Silver Wanted At $50, But Not At $35

Commodities / Gold and Silver 2011 May 15, 2011 - 12:21 PM GMTBy: Clive_Maund

Aren't silver investors funny?? - they were raving bullish when the price was close to $50, now that it's down about $15 and near to $35 they are despondent. In the words of that famed alien with pointed ears, this is "highly illogical". Here on earthbound www.clivemaund.com we have a simpler term for it: "plain nuts". While picking an exact top or bottom is never easy, you can always rely on the collective behaviour of idiots as a guide. So the fact that they are now wary is good news for silver.

Aren't silver investors funny?? - they were raving bullish when the price was close to $50, now that it's down about $15 and near to $35 they are despondent. In the words of that famed alien with pointed ears, this is "highly illogical". Here on earthbound www.clivemaund.com we have a simpler term for it: "plain nuts". While picking an exact top or bottom is never easy, you can always rely on the collective behaviour of idiots as a guide. So the fact that they are now wary is good news for silver.

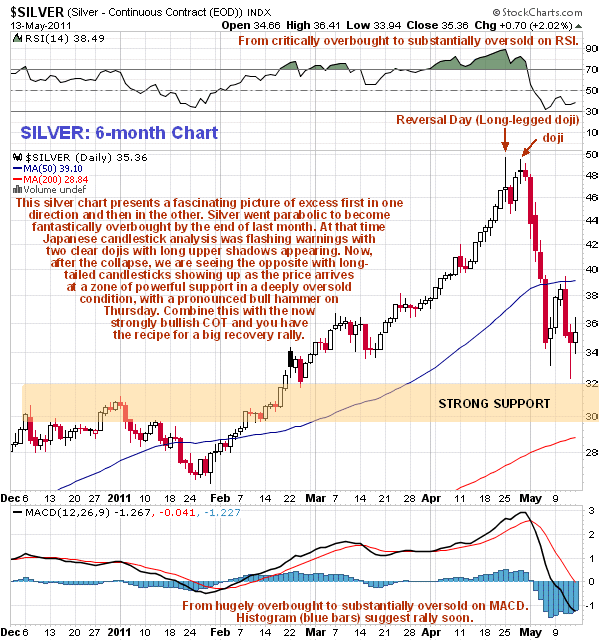

On its 6-month chart we can see how silver went parabolic to become fantastically overbought by the end of last month, as shown by the oscillators at the top and bottom of the chart and by the huge gap that opened up with its 200-day moving average. During the week before it crashed down there were clear candlestick warnings of imminent failure, with a marked Reversal Day appearing that took the form of a long-legged doji that came close to being a strongly bearish "gravestone doji". Now that it has crashed down close to very strong support and the uneducated public have become alarmed and turned bearish, we are seeing the opposite type of candlesticks appearing - long tailed bullish candlesticks, including a "bull hammer" on Thursday. This is saying to us that a significant tradable rally is imminent, even though there is likely to be a another downwave later that takes silver to a lower low probably in the $28 area to complete the reactive phase.

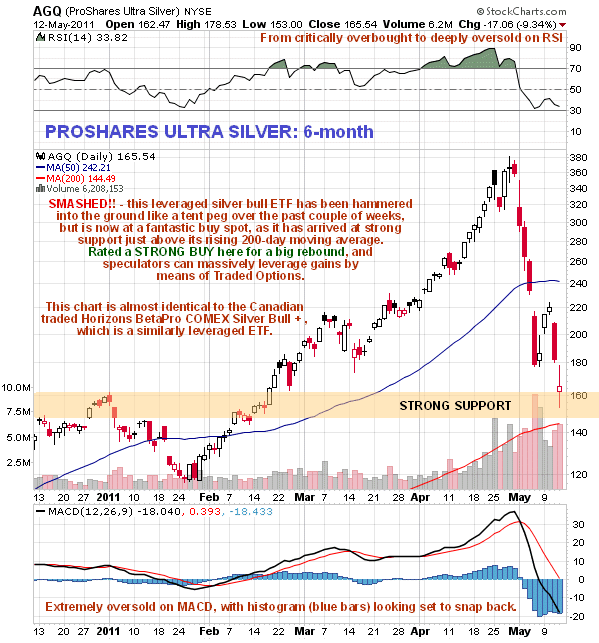

The leveraged silver ETFs magnified the manic depressive lunacy of silver speculators of course, with the ProShares Ultra Silver shown below, which appeared on the site as part of an article about silver bull ETFs and Call options in same, taking a more than 50% haircut in under 2 weeks. It has arrived back in a zone of strong support is a state of massive compression - meaning that it has reacted back fast and deep into the preceding major uptrend, a situation that normally results in a big relief rally.

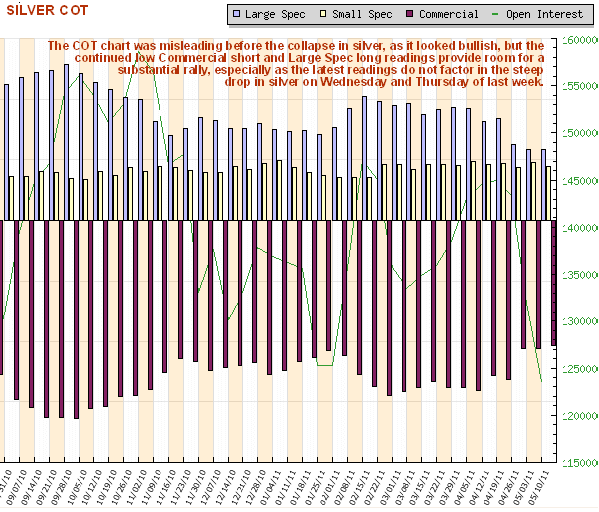

It is worth taking a look at the silver COT chart here in relation to the 6-month silver chart. Although the COT chart was highly deceptive ahead of the collapse as it looked bullish, it is still useful as it shows that we have the lowest Commercial short and Large Spec long positions by a substantial margin for the period of this chart, and in fact going back further - at least a year. This means that at least as far as the COTs are concerned, there is room for a big rally in silver going forward. Actually the COTs are even more bullish than this chart would suggest, as it is up to date as of last Tuesday, and it thus reasonable to suppose that the Commercial short and Large Spec long positions have dropped back even more on the sharp drop in silver that occurred on Wednesday and Thursday of last week.

As we are professionals in the field of market analysis, but not in the field of psychiatry, we of course only have layman's terms to describe the crazed state of mind of the average silver speculator, such as bonkers, dippy, doo-lally, gaga, garrity, kooky, loco, moonstruck, off their rockers, round the twist, a few slates short of a roof, lost their marbles, mad as a March hare, not firing on all plugs, round the bend, unhinged etc and you may be able to think of some more. They would make great subject matter for a PhD thesis, but we don't really want the men in white coats turning up and dragging them off, despite the title of this article - we need these people to keep buying high and selling low so that we can do the exact opposite.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2011 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.