Do The Maths, Worlds Developed Nations are Insolvent

Economics / Global Debt Crisis Aug 22, 2011 - 03:52 AM GMTBy: Puru_Saxena

BIG PICTURE – Let’s face it; many of the world’s ‘developed’ nations are insolvent and the writing is on the wall. Either these indebted states will default or they will try and inflate their currencies into oblivion.

BIG PICTURE – Let’s face it; many of the world’s ‘developed’ nations are insolvent and the writing is on the wall. Either these indebted states will default or they will try and inflate their currencies into oblivion.

As far as the US is concerned, it still has the privilege of owning the world’s reserve currency and its central bank can always create more dollar bills out of thin air. Thus, it is unlikely that the US will ever default on its debt obligations.

Unfortunately, thanks to the brilliant invention of the single currency, the European states do not have the luxury of printing or debasing their currencies. Accordingly, their hands are tied and they are now at the mercy of their foreign friends. Make no mistake, the Greeks, Portuguese and the Italians simply do not have the choice of printing drachmas, escudos or lire. Therefore, unless their creditors accept some big haircuts on their loans, sovereign defaults are inevitable.

Politicians can lie all they want, but the truth is that the debt obligations of these European nations are simply too large relative to the size of their economies. In Greece, government debt now represents almost 160% of GDP and the average yield on Greek debt is around 15%. Thus, if Greece’s debt is rolled over without restructuring, its interest costs alone will amount to approximately 24% of GDP. In other words, if debt pardoning does not occur, nearly a quarter of Greece’s economic output will be gobbled up by interest repayments! Looking at this simple maths, it is obvious to us that unless the Germans or the French comes to its rescue, Greece will default within 2-3 years.

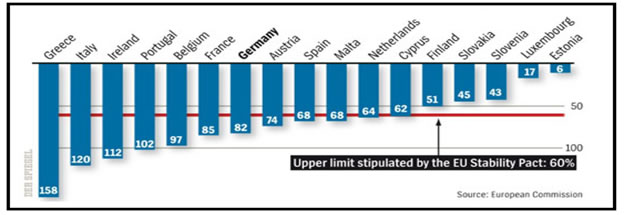

Figure 1 captures the sorry state of affairs in Europe and highlights the continent’s huge debt overhang. Topping this infamous list is Greece and as you can see, Italy, Ireland, Portugal and Belgium complete the top five slots. Moreover, it is interesting to note that only five member states have abided by the EU Stability Pact’s debt ceiling of 60%!

Figure 1: Euro countries - government debt to GDP ratio

Source: European Commission

In our view, Greece’s economy is small enough that the Germans and/or the French may pick up the tab. So, we are not especially concerned about an immediate sovereign default by Greece.

Unfortunately, the Italian economy is a whole lot bigger and its government debt comes in at a staggering Euro 1.9 trillion (US$2.7 trillion). At the time of writing, the 10-year Italian bond yield has jumped to 5.76% and if it continues to rise, elementary maths tells us that Italy will have a serious problem on its hands. It is noteworthy that the recent surge in Italy’s bond yields will increase borrowing costs, which the government estimates will total Euro 75 billion this year or nearly 5% of GDP. According to our estimates, if the average interest rate on Italy’s debt rises to 6% by 2014, annual financing costs will jump to Euro 110 billion or almost 7.5% of GDP. Given the sheer size of the sums involved, it is highly unlikely that the German and/or the French citizens will allow their governments to pick up Italy’s tab. Thus, it is our contention that Italy will ultimately prove to be a bigger nightmare than Greece. Nonetheless, we suspect that any sovereign default will not occur anytime soon. Instead, some of the troubled European states will default towards the end of the next big bear market, which seems to be several months away.

Across the pond, the government debt in the world’s largest economy has climbed to US$14.34 trillion (Figure 2) and equates to almost 96% of GDP!

Figure 2: Houston, we have a problem!

Source: www.thechartstore.com

At present, most of this debt is of the short-term variety and thanks to record-low interest rates, it is being financed cheaply. Therefore, with artificially suppressed short-term rates, financing the US debt is not a problem just yet. However, if inflationary expectations rise and rates appreciate significantly, this debt will have to be refinanced at higher and higher yields. When that happens, the average weighted cost of capital will rise, pushing up borrowing costs to intolerable levels. At that point, a much greater chunk of America’s future output will be used up for interest repayments, thereby exerting additional pressure on the economy.

When the interest payments on US debt become painfully high, Mr. Bernanke will be called upon to unleash the hyperinflation genie. If our assessment is correct, before Mr. Bernanke really unleashes the money creation machine (yes, we have not seen anything yet), the US government will probably dramatically lengthen the maturity of its debt. By fixing its own long-term borrowing costs in advance of the great inflation, the US government will escape the wrath of surging market interest rates.

Look. Whichever way you cut it, the maths simply does not add up. Given the massive debt pile and sluggish economies of the developed world, it is obvious to us that debt restructuring is the only viable solution. If the West wants to avoid economic Armageddon and/or hyperinflation, debt pardoning must commence without further delay. The creditors and bondholders must accept their losses and take haircuts on their loans; otherwise, they will eventually be repaid in worthless money!

The trouble with debt restructuring is that it will wipe out banks’ equity and the contagion will cause many financial institutions to go bust. Furthermore, debt restructuring or defaults will trigger billions of dollars of payments on the credit default swaps which were also issued by the same banks! So, you can see why the banking elite (in conjunction with the politicians) are desperately trying to avoid the inevitable. The truth is that the banking elite do not want to take the losses and they would rather shove more debt down the throat of the troubled states. After all, they print the currencies, so handing out a new loan is not a problem. What they do not want to see is debtors walking away from their obligations, because such a scenario will expose the banks’ insolvency. Figure 3 shows the exposure of the major European banks to the peripheral economies and as you can see, it is not a pretty sight!

Figure 3: European banks’ exposure to the Periphery (euros, millions)

Source: CEBS, Morgan Stanley

Now, we are aware that ‘austerity’ has become a fashionable word and many politicians are talking about cutting their budget deficits. However, we are of the view that all this talk is political jawboning and nothing will be done to address the deep rooted structural problems. As long as governments do not have the power to issue their own currencies and this right lies with central banks, the world’s debt woes will not and cannot go away.

We are happy to note that we are not the only sceptics, even the economists at the Bank for International Settlements (BIS) agree that debt levels will continue to spiral out of control. Figure 4 from the BIS projects the slice of GDP each nation will have to fork out in the future for interest payments on federal debt. As you will note, the BIS is not optimistic and it expects that the interest payments for all these countries will surge as a percentage of GDP. In fact, the BIS believes that by 2040, interest payments in the UK will account for 27% of GDP and interest payments in the US will account for 23% of GDP! Whilst we agree that such long term forecasting cannot be accurate, we are convinced that the debt overhang will crush the economies of the developed world.

Figure 4: Projected interest payments as a percentage of GDP

Source: Bank for International Settlements

Bearing in mind the gigantic debt pile, large budget deficits and rising financing costs, it is not surprising that we remain pessimistic about the developed economies. In our opinion, the West is now well past its prime and the next decade will reveal many cracks in that society. Furthermore, although we are bearish about the US economy, we believe that the Federal Reserve’s ability to inflate will prevent an outright sovereign default. On the other hand, we are not so sanguine about Europe and believe that within the next few years, one or two weak member states may declare bankruptcy.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2011 Puru Saxena Limited. All rights reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.