Gold Lack of GLD Demand, Silver Supply Glut Unfolding

Commodities / Gold and Silver 2011 Jul 13, 2011 - 09:26 AM GMTBy: Ned_W_Schmidt

Coins always have to sides. We all are familiar with well-worn story of heads I win and tails you lose. Maybe this time the coin may be far more desirable. Perhaps it is now heads we win, tails the politicians lose. Maybe the markets are telling us that indeed the era of Keynesian socialism is now becoming part of history. Another chapter in the book of dead and failed economic and political ideologies may be in the process of being written.

Coins always have to sides. We all are familiar with well-worn story of heads I win and tails you lose. Maybe this time the coin may be far more desirable. Perhaps it is now heads we win, tails the politicians lose. Maybe the markets are telling us that indeed the era of Keynesian socialism is now becoming part of history. Another chapter in the book of dead and failed economic and political ideologies may be in the process of being written.

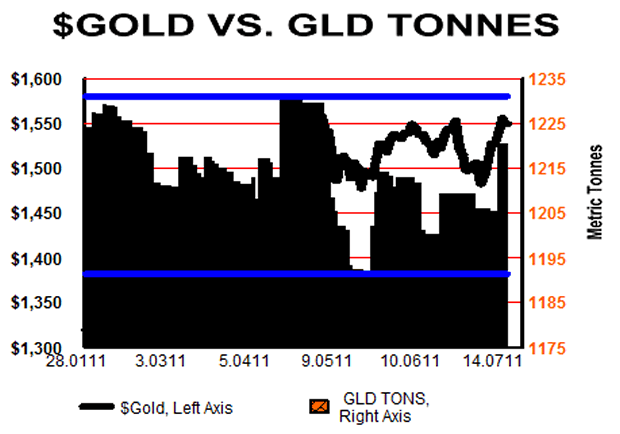

June 2010 was Peak. Down 100 tonnes since then.

In the above chart of GLD's holdings of Gold we can find no rush to buy policies to insure against possible debt defaults by Greece, Spain, Portugal, Italy, U.S. et al, until this week. On Tuesday, panic buying developed on the Street. Such panic buying by the lemmings of the Street never happens at a bottom.

If the financial threat from these Keynesian induced financial disasters were as dire as the commentary suggests, the markets would be sending a far different message. Of course, the ensuing poverty that would develop from such defaults could be causing individuals to hoard cash, rather than investing in insurance.

Discussions on Greece now seems focused on two alternatives, a managed default and an actual default. In a plan that now seems to be moving forward, a managed default would occur. In such a plan investors would have to share some of the loss on that government debt.

This development would be, as they say, a "game changer." With rare exception, for example Argentina which has been a serial defaulter, the world has not allowed sovereign debt to default. In the new game, markets would become the strict disciplinarian for governments with a bad case of Keynesian miseconomic policies. That development may be good news, and we explore that topic more in our July newsletter.

As the cases of the European PIGS are being resolved, the far more important battle on the survival of Keynesianism is taking place in the U.S. Never in 70+ years has a public discourse taken place on whether or not to continue the failed Keynesian policies of the past. Whatever the outcome of the debate on the U.S. debt ceiling, a new game, unlike any before, is unfolding. And the presumption that Gold and Silver price would rise in a U.S. default is likely in error.

This discussion will decide whether Keynesianism withers and dies a slow death, or is marched to the guillotine. Failure to raise the debt limit to a level providing comfort for the ruling junta to win reelection in 2012 may not mean default. Rather, it might mean an end to unlimited spending to buy votes in the U.S. Whatever happens, the world will actually be a financially better place

The above may help to explain why demand for financial insurance, demand for $Gold, has not risen, and why the price remains rather stagnate.

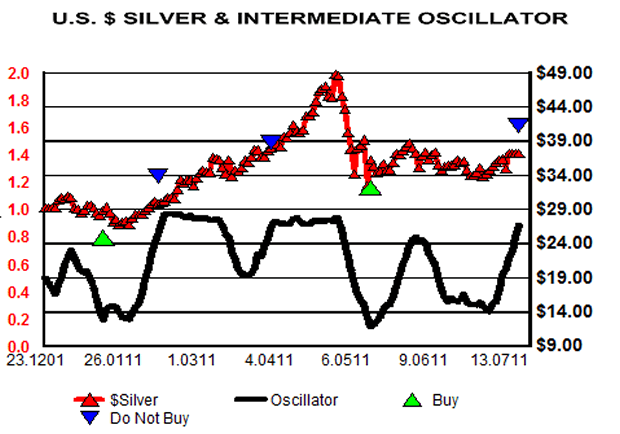

Above chart is for $Silver, a secondary form of financial insurance. While many comments float around on the demand for Silver, price is the ultimate manifestation of the supply/demand for any commodity. Chart formation portrayed might be described as the "squirrel on a limb" pattern.

We have observed on occasion a squirrel moving far out on a limb, in pursuit of some quest only known to it. At some point, the limb fails to provide adequate support, or breaks, plunging the squirrel to the ground far below. Investors may want to get off that limb before the plunge in Silver, moving into Gold, Chinese Renminbi, or Rhodium. Such a move is especially appropriate as near glut conditions will likely develop in Silver during the next couple of years.

Finally, we note with sadness the announced retirement of Representative Ron Paul. He will leave some big boots unfilled, but the record is clear. Ron Paul: 1 Keynesians: 0

Valuation table can be found below.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.