European Stock Market Long-term Analysis

Stock-Markets / European Stock Markets Jun 19, 2011 - 07:24 AM GMT I originally wanted to wait till we had a potential low in place, but I feel that this is important enough to now put down in writing so readers may have some ideas going forward.

I originally wanted to wait till we had a potential low in place, but I feel that this is important enough to now put down in writing so readers may have some ideas going forward.

I want to stress I am not a big fan of these large macro wave counts, at WPT we specialize on shorter term time frames from days to weeks, using wave counts of many year magnitude is in the authors opion not really that beneficial, as being wrong for 2-3 years is not really going to help your account balance.

Being right overall but 2-3 years to late is still wrong imo, as if you're broke from trading and being on the wrong side of the markets, then what's the point of being right if you are broke?

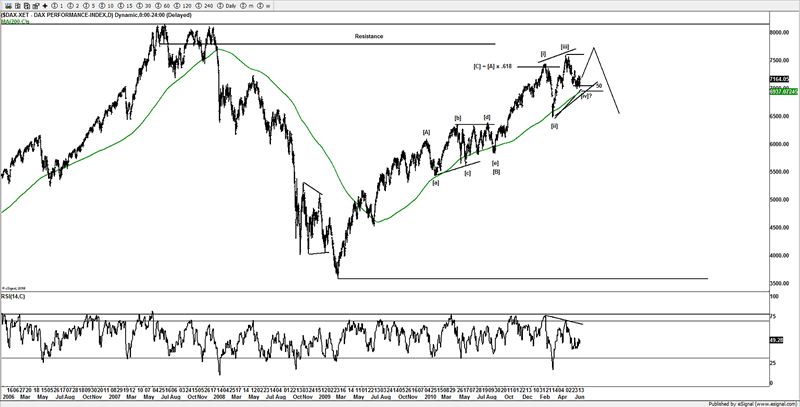

DAX

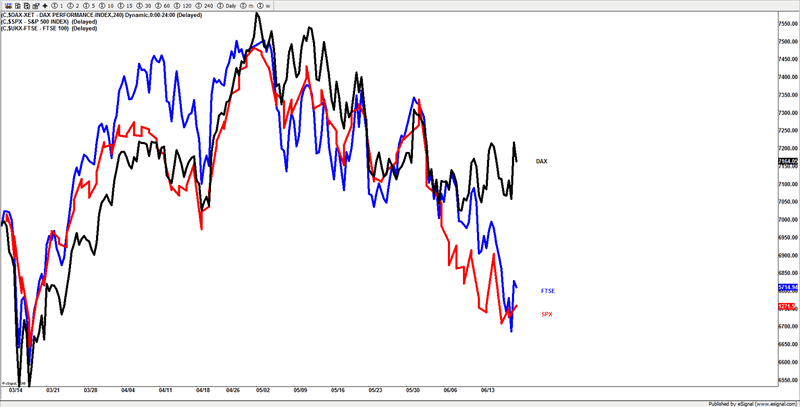

One thing that just keeps bugging and every time I look at this chart is the divergence between the DAX and SPX, it's so obvious is just causes me issues with any bearish case on the US markets, hence I still like the idea of a new yearly high and a flat on the SPX could be nearing its conclusion, the pattern in the DAX suggests a potential reversal, for a 4th wave of an ending diagonal pattern (ED), and we go up to test new yearly highs for the 5th wave.

It's possible we might have topped on the markets, but the lack of follow through in the DAX and the choppy price action is certainly not screaming out an important high has been seen, as some are calling for, with the potential for a new high with a 5th wave for the ED idea, it's something that I think the bears do have to respect, as from here it won't take much to convince me of a bearish tape, as breaking 7000 hard and seeing heavy sell side price action will get us short anyhow.

However I still want to point out the potential for a reversal and a 5th wave of this ED towards 7700. The DAX has yet to break its 200DMA and this ED idea only starts to look wrong below the 6950 area, so whilst this market stays above the 6950-7000 area, I kind of think the bears need to be cautious above betting the farm here on much more downside.

If the market topped (I am not fully convinced just yet) then it won't need much from here to really get bearish.

Is it not better to wait a little for heavy price action under 7000 1st before you commit to getting aggressive on the short side?

One more high would setup a divergence as well with the RSI.

The market may have topped, but with the lack of follow through and the choppiness in the FTSE and US markets I tend to think defense wins the game here. Unless this starts to accelerate under its 200DMA (7000-6950) the door is open for a new move higher in a 5th wave to new yearly highs, and you don't want to be selling that, do you??

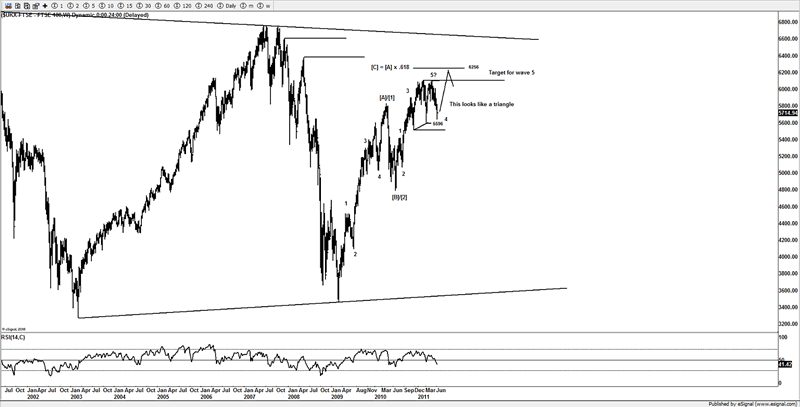

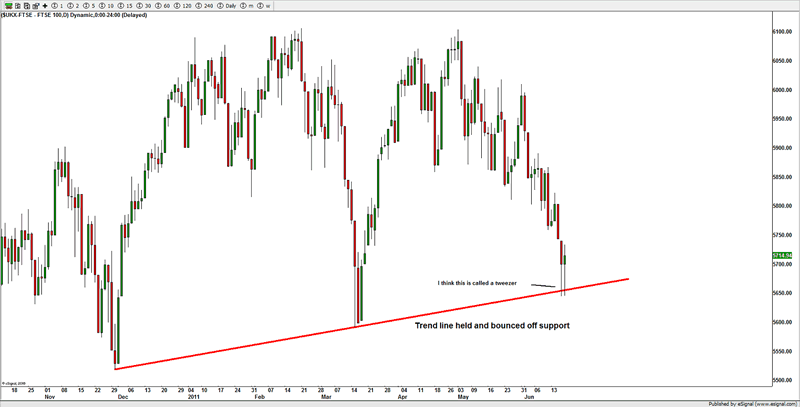

FTSE

I have not been totally convinced that this market has topped either, and watching a potential triangle taking shape, the good thing is that risk can be controlled here to 5596, as the wave [c] low cannot be violated, but even the triangle idea is not really broken till under 5510, the low might well be in, if wave [e] has put in its low, and I noticed the market hit its trend line for the triangle and a tweezer bottom low, although I not an expert on Japanese candlestick patterns I think that's called a tweezer bottom. So like the DAX a reversal here could see a move to above the yearly high around 6150-6250 for wave 5.

The alternative is that wave 5 truncated and we have topped, but the great thing about where we are is that it won't take much to find out if bearish or bullish, the market is at a point where it needs to decide.

Does it want to put in new yearly highs or have we topped? from here the rewards on the US and European markets look good for a low risk buying opportunity, as if the bullish idea of new yearly highs is wrong you simply switch bias and get short as if these markets don't deliver much in the way of strength and strong bounces from the 200DMA test then they are going to be in trouble anyhow and more downside is looming.

Conclusion

Looking at the evidence, combined with the US markets, there is a very good chance that a low is in place or almost in place if the US markets have to put in a marginal new low as per the ED ideas on SPX and R2K etc

We could dip a little lower early next week if the US markets pin a new marginal low, but from what I have seen I would say that it's a great case for a very low risk/high reward trading setup, that if its wrong won't take much to find out, if your right here and new yearly highs, then it's a summer move for a few months and substantial gains to be had.

Bottom line is that the markets in US and Europe are testing or vibrating their respective 200DMAs, the bearish ideas come into play if the markets start sinking lower and break those 200DMAs, or we only see a weak bounce, but if the bulls want new yearly highs, here is where I suspect it happens.

Until next time.

Have a profitable week ahead.

Click here to become a member

You can also follow us on twitter

What do we offer?

Short and long term analysis on US and European markets, various major FX pairs, commodities from Gold and silver to markets like natural gas.

Daily analysis on where I think the market is going with key support and resistance areas, we move and adjust as the market adjusts.

A chat room where members can discuss ideas with me or other members.

Members get to know who is moving the markets in the S&P pits*

*I have permission to post comments from the audio I hear from the S&P pits.

If you looking for quality analysis from someone that actually looks at multiple charts and works hard at providing members information to stay on the right side of the trends and making $$$, why not give the site a trial.

If any of the readers want to see this article in a PDF format.

Please send an e-mail to Enquires@wavepatterntraders.com

Please put in the header PDF, or make it known that you want to be added to the mailing list for any future articles.

Or if you have any questions about becoming a member, please use the email address above.

If you like what you see, or want to see more of my work, then please sign up for the 4 week trial.

This article is just a small portion of the markets I follow.

I cover many markets, from FX to US equities, right the way through to commodities.

If I have the data I am more than willing to offer requests to members.

Currently new members can sign up for a 4 week free trial to test drive the site, and see if my work can help in your trading and if it meets your requirements.

If you don't like what you see, then drop me an email within the 1st 4 weeks from when you join, and ask for a no questions refund.

You simply have nothing to lose.

By Jason Soni AKA Nouf

© 2011 Copyright Jason Soni AKA Nouf - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.