Asian Gold Demand Remains Strong, UK and US Economic Data Shows Stagflation Threat Deepening

Commodities / Gold and Silver 2011 May 18, 2011 - 12:47 PM GMTBy: GoldCore

Gold and silver have snapped their three day losing streak so far this morning and both are higher in all currencies. Sterling has fallen on this morning’s very poor UK employment data. This in conjunction with yesterday’s high inflation figure in the UK and negative data in the U.S. confirm the increasing threat of stagflation to western economies.

Gold and silver have snapped their three day losing streak so far this morning and both are higher in all currencies. Sterling has fallen on this morning’s very poor UK employment data. This in conjunction with yesterday’s high inflation figure in the UK and negative data in the U.S. confirm the increasing threat of stagflation to western economies.

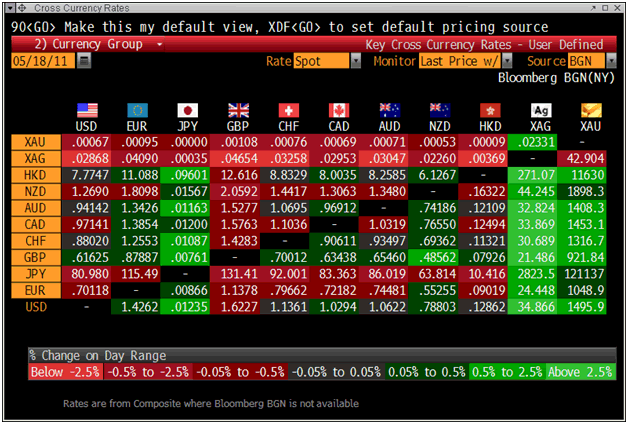

Cross Currency Rates

U.K. unemployment claims rose in April at the fastest pace since January 2010, showing the very fragile nature of the recent tentative economic recovery. Government spending cuts, austerity measures and accelerating inflation are clearly beginning to impact embattled consumers.

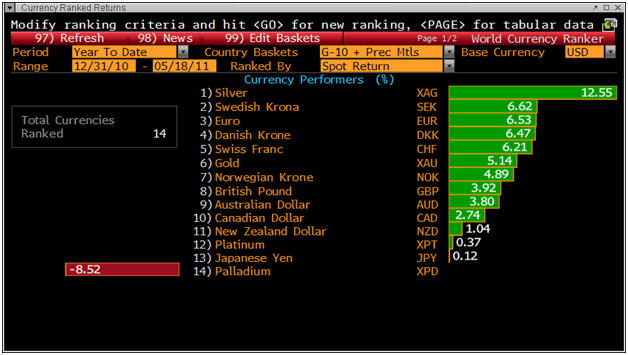

G10 and Precious Metal Returns – Year to Date

In the U.S., stagflation is also an increasing, if unacknowledged, threat as the classic symptoms of inflation - slow growth, high unemployment and inflation are present. Weak U.S. factory output and home building data yesterday suggests that the world's largest economy is slowing down again.

Official inflation figures in the U.S. remain benign but hedonic adjustments and many adjustments to the methodology of calculating inflation in the last 20 years mean that that the Consumer Price Index is no longer an accurate measure of real inflation in the economy.

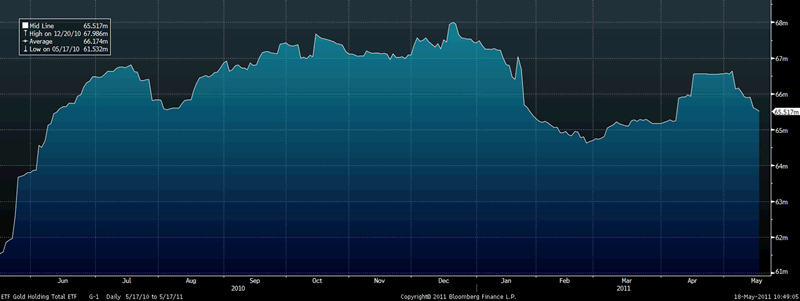

Total Known ETF Holdings of Gold

This macroeconomic risk coupled with continuing geopolitical risk is supportive of gold continuing to receive safe haven demand.

Geopolitical risk remains ever present as seen in Pakistan yesterday where two Pakistani troops were injured after exchanging fire with NATO helicopters that had entered Pakistan’s airspace in the tribal region of North Waziristan. The conflict in Libya looks like it may soon escalate and tensions between Israel and the regimes in Syria and Iran remain high.

Asian Demand for Gold Remains High as Seen in Gold Bar Premiums

A clear sign of healthy appetite in China are the premiums being paid for gold bars in Shanghai and Hong Kong. Shanghai gold closed at a premium of $3.57 to world gold of $1,495.95. The premium increased from that seen Monday when it was $3.09 at $$1,497.45.

The premium on gold bars in Hong Kong increased 10 cents this week to between $1.30 and $1.80 per ounce over London spot prices.

Reuters reports that gold bars in Vietnam, where demand has been voracious in recent months due to a sharp depreciation in the Vietnamese dong, were trading at a $3.92 premium to world gold spot Monday.

India’s banking system was closed yesterday and there are therefore no reported premiums but recent days have seen healthy premiums for gold around the $1,500/oz level in India.

The launch of the new Hong Kong Commodity Exchange will result in Asia having an even bigger say in prices of commodities and precious metals. The exchange is backed by China’s biggest bank and a Russian tycoon and will challenge established markets and exchanges in Europe and the U.S.

Asians increasing power in financial markets and the fundamentals of robust and sustainable demand for gold and silver bullion throughout Asia will mean that speculative interests on Wall Street will find it harder to artificially suppress prices and the massive concentrated short positions on the COMEX may be forced to close their positions propelling bullion prices higher.

George Soros – Bullish or Bearish on Gold?

Despite his exit from ownership of the gold ETFs, Soros continues to have large allocations to gold investments through owning more high risk gold mining shares and a gold mining ETF.

Soros’ fund added Eldorado Gold, Freeport-McMoran Cooper & Gold and Goldcorp to their investments during Q1 2011.

This would suggest that contrary to simplistic reporting Soros continues to remain positive on the gold sector.

It also suggests that as we have long pointed out, a hedge fund selling their gold ETF position does not necessarily mean they are bearish on gold. It can mean that they are concerned about the nature of the structure and intermediation involved in an exchange traded fund and prefer the security of actual physical bullion.

UBS pointed this yesterday. “Some of the ETF liquidation in the quarter was not actually outright gold selling,” UBS’s Tully said. “In some cases, investors switched their gold exposure from ETP-based to allocated, and so this somewhat distorts the ETP ownership picture.”

In the first quarter, gold ETP holdings declined 3.3 percent (see chart above), the first decline in a year. Silver holdings rose 1.9 percent, palladium assets fell 1 percent, and platinum holdings gained 12 percent.

News and commentary can be found on our home page

Gold

Gold is trading at $1,493.55/oz, €1,047.61/oz and £923.05oz.

Silver

Silver is trading at $34.53/oz, €24.22/oz and £21.34/oz.

Platinum Group Metals

Platinum is trading at $1,774.50oz, palladium at $730/oz and rhodium at $2,025/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.