing resolution, a temporary arrangement that is currently financing the operations of the federal government, expires on April 8, 2011. A federal government shutdown follows if Congress fails to authorize appropriations prior to this date. It is widely expected that a breakthrough in budget talks will take place prior to the deadline. However, there is uncertainty about whether a compromise will be reached at the appropriate time.

The 2011 federal budget impasse brings to mind the 1994-1995 shutdown of the federal government following differences between then Speaker Newt Gingrich and President Bill Clinton. The federal government was closed for business November 14-19, 1994 and December 16 - January 6, 1995. It is estimated that this 27-day closure of the federal government entailed a cost of $1.4 billion.

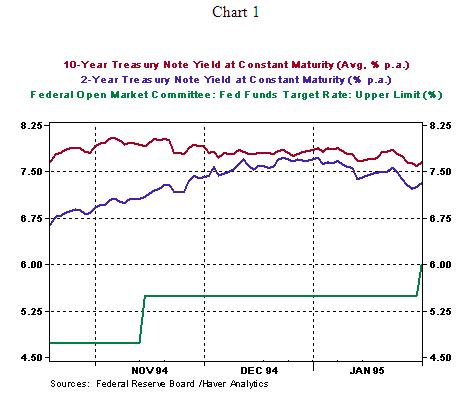

At the present time, the financial market environment is markedly different from 1994-95 period because the global economy is recovering from a severe financial and economic crisis and advanced economies are faced with budgetary challenges. During the 1994-1995 federal budget impasse, the U.S. economy was growing at a rapid clip and the Fed was tightening monetary policy aggressively to rein in inflation. Between November 14, 1994 and January 6, 1995, Treasury market yields were not unduly affected by budget negotiations. The Fed raised the federal funds rate 75 bps on November 14, 1994 and 50 bps on January 31, 1995 (see Chart 1).

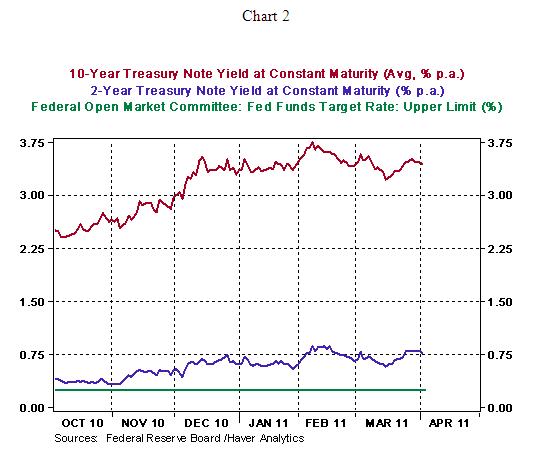

Currently, bullish economic data have been largely responsible for higher Treasury market yields in recent days (see Chart 2).

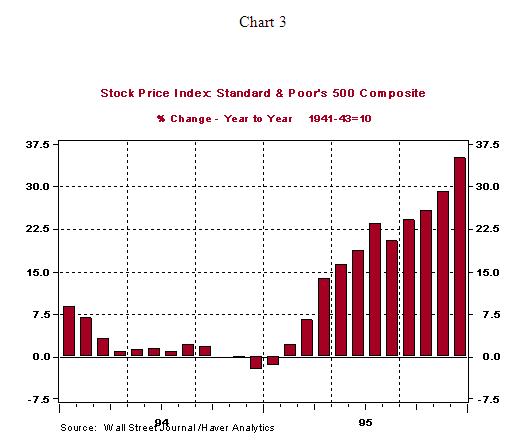

Equity markets in the late-1994 and early-1995 reflected fundamental economic conditions and the impact of tight monetary policy in 1994.

The bottom line is that the federal government shutdown had virtually no impact on financial markets in the 1994-1995 episode; a similar situation is emerging this time around. But, the bigger challenge pertains to the debt limit of the United States.

The current debt limit of the U.S. economy at $14.29 trillion is set by Congress; this was last raised from $12.394 trillion on February 12, 2010. Reaching this limit prevents the Treasury from raising funds through issuing new debt and the Treasury may find itself unable to meet its day-to-day obligations. The statutory debt limit has been raised on ten occasions since 2001. As of March 31, 2011, Treasury debt outstanding was estimated to be $14.2 trillion. (Daily commentaries of January 10 and 11, 2011 include details pertaining to the debt situation)

The Treasury Department estimates that outstanding debt will hit the ceiling by May 16, 2011. Treasury Secretary Timothy Geithner's remarks summarize the implications of the not raising the debt limit.

The "consequences of that would be catastrophic for the United States. Default by the United States would precipitate a crisis worse than the one we just went through. I think it would make the crisis we just went through look modest in comparison. It would force us to cut payments to the military, cut critical payments to our seniors. It would be a reckless, irresponsible act."

He said failing if the country defaulted on its debt (which as of Friday was $14.199 trillion) it would "call into question the willingness of the United States to meet its obligations" and this would "shake the…foundations of the entire global financial system."

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.