Gold and Silver Stocks Maintain Long-Term Support

Commodities / Gold & Silver Stocks Sep 23, 2011 - 06:39 AM GMTBy: Jordan_Roy_Byrne

Now that we are past the Fed circus we can get back to reality. But what is reality? Is it inflation? Deflation? A repeat of 2008? What matters is the message of the markets and the correct interpretation of the message. With regards to the mining stocks we are seeing a stark contrast relative to the rest of the stock market. This positive divergence has been strengthening and remains well intact despite Thursday’s sudden Fed-induced selloff.

Now that we are past the Fed circus we can get back to reality. But what is reality? Is it inflation? Deflation? A repeat of 2008? What matters is the message of the markets and the correct interpretation of the message. With regards to the mining stocks we are seeing a stark contrast relative to the rest of the stock market. This positive divergence has been strengthening and remains well intact despite Thursday’s sudden Fed-induced selloff.

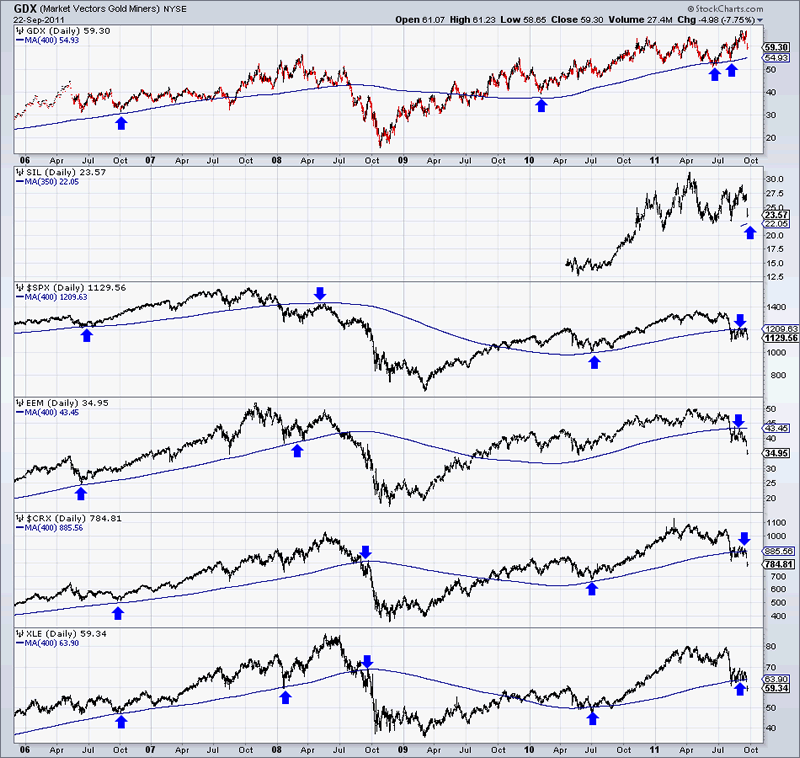

In the chart below we graph GDX (gold stocks) and SIL (silver stocks) at the top followed by the S&P 500, EEM (emerging markets), CRX (commodity stocks) and XLE (energy stocks). In each graph (but SIL) we show the 400-day moving average. The 50 and 200 day moving averages are important but in my opinion the 400-day moving average is the most important when dealing with the primary trend.

The 400-day moving average has been significant for each market as it easily distinguishes between bull and bear markets. Each market, with the exception of the precious metals stocks has broken its 400-day moving average. Equities, emerging market equities and commodity stocks are now in a cyclical bear market. This doesn’t mean these markets will fall another 20%. I think they’ve seen most of their downside. The key point is that these markets won’t make a new high anytime soon and will likely remain in a trading range over the next 12 months.

Meanwhile, despite Thursday’s drubbing, the gold and silver equities remain healthy from a long-term technical perspective. GDX would have to fall another 10% to test its 400-day moving average. SIL doesn’t have 400 days of history but its holding 6% above its 350-day moving average. Back in the summer of 2008, the mining stocks plunged through support alongside commodity stocks and emerging market stocks. Today we continue to see an entirely different picture.

The gold and silver stocks are right where they need to be, holding up well amid a summer swoon that likely ends next month. There may be some more downside for these shares but don’t expect a penetration of long-term support. These stocks have held up well for fundamental reasons. Metals prices are up significantly on all time frames while cost pressures are abating. That is a recipe for higher profits and higher share prices. As we near 2012, a peak in bonds and bottom in equities will send money flowing into the gold and silver stocks.

If you’d be interested in professional guidance then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Chad

23 Sep 11, 16:31 |

Silver

The COMEX spot price will become irrelevent as no one will sell at their ridiculously low "Spot" prices http://www.moneyteachers.org/October+Silver+Futures.htm |