Strategic Petroleum Reserves the New Global QE?

Commodities / Crude Oil Jun 24, 2011 - 01:45 PM GMTBy: Ashraf_Laidi

In order to understand the SPR release of 60 million barrels, we must go back to the November G20 meeting when Asia/Latam Emerging Markets protested against the Fed's November launch of QE2, dubbing it as beggar-they-neighbour USD depreciation.

In order to understand the SPR release of 60 million barrels, we must go back to the November G20 meeting when Asia/Latam Emerging Markets protested against the Fed's November launch of QE2, dubbing it as beggar-they-neighbour USD depreciation.

It was no surprise that Bernanke did not dare utter the words QE3 on Wednesday's press conference. Yet, there was no need to refer to further easing when the FOMC already downgraded its growth outlook for the 3rd successive meeting.

-

Unlike during the end of QE1 (Feb-Mar 2010) when the US economy grew robustly to the extent that the Fed raised the discount rate (Feb 2010) & USD was rallying partly at expense of Greek woes (the other part was due improved US data), the end of QE2 today is fraught with fiscal & macoreconomic deterioration.

-

This creates inevitable continuation of US quantitative easing (reinvesting principal payments), leading to support for commodities and risking inflation.

-

Fed policy means US imports deflation from Asia; Asia/Latam imports inflation from US obliging EM to further tighten.

-

ONLY SOLUTION is for IEA (ie G20) to combat the macoeconomic symptoms of weak USD to cap oil prices via SPR release.

We consider the IEA decision to have been partially prompted by the notion that a continuously falling USD would risk lifting US crude oil back above the $97 and onto the $100 territory as the Fed may be forced to renew its asset purchases. Note how that right after Bernankes conference, WTI rose by more than $2.00 to 95.70s as the market deemed further stimulus to be inevitable.

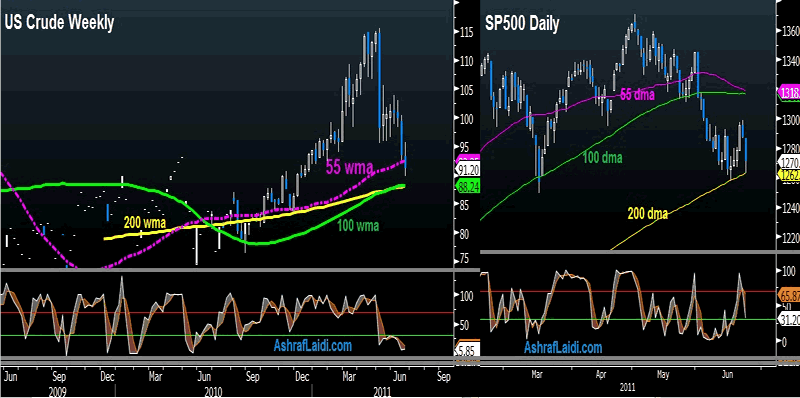

As negative as they appear, both the US crude oil and S&P500 chart remain well supported, with the foundation resting on key technical levels; 200 week moving average for US Crude and 200 day moving average for the S&P500.

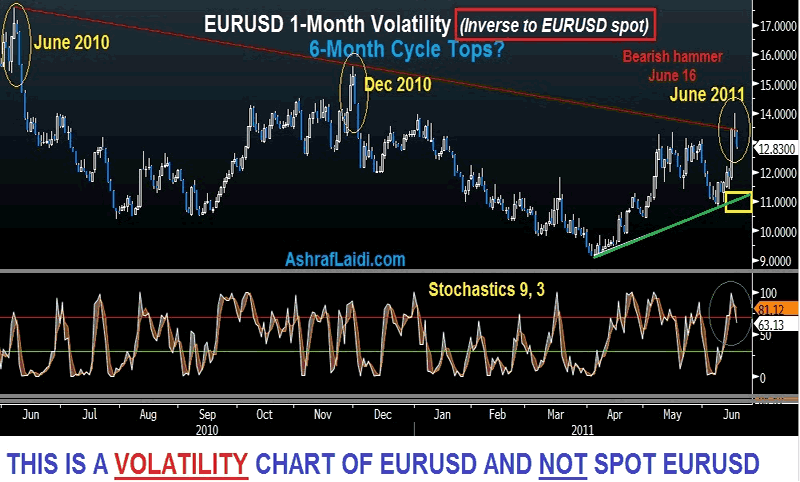

The USD will need more than just bad news in the Eurozone to accumulate any real rally beyond +5% bounce. What was mainly seen as fiscal imbalance weighing on the USD structural fundamentals is now compounded by widespread macro weakness, which will keep monetary easing weighing on USD.

EURUSD will continue hovering between $1.40 and 1.45.

Do not underestimate China's role in propping Europes debt in return for Europe's support for Beijing's aspirations to have its currency (yuan) part of the news reserve currency order. Hence, notice how European nations are no longer dictating Beijing over its currency policy, leaving only the US and Canada in doing so.

Click here for my CNBC-TV appearance on this topic earlier this morning.

Click here to try our Premium service of daily trades & intermarket insights.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2011 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.