Gold Rises 12% in August as Stocks Plunged

Commodities / Gold and Silver 2011 Sep 01, 2011 - 03:28 PM GMTBy: GoldCore

Review of Precious Metals, Equities, Commodities, Bonds and Currencies

Review of Precious Metals, Equities, Commodities, Bonds and Currencies

August was a very turbulent month for markets with equities falling sharply and commodities mixed on Eurozone and United States sovereign debt concerns and concerns about the health of the U.S. and global economy.

For many markets, Augusts’ savage sell-off has been the worst since the October following Lehman Brothers’ implosion and investors diversified into havens such as high credit government bonds and gold.

Gold again proved its safe haven status recording strong gains in the face of turbulent markets globally.

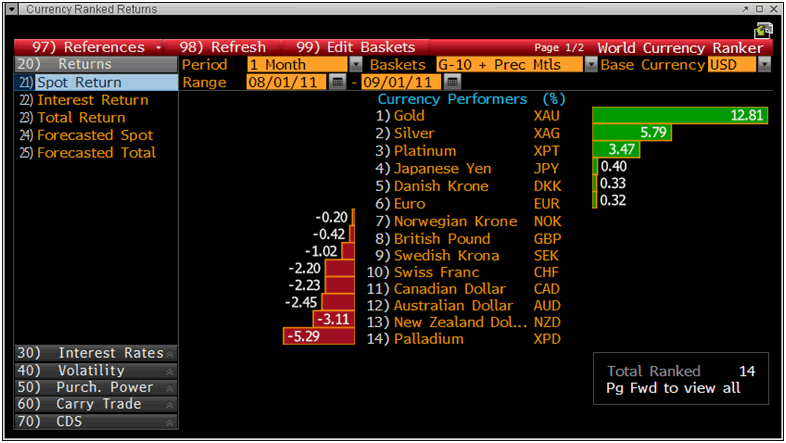

G10 Currencies and Precious Metals in US Dollars in August

Precious Metals

Gold’s London AM fix this morning was USD 1,815.50, EUR 1,270.73, GBP 1,118.95 per ounce. The gold fix was lower than yesterday’s AM Fix in dollars and pounds but higher in euros - USD 1,826.00, EUR 1,264.19, GBP 1,121.14 per ounce.

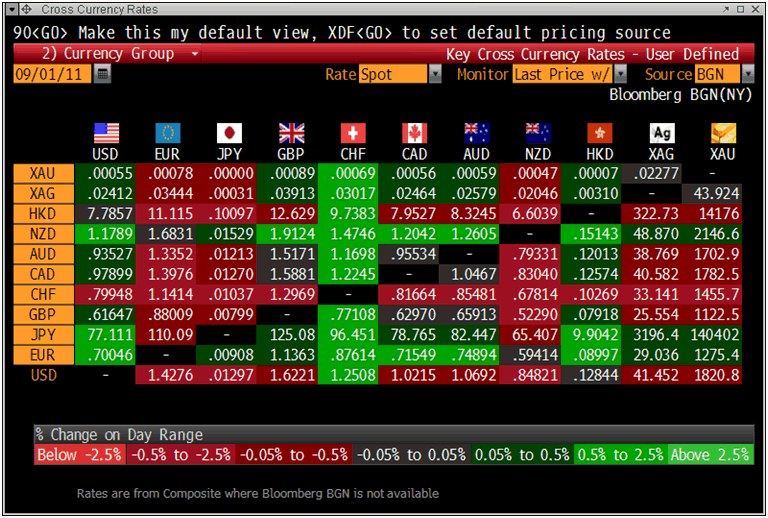

Gold is trading at USD 1,819.50, EUR 1,274.10 , GBP 1,121.30, CHF 1,455.50 and JPY 140,320 per ounce.

Silver is trading at USD 41.46, EUR 29.04 , GBP 25.56, CHF 33.16 and JPY 3,196 per ounce.

For the month, gold rose 12.8% in US dollar terms. Gold rose 12.1%, 13.0%, 12.2% and 14.6% in euros, British pounds, Japanese yen and in Swiss franc respectively.

For the month, silver rose 5.5% in US dollar terms and by similar amounts in other currencies.

Precious Metals in US Dollars in August

Equities

The MSCI All-Country World Index of stocks fell 7% as did the FTSE All World Stock Index.

In the U.S., the Dow Jones Industrial Average dropped 4.4% in August, its fourth consecutive month of declines. For the month, the broader S&P 500 fell 5.7%, also its fourth straight monthly loss.

In Europe, the benchmark Stoxx 600 fell 11%. The FTSE fell 7.4% and the Dax plunged over 20% (the ISEQ fell 8.6%).

In Asia, the MSCI Asia Pacific Index fell 9.8% in August. The Nikkei 225 (NKY) fell 8.9 percent in August. There was a dramatic rise in the level of concern about the U.S. economy resulting in falls of 2.9% for the Australian index to 11.9% for the South Korean index.

The much smaller fall in the MSCI world index again showed the benefits of global diversification.

Commodities

Commodities saw a very mixed performance.

The Standard & Poor’s GSCI Total Return Index of commodities lost 1.8%.

Crude oil on the NYMEX fell 7.2% on US and global growth concerns. Copper fell 6.1% for similar reasons.

Economically sensitive nickel and zinc on the London Metal Exchange led the monthly declines on concern demand may weaken, declining 11% and 8% respectively.

Coffee was the biggest gainer in August, advancing 20%, the most since June 2010. Wheat advanced 11% as dry weather damaged the U.S. crop. Corn rallied 15% as the U.S. Department of Agriculture cut its estimate for the country’s crop, the worlds biggest.

Bonds

U.S. Treasuries returned 2.8% while the global bond market gained 1.99% according to Bank of America Merrill Lynch index data.

German bunds also gained and the German bund yield fell more than 30 basis points over the month to yield 2.23%.

Periphery European nations bonds also saw gains after panic selling earlier in the month saw euro era record high interest rates.

Ireland’s 10-year yields declined 2.23% in August amid speculation that the nation may be able to grow its way out of its massive debt burden.

However, it is too early to tell whether the gains in the so called PIIGS debt markets are sustainable. The real risk is that the ECB intervention and bond buying programme may have merely bought more time and may ultimately lead to contagion in the Eurozone.

Currencies

The euro, the Danish krone, Japanese yen, Norwegian krone and the US dollar were the top performing G10 currencies in August (see ‘G10 Currencies and Precious Metals in US Dollars in August’ table above).

The worst performing currencies were the New Zealand dollar, Australian dollar, Canadian dollar and Swiss franc.

Cross Currency Table

All fiat currencies fell against gold and silver as global currency debasement continues.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $41.60/oz, €29.13/oz and £25.68/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,842.50/oz, palladium at $770/oz and rhodium at $1,800/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.