Gold and Silver: Supreme Safe Haven Assets

Commodities / Gold and Silver 2011 Apr 21, 2011 - 12:28 PM GMTBy: Jeb_Handwerger

Silver (iShares Silver Trust (SLV)) hit the ball out of the park yesterday as it hit a record high exceeding my late January target of $40. Silver has doubled in the past seven months alone. Poor man's gold is making some poor men rich as the US dollar (PowerShares DB US Dollar Index Bullish (UUP)) and long term US debt (iShares Barclays 20+ Year Treas Bond (TLT)) remain under pressure.

Silver (iShares Silver Trust (SLV)) hit the ball out of the park yesterday as it hit a record high exceeding my late January target of $40. Silver has doubled in the past seven months alone. Poor man's gold is making some poor men rich as the US dollar (PowerShares DB US Dollar Index Bullish (UUP)) and long term US debt (iShares Barclays 20+ Year Treas Bond (TLT)) remain under pressure.

Think safe haven, particularly for the middle class citizens who sense that they are being caught between the rock of an out of control budget and the hard place of ineffective legislators posturing for the media. Silver (Proshares Ultra Silver (AGQ)) and gold (Proshares Ultra Gold (UGL)) are taking the reigns as the supreme safe haven asset.

Investing in silver presents an opportunity for the beleaguered middle class taxpayer to defend himself, while 50% of the population pays no taxes (and the same with corporate entities such as General Motors (GM) and General Electric (GE)). Gold (SPDR Gold Shares (GLD)) and silver provide a safe haven despite high prices because none of the budgetary, political and monetary concerns await resolution.

We hear of bubbles but gold and silver are still a small part of global financial assets. The price of gold in 1980 represented four times what it is today. China may be reentering the metals markets after taking a brief seventh-inning stretch adding impetus to the upward move in precious metals. Over 19 central banks were net buyers in the year 2010. This still leaves plenty of banks waiting in the wings. Gold supplies from scrap metals fell in 2010, while gold prices were higher, signifying that people are holding onto their scrap as they feel prices are going higher.

Protection against untenable fiscal imbalances and currency debasement is one of the few ways the middle class can defend themselves. Always remember that precious metals are on a long-term rising cycle and will remain a profitable focus for years to come. Often times the precious metals cycle moves slowly yet it bends upward. Long term US debt and the US dollar are in secular downtrends.

I am acutely aware that our valuable service has protected investors in this climate. Since the depths of the credit crisis, I have been alerting my readers to protect their assets through movement away from the US dollar and into the safe harbor of precious metals and natural resources.

There are many concerns about the falling dollar against the rising euro (CurrencyShares Euro Trust (FXE)) as this may put pressure on debt-ridden countries such as Greece, Portugal and Ireland. The question on the table is how should investors react in such a scenario. As the middle class loses buying power daily supporting corporate thieves and non-tax-paying entitlement brigands, we stand ready to monitor this situation on an hourly basis. If economic weakness occurs in the eurozone due to rapid currency appreciation you can be sure central banks will continue to ease liquidity into the system.

For the time being as we approach our measured targets in gold at $1600, it might be prudent to use this benchmark as a metric to dictate a commensurate sale. Playing with the house's money is a conservative position in a highly manipulated market. Remember: The Fed is answerable to no one, and with one stroke could cause a temporary short-lived sell-off in precious metals. Notice how Goldman Sachs this week came out with a bearish report on commodities. In yesteryear's markets this may have caused a prolonged decline, yet investors have shrugged off that report. Commodities have rebounded since that release.

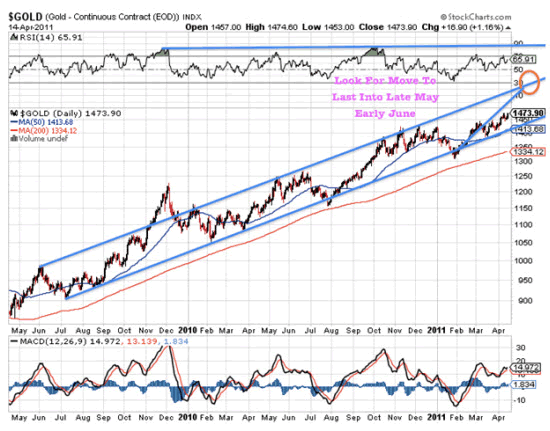

One technique you can use to secure these hard-earned gains is to follow the 20-day moving average, which has historically proven to be an excellent short-term indicator as a trailing stop loss. If gold or silver breaks below the 20-day or short-term trend, then one can secure profits and not have to sit through a sell-off on the upward secular path.

I believe we are about halfway from the January buy signal to our $1600. My time frame is that precious metals should still see strength into the end of May or early June.

Grab your free 30-day trial of my Members-Only Premium Stock Analysis Service NOW at:

http://goldstocktrades.com/premium-service-trial

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.