Nuclear Glow at the End of the Tunnel

Commodities / Nuclear Power Aug 04, 2011 - 06:32 AM GMTBy: Casey_Research

By Elizabeth Manning, Casey Energy Opportunities writes: Nuclear energy has taken a beating since the Fukushima crisis began in March, but we believe the arguments are strong that it's not down for the count.

By Elizabeth Manning, Casey Energy Opportunities writes: Nuclear energy has taken a beating since the Fukushima crisis began in March, but we believe the arguments are strong that it's not down for the count.

There are a couple of factors that the Casey Energy Team considers bullish for the nuclear industry and market. Let's take a closer look and back them up.

Factor #1: The pre-Fukushima price of uranium reflected not just market perception but a very real shortage of uranium that's looming in the face of growing global demand.

The Japanese earthquake struck just as the nuclear renaissance was gaining momentum. After a decade, efforts by the industry to promote nuclear power as a safe, clean and reliable alternative to fossil fuels were finally taking hold. So was the message that nuclear power offers the "always on" type of electricity that other, more glamorous low-carbon technologies like solar and wind power could only supplement, not replace.

China ordered a swath of new reactors, Russia embarked on a nuclear construction boom, India made nuclear power a key component of its energy plans, and the U.S. Congress issued loan guarantees for new plants.

The price of uranium responded, climbing slowly but surely out from its late-2000 all-time low of US$7.10 per pound, then spiking rapidly from the low US$70s in 2006 to a record US$136 in 2007. That unsustainable drive was fueled by speculators and hedge fund investments that disappeared with the 2008 recession. The spot price dropped back into the US$40s per pound.

While most other commodities recovered, uranium spent 2009 and the first half of 2010 dormant. The market woke up in mid-2010, starting a remarkable eight-month ascent from US$42 to US$72.65 per pound in February. Uranium outperformed every other commodity in that period, including gold, gaining 73%.

The 2007 frenzy aside, uranium's bullish drive is justified by industry conditions. We already mentioned the construction trend; now here are some numbers to back it up.

Global uranium demand is set to increase some 33% from 2010 to 2020, according to the World Nuclear Association (WNA). China is the most important player in that prediction: the Asian giant plans to increase nuclear capacity to 80 GWe by 2020, 200 GWe by 2030, and 400 GWe by 2050. A gigawatt electrical (GWe) is one billion watts, which provides enough power for roughly one million households in a developed country.

China may lead the world in number of nuclear reactors under construction, at 27, but Russia is building 11 and India has five in the works, while countries like Bulgaria, the Slovak Republic, and Ukraine each have two under construction. Demand for uranium is absolutely on the up-and-up.

Supply is another story. To reach just its 2030 target, China alone will need some 95 million pounds of uranium each year. In 2010, the world as a whole produced just over 118 million pounds.

.png)

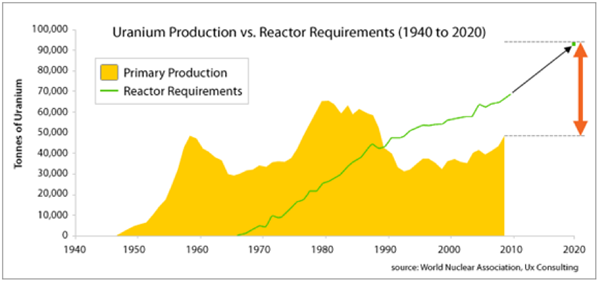

This WNA graph compares projected uranium demand and supplies. It's important to note that the solid line, indicating mid-range projected demand, will only be met if mines under development make it into production and, starting in six years, if mines now just in the planning stages start also operating. Those are two big "ifs," given that building uranium mines is an expensive, time-consuming business, and a venture with many opponents.

Most analysts do not expect supplies to meet growing global demand unless prices increase enough to make it economic to build these new mines. There's the key bit - unless prices increase enough to make new mines economic. Commodity prices are arguably the most important factor in whether a proposed mine will be economic, and therefore production rates track prices pretty closely.

In that context, the major gains in the price of uranium during late 2010 and early 2011 were justified. A uranium price above US$70 per pound was a real reflection of restricted supplies in the face of growing demand, and most industry observers expected the price to only climb, if slowly, from there.

Then came the earthquake.

Factor #2: Fukushima will not have any significant impact on global uranium demand in the long run.

Initially, the world reacted to the Fukushima crisis with dramatic calls to reconsider the use of nuclear power. Several governments put their nuclear power programs on hold, including China. For a moment, there was a real chance that Fukushima would derail the nuclear renaissance.

But is has not. Nuclear power growth in the developed world has been impacted, but the developed world isn't the make-or-break player for growth in the nuclear industry. The developing world is where the action will be, where governments are struggling to provide power to millions of impoverished people while still keeping some control of greenhouse gas emissions.

As expensive as a nuclear power plant is, they're relatively economical to keep running, and these countries have little luxury of choice. Coal may be the quick fix, but it's becoming increasingly expensive as well as laden with carbon-emissions baggage.

With that in mind, events that have garnered a lot of attention in the popular press, such as Germany's announcement to phase out its nuclear reactors by 2022, shrink into perspective. It's no real surprise, for one thing: the decision simply reverses one made last year to keep them open (yes, that would be reversing the reversal).

For another, Germany's 17 reactors accounted for 5% of uranium demand in 2010. By comparison, there are 104 reactors in the United States, 58 in France and dozens being built in China, India, and Russia. Finally, Germany relies on nuclear reactors for 23% of its power, and 2022 is awfully optimistic to ramp up alternative (i.e., other clean) energy technology to fill the gap. So let's just say we're skeptical.

On the other side of the equation are pro-nuclear movements in several places around the globe, such as in the Czech Republic. Prague is working to approve a plan to extend the life of the country's only uranium mine and wants to build three new reactors. It's labeled uranium a "super strategic" commodity and uranium mining a "strategic advantage for the Czech Republic."

Where Nuclear Energy Is Headed

Sixty of the 65 reactors currently under construction around the world are in developing countries. China has 27 reactors under construction, 50 planned and another 110 proposed. India has 5 under construction, 18 planned and 40 proposed. Russia has 10 under construction, 14 planned and 30 proposed. These countries need power, and they want to diversify their power sources as they build capacity so that they don't end up reliant on a single commodity.

In addition, the nuclear industry's safety record is actually pretty good. Fukushima is only the third serious accident in more than 65 years of nuclear power. No one died at Three Mile Island, and no one has died from radiation effects at Fukushima, though five people died in the hydrogen explosions and in a crane accident. Chernobyl was certainly deadly, but it was human error, not a fault in the system, that was to blame there.

By contrast, thousands of people lose their lives every year in the fossil fuel industry, in coal mine accidents, oil rig explosions, drilling mishaps, pipeline blasts, refinery fires and tanker accidents, not to mention from the raft of illnesses caused by smog and soot.

Power generation is about balancing needs with impacts. Every major power source has drawbacks, but the developing world in particular needs more electricity. In that context, nuclear power is still a necessity - nuclear plants can provide low-emission, reliable, baseload power, precisely the kind that the world needs.

Uranium was a solidly bullish market on March 10, for good reasons that haven't changed. Even though Fukushima was scary and has illuminated the need for better nuclear power regulations, ultimately it won't derail an industry that is poised for major growth.

We’re running out of oil, fast – and a “triple threat” makes dealing with that fact more of a challenge than many Americans know. There are many ways savvy investors can profit from this situation, however. Learn how to be among them.

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.