Wholesale Credit Creation Benefits Gold

Commodities / Gold & Silver Dec 19, 2007 - 09:34 AM GMTBy: Gold_Investments

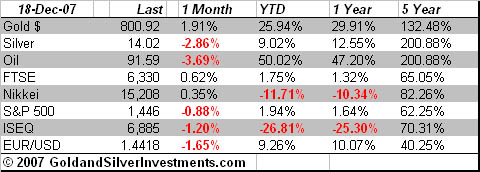

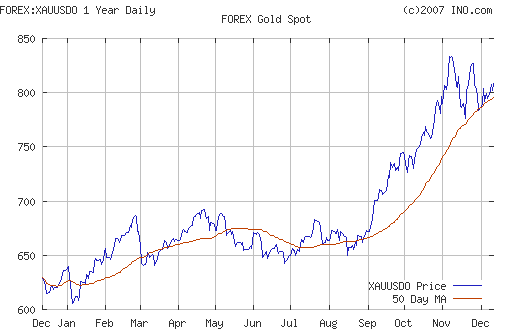

Gold was up $8.40 to $802.90 per ounce in New York yesterday and silver was up 22 cents to $14.03 per ounce. Gold traded sideways in Asia and Europe and the London AM Fix was at $801.50 (up from $796.25).

At the London AM Fix gold was trading at £399.352 GBP (marginally up from yesterday's London AM Fix at £395.67) and €556.83 EUR (up from yesterday's London AM Fix at €553.53 ). Gold has increased in sterling and in euros. The recent record highs for gold at the London AM Fix on the 7th of November were $841.75, £400.47 and €573.55. Gold is thus very close to surpassing it's all time record high in british pounds at £400.47.

The dollar has rallied probably primarily on year end short covering and this may have curtailed gold's gallop in the short term. Most of today's key releases are now out of the way and there is little in the way of top-tier economic data for the rest of the day. Later today Treasury Secretary Paulson and Richmond Fed President Lacker are both out speaking on the economy.

Controversial politician Jacob Zuma is expected to be named president of the ruling African National Congress, which would make him the automatic choice to become South Africa's president in 2009. Zuma enjoys huge support from communists and unions, and investors fear he may lead South Africa's economy on a more left-leaning course. Some of his supporters support nationalisation of key industries. This is will likely lead to extra support in the gold and platinum markets. Resource nationalism is alive in Russia, sweeping South America and now in Africa.

The end of year Christmas period is traditionally a strong period for gold. When western markets are closed, Middle Eastern and Asian markets take precedence and this physical buying can result in higher prices.

This is especially the case as western central banks are opening the money taps at full blast in an effort to head off a liquidity and possible solvency crisis. The European Central Bank today allocated more than $500 billion in euros to banks at below-market interest rates. Banks with sufficient collateral submitted bids at interest rates as low as 4.2 percent. The FT said that the action has stunned investors. Analysts fear banks are hoarding funds because they fear further big credit losses next year. Banks still face considerable difficulties as a result of the global credit squeeze. The US Federal Reserve will on Wednesday publish the results of an exceptional $20bn auction it performed on Monday to inject funding into the US financial system.

Martin Wolf wrote an article in the FT 'The helicopters start to drop money': "The central bank helicopters are planning a co-ordinated drop of liquidity on troubled market waters. The money to be dropped now is not that large. But if this does not work, more will surely follow. The helicopters will fly again and again and again." This is Federal Reserve Chairman's Alan Greenspan's phrase 'fiat money in extremis'. In 1999 Greenspan told US Congress that "Gold still represents the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted."

Wholesale massive credit creation is the order of the day and this monetary debasement can only be bullish for the universal finite currency that is gold. Gold will thus continue to rise in all major currencies and not just the dollar. Actually, it is mistaken to think that gold is rising in terms of various currencies. Rather these currencies are losing their value or purchasing power in relation to gold.

Silver

Silver is trading at $13.99/14.01 at 1200 GMT after yesterday's rally.

PGMs

Platinum was trading at $1505/1510 as per above (1200 GMT).

Spot palladium was trading at $352/356 an ounce (1200 GMT).

Oil

Oil remains at elevated levels above $90 per barrel and NYMEX light sweet crude oil was trading at over $90.16 a barrel.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.