Fed Officials Voice Dissenting Opinions Again

Interest-Rates / US Interest Rates Sep 30, 2011 - 05:05 AM GMTBy: Asha_Bangalore

Chairman Bernanke highlighted the gravity of the unemployment problem in the Q&A session in his speech after markets closed yesterday.

Chairman Bernanke highlighted the gravity of the unemployment problem in the Q&A session in his speech after markets closed yesterday.

“This unemployment situation we have, the jobs situation, is really a national crisis,” We’ve had close to 10 percent unemployment now for a number of years and, of the people who are unemployed, about 45 percent have been unemployed for six months or more. This is unheard of.”

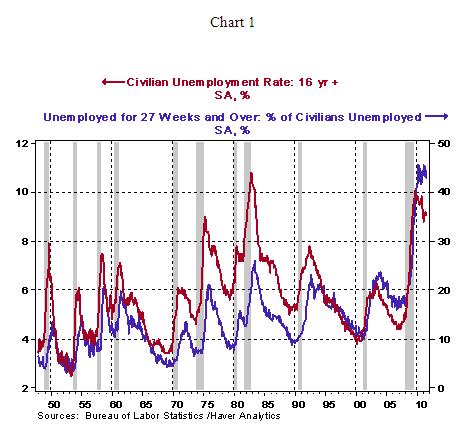

As Chart 1 indicates, the combination of high unemployment and a large percentage of them unemployed for an extended is a new occurrence in the post-war period. Around 43% were unemployed for over 27 weeks in August 2011 vs. about 25% during the 1981-82 recession (the jobless rate peaked at 10.8%).

This is Bernanke’s first speech after the FOMC policy action referred to as “Operation Twist” was announced on September 21. The Fed indicated it would purchase $400 billion of long-term Treasury securities to replace short-term securities of the same value and hold its balance sheet size unchanged. The Fed also announced plans to purchase expiring and pre-paid mortgage back securities. Fed Presidents Rosengren and Lockhart of Boston and Atlanta, respectively, have spoken in favor of this program this week. Bernanke also noted that there is room for other policy options to address the woes of the U.S. economy. Rosengren and Lockhart are both non-voting members of the FOMC.

“Monetary policy is not a panacea,” Bernanke said. “There are certainly some areas where other policy makers could contribute,” and “strong housing policies to help the housing markets recover would certainly be useful.”

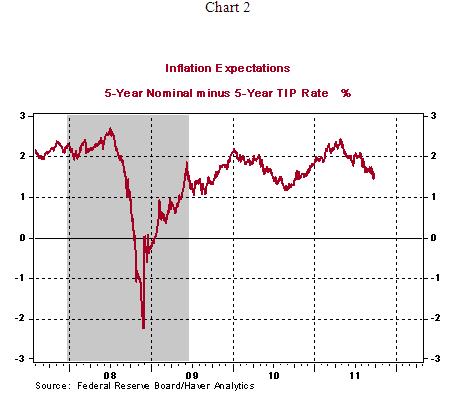

The threat of deflation also featured in the Bernanke’s Q&A session. He noted that the Fed would need to act if inflation or inflation expectations fall too low. Inflation expectations, as measured by the difference between the 5-year Treasury note yield and 5-year TIP, have dropped to 157 bps from a high of 255 bps as of May 2011 (see Chart 2), but actual inflation stood at 3.8% in August, while core consumer prices, which exclude food and energy, show a 2.0% year-to-year gain. Given projections of weak economic conditions, inflation readings are predicted to show a moderating trend.

However, there are different views within the Fed. Fed Presidents Plosser and Fisher of Philadephia and Dallas, respectively, voiced their serious reservations about the recent policy action. Plosser warned that the Fed’s extraordinarily easy policies would lead to an inflationary situation in the months ahead, even with high inflation. He noted that a deflationary threat or a severe European debt crisis leading to financial market meltdown would persuade him that further easing would be necessary. Fisher is also concerned about the inflationary potential of Fed’s position and holds the opinion that costs of Operation Twist outweigh its benefits. Both these them cast dissenting in the August and September FOMC meetings. Summing up, current economic evidence offers strong support to Bernanke and members of the Fed who are focused on the elevated unemployment rate.

Asha Bangalore — Senior Vice President and Economisthttp://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.