Gold Strength Expected as Global Fiat Financial System Continues to Deteriorate

Commodities / Gold & Silver Dec 17, 2007 - 09:25 AM GMTBy: Gold_Investments

Gold was down $5.50 to $793.10 per ounce in New York Friday and silver was down 28 cents to $13.81 per ounce. Gold opened strongly in Asia but has since sold off and the London AM Fix was at $787.00. At the London AM Fix gold was trading at £391.38 GBP (marginally down from Friday's London AM Fix at £392.18) and €549.08 EUR (up from Friday's London AM Fix at €547.18). Thus while gold has sold off in dollars, it has remained flat in sterling and actually increased in euros.

Gold was down $5.50 to $793.10 per ounce in New York Friday and silver was down 28 cents to $13.81 per ounce. Gold opened strongly in Asia but has since sold off and the London AM Fix was at $787.00. At the London AM Fix gold was trading at £391.38 GBP (marginally down from Friday's London AM Fix at £392.18) and €549.08 EUR (up from Friday's London AM Fix at €547.18). Thus while gold has sold off in dollars, it has remained flat in sterling and actually increased in euros.

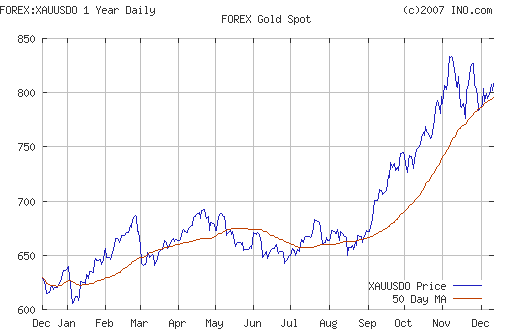

We continue to belief that any sell off will be short as it has been since 2000. Gold will likely end 2007 above $800 per ounce before making new record highs early in 2008. This is especially the case given the continuing deterioration of the global financial and monetary system (as outlined below). There is support at $776 and strong support at $750.

The global macroeconomic climate continues to deteriorate. One of Britain's leading economists has warned of an economy that could "make 1929 look like a walk in the park."

Peter Spencer of the Ernst & Young Item Club, is calling for a suspension of the Basel banking rules that influence financial systems worldwide. The Basel rules are adding to the current financial crisis, said Peter Spencer, who warned of an economy that could "make 1929 look like a walk in the park" if the rules are not relaxed, Britain's Telegraph reported Saturday. The Basel rules determine how much capital banks must raise to keep their accounts in order. Under the rules, banks forced to take off-balance sheet assets from troubled investment vehicles onto their books must raise cash from overseas or cut back dramatically on their spending, Spencer said. Having just those two options is freezing money markets and deepening the credit crisis, Spencer said, recommending the Basel capital requirement level be cut from 8 percent to 6 percent, the Telegraph reported.

He warned that, if London's money markets remained frozen and the authorities retain the strict Basel regulations, the full scale of the eventual credit crunch and economic slump could be "disastrous". Capital requirements are the only control on financial institutions and banks have and eliminating them would be a drastic action which could ultimately lead to greater financial problems. This is another short term panacea at best.

Gordon Brown's selling off of the UK's gold reserves at the bottom of the market was strongly criticised by ex UK Prime Minister John Major on BBC at the weekend. He said that Gordon Brown's decision to sell much of Britain's gold reserves in 1999 had lost the economy billions of pounds. Major warned of bleak economic times ahead, adding: "It's beginning to unravel in quite a serious way. The economy is running into serious difficulty."

A virulent strain of stagflation looks set to hit many western economies as economic growth slows down in a very inflationary environment. The FT reports that a second wave of food price inflation is set to hit the world's leading economies as new agricultural benchmark prices are reset today at much higher levels. In Chicago, wheat and rice prices for delivery in March 2008 have jumped to an all-time record, soyabean prices have surged to a 34-year high and corn prices have hit a 11-year peak. As these record levels become the benchmark for the food industry today, knock-on price rises are set to hit consumers in coming months, raising inflationary pressure and constraining the ability of central banks to mitigate the economic slowdown. A first wave of surging cereals prices that hit the wholesale market during the summer has now fed through the supply chain and contributed to rising inflation.

Cereals supply was this season lower than expected as several major countries suffered weather-related losses. Global warming was cited as a factor. Jean Bourlot, head of agriculture commodities at Morgan Stanley in London, said: "High cereals prices are here to stay." High food and commodity prices are here to stay unless there is a serious deflationary 1930's style crash. Serious stagflation looks more likely at present. Stagflation is very bullish for gold. Delfation is also bullish for gold as it was in the 1930's when the US revalued gold from the fixed $22 per ounce to $35 per ounce or by some 60%.

Silver

Silver is trading at $13.75/80 at 1200 GMT after yesterday's sharp sell off.

PGMs

Platinum was trading at $1472/1476 (1200 GMT).

Spot palladium was trading at $348/354 an ounce (1200 GMT).

Oil

Oil remains at elevated levels above $90 per barrel and was trading at over $93 a barrel.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.