US Dollar Devaluation is a Supply and Demand Problem

Currencies / US Dollar Nov 17, 2007 - 02:03 PM GMTBy: Andy_Sutton

Dollar falls to all-time low against the Euro"

Dollar falls to all-time low against the Euro"

"Canadian dollar hits all-time high versus US counterpart"

"Australian dollar at multi-year high"

"British Pound crosses $2 threshold"

These are just some of the headlines that have emerged during the past year concerning the ails of the US Dollar. There have been hundreds, perhaps thousands of explanations for why this is a good or bad thing. Thousands more questions asked, but never answered. At the end of the day though, it is really about our old friend: The law of Supply and Demand.

The Demand Side

There are three major areas of demand for US dollars. The first is the domestic US economy, which needs enough dollars to run smoothly. This includes the broader categories such as mortgages, credit cards, various consumer loans, corporate credit and circulating specie (printed dollar) currency. We have seen waning demand for dollars in the area of mortgages, and an overall flattening in terms of consumer spending. If the consumer spending numbers were adjusted honestly, we would likely be seeing real declines in consumer spending.

This all translates into a decreased demand for dollars. One point worth mentioning in this case is that it explains on several levels the Fed's decision to drive their target interest rates lower. They are attempting to induce borrowing through lowered costs of money. This is a classic response to diminished demand. The Fed was clearly at a crossroads. They could have saved the dollar or the debt-reliant economy. They chose to save the economy. Given the hyper-dependent condition of our society, it was the only choice really.

There is a tug of war going on with regard to decreased demand for dollars and the perceived counterparty risk when loaning dollars. Those lending want to be compensated for the risk they take when making loans. However, their desired rate of return doesn't match the rates at which borrowers are willing to take on more debt. The result? Turmoil, volatility, and eventually, panic in even the shortest-term money markets.

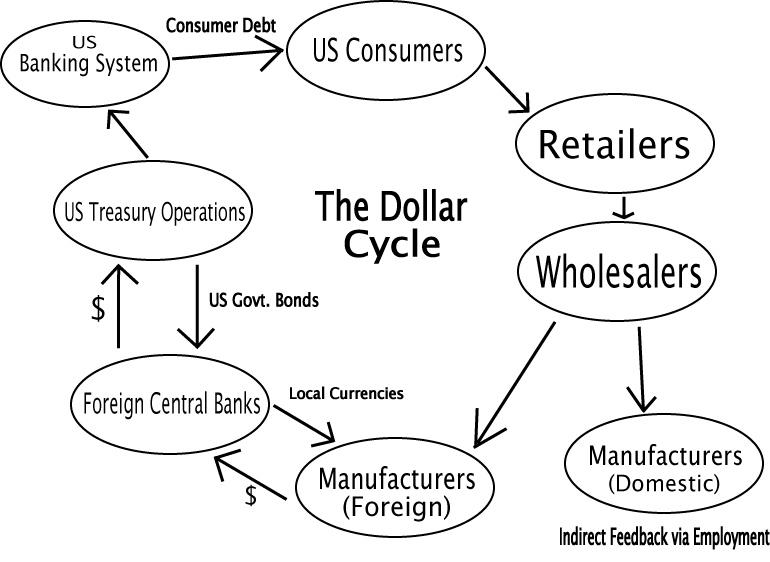

The second is the foreign demand for dollar denominated assets to soak up their accumulated dollars. The below diagram is a graphic representation of the flow of dollars around the globe:

As can easily be seen by the chart, the demand for dollars exists only so long as there is profit to be had from re-enabling US consumers to buy products they could otherwise not afford. For decades now we have not been able to pay for our consumption with production. This is the reason for our persistent trade deficits. Our overconsumption fuels the dollar cycle. When enough of our wealth has been transferred to foreigners, they will no longer need us to purchase their products since they will be able to afford to purchase the products themselves. Headlines screaming of the fact that Chinese automobile, retail and household electronics are increasing at a rapid pace fuels speculation that the fuel for the Dollar Cycle pump is beginning to run out.

The third source of demand is for petrodollars. Since the dollar is still used as the medium of exchange for many (although a slowly shrinking) number of oil transactions, countries that are net importers of oil need to keep a stock of dollars around for financing their oil habit. Smaller examples of oil-producing nations demanding something other than dollars for purchase of their oil have been emerging recently. These actions while individually small, in aggregate, serve to erode demand for the dollar. When the combined effect of petrodollars, flattening US consumption, and the drying up of the Dollar Cycle are considered, it is easy to understand the concept of diminishing dollar demand.

The Supply SideThere are several mechanisms by which the supply of dollars may be manipulated. First, the Fed can create electronic digits and infuse them directly into the banking system. Secondly, they can purchase assets of compromised value at par (near what they used to be worth). Third, they can purchase bonds directly from the Treasury, thereby monetizing our debt. In effect, what the Treasury is doing is robbing Peter (future generations of Americans) to pay Paul (current and prior deficits). The Treasury takes the dollars they get from the Fed in exchange for the debt they sold to the Fed and spends them into the economy causing inflation. There is a common misunderstanding among many individuals.

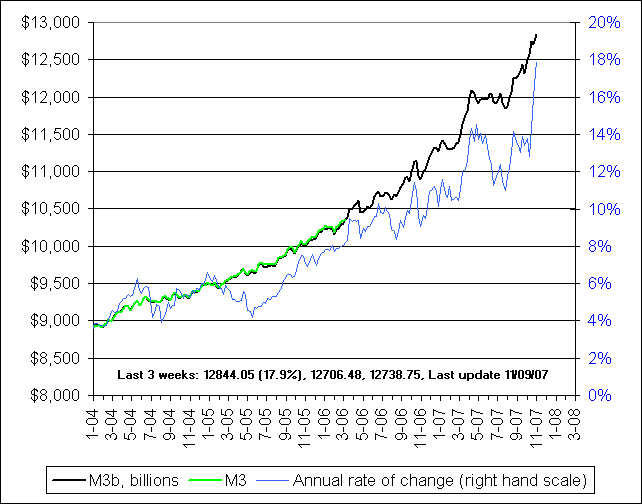

They think that the Fed is part of the government. It is not. The Fed is a private banking cartel whose ownership is divided up among the world's largest banks. Every dollar they create is a debt that is owed them with interest. In addition to the Fed, the banking system itself can create money out of thin air with fractional reserve banking by using ridiculously low reserve requirements. Combined, our money supply growth is accelerating at an alarming rate. One look at the reconstructed M3 chart from www.nowandfutures.com tells the story:

In summary, the demand for dollars is beginning to wane while the supply is clearly growing at an ever-increasing rate. The results are predictable: The price (value) of the dollar will go down against other types of currency and real money. One caveat to this analysis is that it is not safe to assume that the Euro et al are ‘hard' currencies just because they are appreciating versus the dollar. Nothing could be further from the truth. While it is true that many of these other currencies have implicit backing by natural resources or strong productive economies, none of them have the one true hallmark of a stable money system: an indestructible link to tangible value.

For those individuals who are interested in specific companies and recommendations, please contact us. Due to a growing number of requests, we are going to begin offering, among other services, a paid newsletter that will profile specific recommendations on companies and industries. For a nominal fee, subscribers will receive a monthly newsletter that will discuss current issues in personal finance, investment, macroeconomics and related strategies designed to navigate today's difficult financial landscape. All interested parties should visit www.my2centsonline.com for forthcoming information or email us at info@my2censtonline.com Tomorrow's investments…Today

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. He currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.