Gold Hitting Record Highs: Time to Buy The Undervalued Gold Miners

Commodities / Gold & Silver Stocks Aug 20, 2011 - 05:14 AM GMTBy: Jeb_Handwerger

Uncertainty and fear are the mother's milk of the metal's market. Our pundits, politicians and professors have given us plenty of reasons to question whether these supposed savants are steering with a working compass. One day headlines proclaim, "Bernanke Ready To Do More If Needed". Then we later read that the Professor is playing down the possibility of additional quantitative easing due to internal dissent. This cold water is being doused on the markets after evoking these hopes.

Uncertainty and fear are the mother's milk of the metal's market. Our pundits, politicians and professors have given us plenty of reasons to question whether these supposed savants are steering with a working compass. One day headlines proclaim, "Bernanke Ready To Do More If Needed". Then we later read that the Professor is playing down the possibility of additional quantitative easing due to internal dissent. This cold water is being doused on the markets after evoking these hopes.

How can the bourses be anything but unsettled by such erratic behavior emanating from Washington's mavens and Europe's Pundits? An old blues song keeps playing in the subconscious-

"First You Say You Do and Then You Don't, Then You Say You Will and Then You Won't. You're Undecided Now, So What Are You Going To Do? Now you wanna play, and then it's no, And when you say you'll stay, that's when you go, You're undecided now So what are you gonna do? If you're kind, make up your mind You're undecided now...So what are you gonna do?"

Precious metals thrive on equivocation in high places. Ergo volatility and obfuscation. There are plenty of exogenous factors that are present in the market mix such as the debt ceiling, downgrades from the S&P, the persistent Euro-Zone travails and not to forget the constant rumblings from the Middle East cauldron. A sector of the world although presently unnoticed may soon resume its position on the global market stage. We intend to write more about this particular area as we expect it to exert a profound impact on the financial markets going into the second half of 2011.

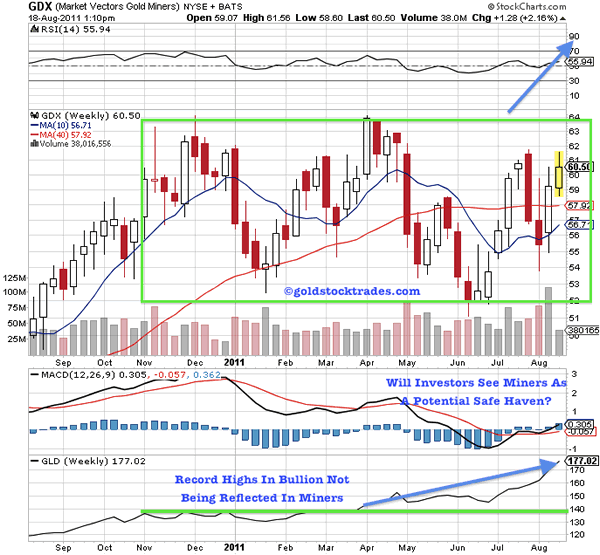

Gold Stock Trades has alerted its subscribers to the breakout in precious metals and critical pivot point of $52.50 on the Gold Miners(GDX). This move may encounter ebbs and flows on its way to its destined heights. Constant vigilance for possible entry points on the way up are advised. Let's look at the record. Our technical studies reveal an upward arc despite the diversions of day to day turbulence. Volume on the pullbacks are only merely above average. These volumes were significantly less than recorded by recent breakouts indicating institutions may be adding miners as a safe haven.

For many weeks $52.50 was our line in the sand. That has held and I would like to review this chart as a precaution to those who panic out at exactly the wrong times. Notice on the chart the weekly inverted hammer which occurred at that critical area, the second week of June. Weekly inverted hammers are common around bottoms of corrections as it indicates a large number of speculators who began shorting as GDX tested and made a fake breakdown penetrating momentarily 2011 lows.

At that time many were calling an end to the precious metals market and began shorting as it momentarily broke support. However, we saw a trap...many were caught. Short covering rallies morph into authentic breakouts as the long term trend followers return after the 200 day is regained on excellent volume. Some of the major miners such as Goldcorp (GG), Newmont (NEM) and Barrick(ABX) exhibit the powerful technical and fundamental characteristics of potential precious metal leaders.

The weekly long term downtrend in the U.S. dollar (UUP) is intact as it threatens reaching new lows. Through the first half of 2010, we were dealing with Euro Debt concerns and the run up last summer in the U.S. dollar showed it still maintained a safe haven status. Conversely in 2011, we have had a confluence of black swans globally especially with the Euro (FXE) and the U.S. dollar is not catching a bid and is still hovering around record lows.

We are seeing parabolic moves in gold (GLD) and silver (SLV) in 2011 as more investors realize the validity of precious metals as a safe haven. Soon investors will realize miners are sitting on assets increasing in value, which have not yet been reflected in their share price. Stay tuned to my daily bulletin for timely updates.

Disclosure: Long GLD,SLV,GDXRos

By Jeb Handwerger

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.