Rare Earths Metals Group Mine to Magnet

Commodities / Metals & Mining Jun 17, 2011 - 02:40 AM GMTBy: Richard_Mills

The rare earths are a group of 17 elements comprising Scandium, Yttrium, and the Lanthanides. The Lanthanides are a group of 15 (Cerium, Dysprosium, Erbium, Europium, Gadolinium, Holmium, Lanthanum, Lutetium, Neodymium, Praseodymium, Samarium, Terbium, Thorium, Thulium, Ytterbium) chemically similar elements with atomic numbers 57 through 71, inclusive.

The rare earths are a group of 17 elements comprising Scandium, Yttrium, and the Lanthanides. The Lanthanides are a group of 15 (Cerium, Dysprosium, Erbium, Europium, Gadolinium, Holmium, Lanthanum, Lutetium, Neodymium, Praseodymium, Samarium, Terbium, Thorium, Thulium, Ytterbium) chemically similar elements with atomic numbers 57 through 71, inclusive.

Yttrium, atomic number 39, isn’t a lanthanide but is included in the rare earths because it often occurs with them in nature - it has similar chemical properties. Scandium, atomic number 21 is also included in the group although it usually occurs only in minor amounts.

The most abundant rare earth elements (REE) are each found in the earth’s crust in amounts equal to nickel, copper, zinc, molybdenum, or lead - Cerium is the 25th most abundant element of the 78 common elements in the Earth’s crust. Even the two least abundant REEs (Thulium, Lutetium) are nearly 200 times more common than gold. Overall Rees have an abundance greater than silver and similar amounts to copper and lead.

The “rare” in rare earth elements came from frustrated 19th century chemists who decided they were uncommon after trying to isolate these chemically related elements. REES are also very hard to find in economic concentrations.

The Lanthanides are divided into light rare elements, LREE, and heavy rare earth elements, HREE. Light REE's are made up of the first seven elements of the lanthanide series - Lanthanum (La, atomic number 57), Cerium (Ce, atomic number 58), Praseodymium (Pr, atomic number 59), Neodymium (Nd, atomic number 60) Promethium (Pm, atomic number 61) and Samarium (Sm, atomic number 62).

HREEs are made up of the higher atomic numbered elements - Europium (EU, atomic number 63), Gadolinium (Gd, atomic number 64), Terbium (TB, atomic number 65), Dysprosium (Dy, atomic number 66), Holmium (Ho, atomic number 67), Erbium (Er, atomic number 68), Thulium (Tm, atomic number 69), Ytterbium (Yb, atomic number 70) and Lutetium (Lu, atomic number 71).

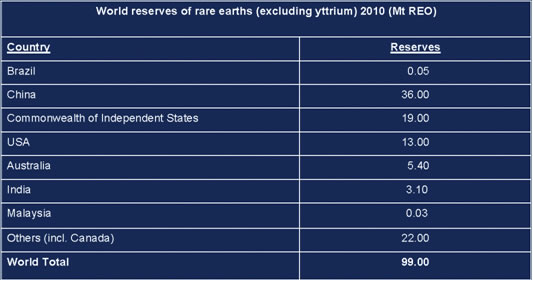

Source USGS

The principal economic sources of LREE are the minerals bastnasite and monazite. In most rare earth deposits, the first four REE - La, Ce, Pr, and Nd - constitute 80 to 99 percent of the total.

Deposits of bastnäsite in China and the United States represent the largest percentage of the world’s Rare Earth economic resources.

The second largest percentage of the world’s LREE Rare Earth economic resources is monazite. Monazite contains less La, more Nd and some HREE with usually elevated levels of thorium compared to bastnasite.

Ion-adsorbed REE in clays from South China provide the bulk of HREE to the market place.

Uses

Many REE applications are highly specific and substitutes are inferior or unknown:

- Color cathode-ray tubes and liquid-crystal displays used in computer monitors and televisions employ europium as the red phosphor

- Terbium is used to make green phosphors for flat-panel TVs and lasers

- Lanthanum is critical to the oil refining industry, which uses it to make a fluid cracking catalyst that translates into a 7% efficiency gain in converting crude oil into refined gasoline

- Rechargeable batteries

- Automotive pollution control catalysts

- Neodymium is key to the high strength permanent magnets used to make high-efficiency electric motors. Two other REE minerals - terbium and dysprosium – are added to neodymium to allow it to remain magnetic at high temperatures

- Fiber-optic cables can transmit signals over long distances because they incorporate periodically spaced lengths of erbium doped fiber that function as laser amplifiers

- Cerium oxide is used as a polishing agent for glass. Virtually all polished glass products, from ordinary mirrors and eyeglasses to precision lenses, are finished with CeO2

- Gadolinium is used in solid-state lasers, computer memory chips, high-temperature refractories, cryogenic refrigerants

- Used in improving high-temperature characteristics of iron, chromium, and related alloys

- Y, La, Ce, Eu, Gd, and Tb are used in the new energy-efficient fluorescent lamps. These energy-efficient light bulbs are 70% cooler in terms of the heat they generate and are 70% more efficient in their use of electricity

- REEs are used in metallurgy as an alloying agent to desulphurise steels, as a nodularising agent in ductile iron, as lighter flints and as alloying agents to improve the properties of superalloys and alloys of magnesium, aluminium and titanium

- Rare-earth elements are used in the nuclear industry in control rods, as dilutants, and in shielding, detectors and counters

- Rare metals lower the friction on power lines, thus cutting electricity leakage

China

China mines REEs from bastnäsite ore in the provinces of Gansu and Sichuan. In Inner Mongolia REEs are obtained as a by-product from iron making.

HREE extraction, based on ion absorption clays, occurs in the states of Guangdong, Hunan, Jiangxi and Jiangsu. These clays have very low cerium content and as a consequence the other REES, in particular the HREEs, comprise a much larger share of the ore than is typically found elsewhere.

Currently Chinese ion absorption ore is the main source for HREE and resources are not published. There may be the possibility of discovering new ion absorption deposits in Southeast Asia, however high costs for labor, lack of infrastructure and environmental restrictions may render these new deposits uneconomical when competing in the market place with Chinese output.

China has 36 to 53 percent of the world’s REE deposits (industry figures differ) and supplies 97 percent (this number is constant) of the global demand for rare earth elements. The low cost and unregulated production from China’s large deposits forced the closure of almost every rare earth mine outside of China.

Tighter limits on production and lowered export quotas are being put in place to ensure China has the necessary supply for its own technological and economic needs - in 2006 volume dropped to 48,000 tonnes. In 2007 volume dropped to 43,574 tonnes, in 2008 volume dropped to 40,987 tonnes and in 2009 to 33,300 tonnes. In 2010 China dropped its annual REE export quota by 37% and then announced an additional 35% drop in its H1 2011 export quota.

In a hunt to secure jobs, and access to advanced technologies, the Chinese have forced manufacturers needing access to REEs to make their products in China. These manufacturers must either cut back production or build their factories/products in China - recently major producers of the magnet material Neodymium-Iron-Boron have transferred their operations to China.

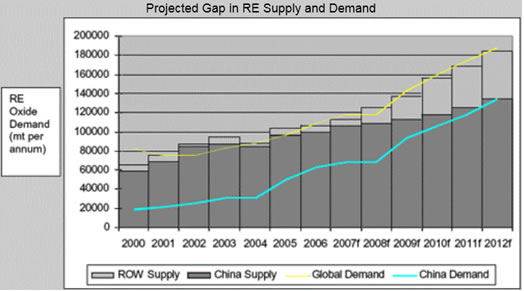

Demand for Rare Earths is forecasted to grow at 8-11% per year between 2011 and 2014. Many experts are predicting that the Chinese, and those end users who moved to China for security of supply, will be internally consuming most of the countries rare earth production by about 2014.

Forecast demand, source: IMCOA presentation

Rare earth demand is driven by several global macroeconomic trends:

- Miniaturization

- Environmental protection

- Increasing demand for energy, power and fuel efficiency

The highest demand growth is expected for magnets and metal alloys - hybrid and electric vehicles along with wind turbines (also High Speed Rail) will compete for the essential materials and there are no substitutions for the REEs used in these applications. An increased use of energy efficient fluorescent lights and growing demand for LCDs, PDPs will increase the use of phosphors.

The French Bureau de Recherches Géologiques et Minières rates high tech metals as critical, or not, based on three criteria:

- Possibility (or not) of substitution

- Irreplaceable functionality

- Potential supply risks

It’s very obvious REEs are critical metals and that the west is going to need a secure, long term supply of Rare Earth Elements completely independent of Chinese control.

There are a lot of junior companies in this space competing for investor attention.

Wilderness of mirrors

“Wilderness of Mirrors” is a phrase coined by the 1950s era counter-intelligence chief John Foster Dulles to describe the intelligence game. In particular, the phrase refers to the difficulty of separating disinformation from truth.

One of the world’s foremost REE geologists and mineralogists Anthony “Tony” Marianno says each REE deposit, assuming a favorable political climate and good logistics, will need certain conditions present:

- Favorable mineralogy and lanthanide distribution

- Necessary grade and tonnage

- Mining and mineral processing at low costs

- Successful chemical cracking of the individual lanthanides for their

isolation and eventual recovery

- Low values of thorium, uranium and other deleterious impurities

- Minimum environmental impact

Dudley Kingsnorth of Industrial Minerals Company of Australia (IMCOA) outlines the necessary steps to take a REE deposit all the way to production:

- Prove resource: grade, distribution and understand mineralogy

- Define process and bench scale - each ore-body is unique. Because of this uniqueness a new separation process has to be developed for each individual deposit

- Conduct pre-feasibility study

- Demonstrate technical and commercial viability of the process

- Obtain environmental approval

- *Publish Letters of Intent – marketing is customer specific. The main value added from Rare Earths is not in the mining and extraction, so it is necessary to either develop your own supply chain or gain access to an existing supply chain

- Complete a bankable feasibility study

- Effect construction and start-up

There are significant barriers to entry into the Rare Earths market:

- Developing a rare earth mine and processing plant is capital intensive. Capacity costs are high - plus US$30,000 per tonne of annual separated capacity versus less than US$3500.00 for an open pit mine in the US. History shows that the development time can be very long at 10-15 years

- Operational expertise is very limited outside of China - limited technical expertise on mining, cracking and separating

- Major mining companies, and institutions, are put off by investments in such a tightly focused market - this leaves juniors with potential development issues

REE Minerals

There’s a saying regarding the search for economic quantities of rare earths:

“You are not looking for a REE deposit, you are looking for a Bastnaesite deposit.” anon

Practically all light REE are extracted from bastnaesite and monazite, while the heavy REE comes from xenotime and ionic clays. The process of extracting REE from these four minerals has not changed over the last two decades. When you review these four minerals chemical compositions you will see they are not complex. The more complex, the harder it is to extract what you want and get the ultra high purity oxides, metals, alloys and powders required.

Mineralogy is mineral composition, metallurgy the process of extraction. Complicated mineralogy can mean complex, expensive, power intensive, time consuming metallurgy.

Bastnaesite: REE CO3F, LREE dominant.

Monazite: REE PO4, LREE dominant.

South China Clays: Ion-adsorbed REE+Y in Clays

Xenotime: Y,HREE PO4, HREE dominant, one of the best sources for Y and HREE. Usually found in small quantities associated with monazite.

Ancylite: (Ce) SrREE(CO3)2(OH)·H2O, LREE dominant.

Eudialyte: Na15Ca6(Fe2+,Mn2+)3Zr3(Si,Nb)(Si25,O73)(O,OH,H2O)3(CL,OH)2, HREE dominant, name derived from the Greek phrase Εὖ διάλυτος eu dialytos - "well decomposable" alluding to its ready solubility in acid. Colloidal silica makes it difficult to isolate the REEs but Eudialyte ores are among the most promising sources of rare earth mineral raw material.

Britholite: (REE,Y,Ca)5(SiO4,PO4)3(OH,F), a phosphate so should be able to crack it.

Allanite: (Ce) (Ce,Ca,Y)2(Al,Fe2+,Fe3+)3(SiO4)3(OH), LREE dominant but with low quantities of REE+Y compared to bastnasite. Refractory in nature.

Zircon: ZrSiO4, Zircon is often the major heavy mineral in beach sands and river placers. It is also a byproduct of Sn, Ti and Au mining. Strong refractory nature and resistance to chemical dissolution. Zircon is the main raw material needed for value-added zirconium chemicals production.

Loparite (Ce) (REE,Na,Ca) (Ti, Nb,Ta)O3 Alkaline igneous massif

Uraninite: REE and Y - Released as dissolved elements in rafinates from uraninite

Fergusonite is a mineral comprising a complex oxide of various rare earth elements. Fergusonite occurs in many geologic environments and has attractive chemistry. Unfortunately it isn’t found in exploitable quantities.

Mines to Magnet

Mining REEs is fairly straightforward but separating and extracting a single REE takes a great deal of time, effort and expertise.

Rare Earth Ore: the ore is ground up using crushers and rotating grinding mills, magnetic separation (bastnaesite and monazite – are highly magnetic, they can be separated from non-magnetic impurities in the ore through repeated electromagnetic separation) and floatation gives you the lowest value sellable product in the Rare Earth supply chain - the concentrated ore. The milling equipment; crushers, grinding mills, flotation devices, and magnetic, gravity, and electrostatic separators all have to be configured in a way that suits the type of ore being mined - no two ores respond the same way.

Concentrated ore: chemically extract the mixed rare earths from the concentrated ore (cons) by chemical processing. The cons have to undergo chemical treatment to allow further separation and upgrading of the REEs. This process – called cracking – includes techniques like roasting, salt or caustic fusion, high temperature sulphidation, and acid leaching which allow the REEs within a concentrate to be dissolved. This separates the mixed rare earths from any other metals that may be present in the ore. The result will be still mixed together rare earths.

Rare Earth Oxide (REO): the major value in REE processing lies in the production of high purity REOs and metals - but it isn’t easy. A REE refinery uses ion exchange and/or multi-stage solvent extraction technology to separate and purify the REEs. Solvent-extraction processes involve re-immersing processed ore into different chemical solutions in order to separate individual elements. The elements are so close to each other in terms of atomic weight that each of these processes involve multiple stages to complete the separation process. In some cases it requires several hundred tanks of different solutions to separate one rare earth element - HREEs are the hardest, most time consuming to separate.

The composition of REOs can also vary greatly - they can and often are designed to meet the specifications laid out by the end product users - a REO that suits one manufacturers needs may not suit another’s.

In this authors opinion a few junior REE miners will be able to produce oxides but the product will not be more than 98% pure and command, as of April 11th 2011, US$38kg. The cost to increase the purity to the 99.999% required by most end users - and the technical knowhow and operational expertise - will be beyond the capabilities of almost every junior miner. The 98% oxide will still have to be sent for further refining.

Very few REE miners will ever get paid for producing a 98% oxide (Molycorp does, their average price for a kilogram of oxide product in the first quarter of 2011 was US$38) let alone a 99.999% pure oxide (average LREE oxide price US$197kg June 11th) – it seems very likely that most REE juniors will end up selling a mixed rare earth solution - a concentrate comparable (place in the supply chain) to what a junior copper miner would sell.

Others further up the REE value added supply chain will turn the concentrate into high purity rare earth oxides and continue the process of making the high purity metals, alloys and powders.

Demand is growing for rare earth metals.

A common technique for producing metals from REOs is metallothermic reduction. The oxides are dispersed in a molten, calcium chloride bath along with sodium metal. The sodium reacts with the calcium chloride to produce calcium metal, which reduces the oxides to rare earth metals.

Sorption is a combination of the two processes – absorption, in which a substance diffuses into a liquid or solid to form a solution, and adsorption, in which a gas or liquid accumulates on the surface of another substance to form a molecular or atomic film.

Other extraction technologies include; vacuum distillation, mercury amalgamate oxidation-reduction, high-performance centrifugal partition chromatoagraphy and Sl-octyl phenyloxy acetic acid treatment.

The continuing miniaturization of electronic devices - such as disk drives and micro motors – is possible because of the ability of rare earth magnets to combine high magnetic strength with a small size and weight.

Magnetic powders are produced by processing specific combinations of elements that result in distinct magnetic and physical characteristics. These powders are the primary material used in the manufacture of rare earth permanent magnets. The main elements consumed in the manufacture of Neo and samarium-cobalt permanent magnets are; neodymium, samarium, some dysprosium and praseodymium.

Neodymium is alloyed with iron and boron as well as other elements (like cobalt). In order to produce neo powder for the manufacture of bonded (highly shapeable) Neo magnets, the alloy is melted and then rapidly solidified to produce Neo powders with the desired characteristics.

The flow of electrical signals on every printed wiring board used in electronic devices is regulated and controlled by the use of dielectric chips known as multi layer ceramic capacitors ("MLCC's"). Many use rare earth formulas containing lanthanum and neodymium of high purity and with precisely engineered physical properties.

All the above complex metallurgical technologies have taken decades to evolve, the methods of manufacture and compositions of metals, alloys and powders used are all proprietary methods developed over years of trial and error - they are not common knowledge, exactly the opposite, they are tightly held secrets that very few know. Lack of access to proprietary information about complex physical and chemical processes will severely restrict companies from climbing the value added chain.

This author believes no junior REE miners will be able to produce a rare earth permanent magnet - or the high purity metals, alloys and powders used in manufacturing high tech devices.

What to Watch For

When I evaluate a REE junior’s project I want to see one mineral hosting as much of the REE as possible, not three or more. I want that mineralization large grained and non-interlocking and I want road, rail and access to the power grid close.

Each deposit will have its own unique mineralogy - this has to be determined. A company has to concentrate its recovery efforts on the REE’s - whether LREE or HREE - that are going to be easy to recover in an inexpensive uncomplicated circuit, they have to work with what nature has given them in order to be competitive in the market. Watch for how many different types of minerals the REE are hosted in.

Work index

When we talk about a grinding or crushing circuit the terms Bond Equation and Work Index come into play. The term Bond Equation measures work done or work that has to be done while the Work Index is defined as the power consumption necessary to accomplish the work.

If REE host minerals have large distinct grains (the larger the grain the easier the extraction of REE) and very little intergrowth (there’s always some) the REE is easy to extract and there is very little crushing involved. The amount of work needed to be done, the Bond Equation, and the amount of power needed, the Work Index, is very low. Some deposits host mineralization whose grain size is measured in millimeters, low Bond Equation = low Work Index = lower power consumption. Therefore electrical power and other associated costs (maintenance and replacement) are low – power consumption costs for grinding and crushing are major costs for miners, especially deposits far off the grid requiring diesel to generate electricity.

If mineralization is smaller grained and interlocked it is very hard to extract the REE. In this scenario the Bond Equation is very high because of all the work necessary - some deposits ore has to be crushed down to the micron level (dust) for REE extraction. The Work Index, the power required to grind and crush to so fine a product is immense.

An extremely high Work Index to prepare ore can make or break a deposits economics, especially when poor infrastructure is considered – no rail or road for transport, no access to the power grid and a high Work Index are all potential deposit killers when it comes to competing in the market place.

Silica (Si) does not dissolve in acid easily and being sand is very hard on grinding and crushing equipment. Silica will actually wear on ball mills and that adds contaminants.

Company metallurgical reports can show up to 98% average recovery rates for all REES listed in their assay tables - but this is lab testing, crushed to dust, roasted and acid leached for hours times three - we could get that kind of recovery from the asphalt out in front of my house if it had any REE in it. In 2010 SRK Consulting studied 18 years of annual performance data and six months of operational data between 2001 and 2002 (after implementation of improvements) from Molycorps existing mill. The average recovery rate was 63%. SRK suggested that a mill recovery of 70% is possible when the mill is operated on a sustained basis and with further improvements.

We’re told the value of the ore is based on - converting the individual REE percentages to oxide, times the current selling price per kilogram, add them all together. The problem is the company will never get paid 98% oxide prices for all those different REEs – let alone get paid for a 99.999% pure oxide which is the price many are using.

Does a company have high levels of uranium or low levels of thorium in it’s deposit? If you’ve got thorium where does it report to? If its recovered as thorite you can extract and deal with it separately - it doesn’t have to go into a tailings pond. Look very closely at the drill tables companies publish on their websites. Ratios of thorium versus REEs usually remain constant - if you see a spike in thorium levels you will almost always see a spike in REE levels. If there’s a spike in thorium without a spike in REEs then your thorium might be recovered as thorite.

How radioactive is the concentrated ore and waste? Will the company be classified as mining radioactive material if it gets that far? Over a certain rad count in British Columbia – in many other places as well – and you start playing in a whole different ballpark as far as mining and the environment are concerned.

Three Hour Tour

A few analyst reports have been published that say the REE market will be saturated within a few years because of a huge increase in production expected from new mines coming on stream. As of yet none of these mines are on stream - some have been going into production next year for the last several years – and are today still raising money for “production”, still haven’t done a preliminary economic study (PEA), a pre-feasibility or feasibility studies, have no economic reserves, have no permits and have published no realistic estimates of mining costs or even a metallurgical report.

Source IMCOA

Many of the deposits being counted on for near and mid-term supply simply don’t, in this authors opinion, have the mineralogy and/or the necessary close by infrastructure to compete in the market.

The Future

The future for some of our junior company’s REE deposits (the ones with the right mineralogy and that are of sufficient tonnage) will be end users securing off take agreements or buying a company’s REE deposit outright to have security of supply.

Spending 200 or more million dollars for outright ownership of a deposit, or doing a strategic financing to get the deposit into production for an off take agreement is very little money upfront to take so much security of supply risk off the table for a major high tech manufacturing company or a value added rare earths producer.

Conclusion

The opportunities in the junior REE sector are significant. But the junior population is quite large - there are literally hundreds of stocks to choose from that want your dollars.

There is a steep learning curve and there are serious risks – great rewards come hand in hand with great risk. You must be prepared to do your own due diligence and uncover the opportunities.

You must be able to evaluate these opportunities, pay regular attention to your portfolio, manage the risk and take responsibility for your own decisions.

Fish, in their album “Vigil in a Wilderness of Mirrors” sang:

I keep a vigil in a wilderness of mirrors

Where nothing here is ever what it seems

Good advice.

Is the REE junior resource sector, with its immense opportunity, on your radar screen?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2011 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.