Gold Remains in Tight Trading Range over Christmas Holidays

Commodities / Gold & Silver Dec 21, 2007 - 10:19 AM GMTBy: Gold_Investments

Gold was down $2.60 to $798.50 per ounce in New York yesterday but silver was up 14 cents to $14.21 per ounce. Gold traded sideways in Asia and ticked up in Europe and the London AM Fix was at $803 (up from $799.50). At the London AM Fix gold was trading at a new all time record in British pounds at £404.68 GBP (up from yesterday's London AM Fix at £401.62). Gold went up to €558.88 EUR (up from yesterday's London AM Fix at €557.30 ). Gold has again increased in sterling and in euros. Gold thus surpassed it's all time record high in british pounds with news of the horrendous current account deficit and deteriorating UK economy (see below). Gold will likely reach it's non inflation adjusted highs in euros and dollars early in the New Year.

Gold was down $2.60 to $798.50 per ounce in New York yesterday but silver was up 14 cents to $14.21 per ounce. Gold traded sideways in Asia and ticked up in Europe and the London AM Fix was at $803 (up from $799.50). At the London AM Fix gold was trading at a new all time record in British pounds at £404.68 GBP (up from yesterday's London AM Fix at £401.62). Gold went up to €558.88 EUR (up from yesterday's London AM Fix at €557.30 ). Gold has again increased in sterling and in euros. Gold thus surpassed it's all time record high in british pounds with news of the horrendous current account deficit and deteriorating UK economy (see below). Gold will likely reach it's non inflation adjusted highs in euros and dollars early in the New Year.

Gold remains in a tight trading range between $785 and $815 and the dollar's recent strength seems to have capped gold's gains. The trading range continues to narrow and gold is now in a pennant formation which normally presages a strong break out and move to the downside or upside. Gold is up some 25% year to date and with increasing inflation internationally and with the printing presses in full effect gold will likely again outperform other asset classes in 2008.

Markets will be looking to this afternoon's US releases for some direction going into the Christmas weekend with the personal income and expenditure report for November likely to top the agenda. It contains details of the Fed's preferred inflation measure, the core PCE, which will be even more closely watched in light of last week's surprisingly poor CPI data.

| 19-Dec-07 | Last |

1 Month |

YTD |

1 Year |

5 Year |

||

| Gold $ | 798.60 |

2.48% |

25.57% |

28.37% |

131.80% |

||

| Silver | 13.97 |

-1.41% |

8.63% |

10.41% |

199.78% |

||

| Oil | 90.19 |

-4.93% |

47.73% |

41.96% |

195.12% |

||

| FTSE | 6,261 |

2.28% |

0.64% |

0.91% |

63.39% |

||

| Nikkei | 15,031 |

-0.08% |

-12.74% |

-10.41% |

79.20% |

||

| S&P 500 | 1,455 |

1.51% |

2.58% |

2.06% |

64.54% |

||

| ISEQ | 6,829 |

0.89% |

-27.41% |

-25.87% |

71.44% |

||

| EUR/USD | 1.4387 |

-1.91% |

9.03% |

8.96% |

40.15% |

||

| © 2007 GoldandSilverInvestments.com | |||||||

Gold Gains 2001-2007 |

|

| Year | Annual Return |

| 2001 | 2% |

| 2002 | 23% |

| 2003 | 21% |

| 2004 | 5% |

| 2005 | 20% |

| 2006 | 19% |

| 2007 (year-to-date) | 25% |

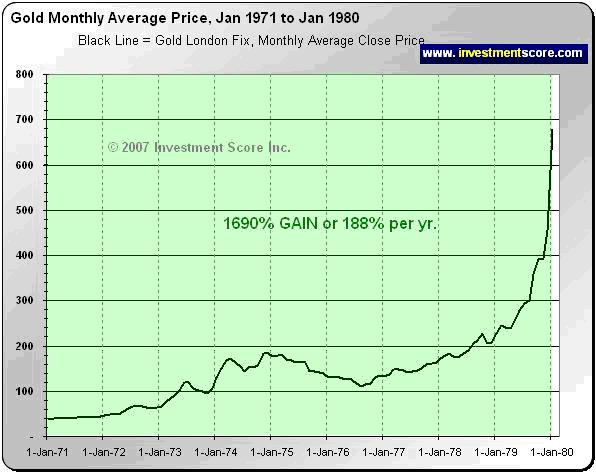

An illustration of how gold's returns so far are more than sustainable and an indication that we remain in the early stages of the bull market are seen when we compare gold's performance in the 1970's with gold's performance so far in the 2000's. Since 2001 gold is up some 196% whereas in the 1970's it was up some 3,000% from $35 to $850 (or some 1690% on a monthly basis as per below). This resulted in a monthly gain of some 188% per year in the 1970's. Interestingly, the NASDAQ returned some 2900% or 121% per annum from 1980 to 2000.

So far gold has only had gains of a more than sustainable below 20% per annum. Hardly the stuff of a speculative mania and a top in the price. Calling a top in gold is akin to calling a top in the NASDAQ in 1987 some 13 years prior to the actual blow off top in the NASDAQ. Gold remains a 'fringe' investment and probably less than 5% of investors have an exposure to gold and of them most of them would only have a small allocation of some 5% to 10%. Thus we remain in the early stages of a multi year bull market and gold will become fairly valued when it has reached it's inflation adjusted high of some $2,400 per ounce.

The FT reports that a wave of bad economic news hit the UK government on Thursday, a day after the prime minister and the chancellor insisted the economy was fundamentally strong and would “weather” global financial storms. The credit squeeze has contributed to the worst public finance deficit ever in the first eight months of the financial year and an annual drop in new mortgage lending. It has also choked off growth in money deposited in banks.

The biggest surprise was the Office for National Statistics' revelation that the current account deficit widened from a revised £13.7bn to a record £20bn in the third quarter, equivalent to 5.7 per cent of gross domestic product, giving Britain the unenviable record of the largest current account deficit in the group of seven leading countries.

The most worrying figure for the government is the sudden and deep deterioration in the public finances, caused in the main by a shortfall of tax revenues. Analysts said the data presented an “ugly picture” of an unbalanced economy that could be one of the most vulnerable in the G7 to the effects of the credit squeeze. “It is worrying to think the new chancellor has no room for manoeuvre and will have to tighten fiscal policy when the economy is in a tail spin,” said Peter Spencer, chief economic advisor to the Ernst & Young ITEM Club. Kevin Daly, of Goldman Sachs, said the figures made “bleak reading” and “are especially negative for sterling”. The pound fell against almost all other leading currencies. It was down 0.9 per cent on a trade-weighted index by the close.

Silver

Silver is trading at $14.28/14.30 at 1130 GMT.

PGMs

Platinum was trading at $1511/1516 as per above (1130 GMT).

The European Commission agreed this week to introduce fines on manufacturers that do not comply with new CO2 emission limits is bullish for the PGM prices in the coming years as it will lead to ain increase in demand for platinum and palladium.

Palladium was trading at $353/358 an ounce (1130 GMT).

Oil

Oil remains at elevated levels above $90 per barrel and NYMEX light sweet crude oil (FEB08) was trading at over $91.46 a barrel creating gold buying interest from investors looking to hedge against surging inflation.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.