Pop Go the Liquidity Bubbles

Stock-Markets / Financial Markets Dec 22, 2007 - 07:52 PM GMTBy: John_Mauldin

In this issue:

In this issue:

- Pop Go the Bubbles

- Lights for Myanmar, Water for Darfur

- A Half A Trillion Here and There

- Consumer Spending is Up? Wait, Is It Down?

- The Presidential Race

- Family, Christmas, and Home

Consumer spending was much stronger than thought in November, yet Circuit City Stores Inc., Best Buy Co. and other retailers that warned of a slump in purchases. A private report today showed consumer confidence slid to the lowest level in more than two years in December. The stock market chooses to see all things bullish, and so it powers ever upward. This week we take a brief look at the consumer, recent "shock and awe" central bank actions, money supply and more, trying to see how it all fits together.

But first, let's quickly turn our attention to a practical way we can help save the lives of those who are desperately suffering in Darfur and Myanmar. Over the years my readers have generously supported the work of a very special group of guys who help bring aid to places where it is the most difficult, if not dangerous, to reach.

Knightsbridge International is a small group of volunteers who go to places that are not safe but the needs for help is critical. Like the Knights of old, who ran hospitals and relief efforts, these modern day knights go to where the need is the greatest. They took food and medicine to northern Afghanistan before the troops went in (very dangerous!). They went to rebel held territory in Sri Lanka after the tsunami when no one else could get medicine and help in. Whether it's driving in to rescue nuns in Rwanda (fascinating story!), or taking solar power for clinics in Myanmar, Water Purification Units and medicine to Darfur, and a lot more, they go where other groups fear to tread. They have no political or religious agendas, just the drive to get aid to where it can do the most good.

Last year an award-wining documentary was made about three of the men, Ed Artis, Dr. Jim Laws and Walt Ratterman, which has been shown on PBS and viewed all over the world. These men are the real deal; heroes who like to do good deeds but get an adrenaline rush at the same time. Some of the things they do I cannot write about, as it would put them and others in serious danger. They are a little bit crazy, but then someone needs to be to get done what they do. But let me tell you about two projects that are public knowledge that they will be doing after the first of the year.

Everyone should know by now what a true world class disaster the genocide in Darfur is. There are literally thousands starving and dying each week. Knightsbridge is going to help in two ways. First, Ed is going to deliver two solar powered water purification plants each capable of purifying 30,000 gallons of water a day. Walt Ratterman, one of the world's leading experts on solar technology will go with Ed to train those who will use the systems. The key, quite bluntly, is getting the plants in and across the desert to the Darfur region. Ed is very good at getting critical items to where they need to be in very difficult if not dangerous conditions. The stories he can tell.

At the same time, Dr. Jim Laws, a cardiologist and others will be going into Chad to work in refugee camps there; bringing medicine and medical help to a very desperate situation. They will be going there several times over the year.

Readers of my letter may be familiar with Walt Ratterman. I have mentioned his work in Thailand where he goes to refugee camps (mostly the minority Christian Karin tribe) along the Burma border, bringing solar power to clinics there. As one doctor said, it is hard to do an amputation by flashlight. They are now bringing in more powerful units capable of providing enough power for small medical devices, vaccine refrigeration, with power outlets that will allow them to operate a laboratory, a computer, and a surgical room that will accommodate minor surgery and cataract eye surgery. These systems are carried on foot into Myanmar for the Internally Displaced People camps where the "hospitals" can now do little more than first aid. These units are truly life savers.

Walt will go to Thailand several times this year. Besides solar power, he takes drugs and equipment specifically requested by the local doctors.

No one in Knightsbridge gets a salary. There is no office. Everyone pays his own way. 100% of the money donated goes directly to the cause. Over the years, my readers have donated more than $100,000 to help in the worst disaster spots of the world. Some readers, like Walt, decide to become part of the team.

I am going to give you a few links below. You can donate by check or credit card. The address is: Knightsbridge International, Post Office Box 4394, West Hills, California 91308-4394. If you write a check, please note on the check whether the money is being donated for Water for Darfur or Solar for Myanmar or split between both.

The Knightsbridge Web site is www.kbi.org . It is being changed as I write to update some of the more recent missions, but the link to donate by credit cards works just fine. Use that if you want to donate to the Myanmar project. If you want to donate by credit card to Darfur, you can go to http://www.onedollar4darfur .com/index.html , which is a web site run by two ladies in Los Angeles who work to raise money for Knightsbridge for their specific Darfur projects. There is a lot of good information on the site, and a trailer for the film Beyond the Call at the bottom of the home page.

You can also read about and see a TV spot on CBS at the following link: http://www.cbsnews.com/stories /2007/04/10/earlyshow/main26667 59.shtml

This segment will also be re-broadcast on January 1st 2008 during the 8:30 half hour on The CBS Early Show.

I know these guys personally and have spent a great deal of time with them. They have my full 120% endorsement. I am told all the time that I should charge for this letter. So, instead of paying for the letter, why don't you make a donation? If 10,000 readers sent $100 or $1,000, it would make a huge difference in the lives of desperate men, women and children. Please consider helping people who have so little. And for some of you more adventurous types, maybe even think about going.

A Half A Trillion Here and There One certainly cannot complain that central banks are being too tight with credit. The European Central Bank auctioned off $500 billion in credit facilities this week, in part to cover over what everyone hopes is just a temporary year end credit crunch. That is a staggering amount of money. It makes the money the US Federal Reserve bank is putting to work seem small by comparison. They did their second $20 billion auction, and told us that when they said they would do four of the auctions, what they really meant to say that they would do as many as necessary.

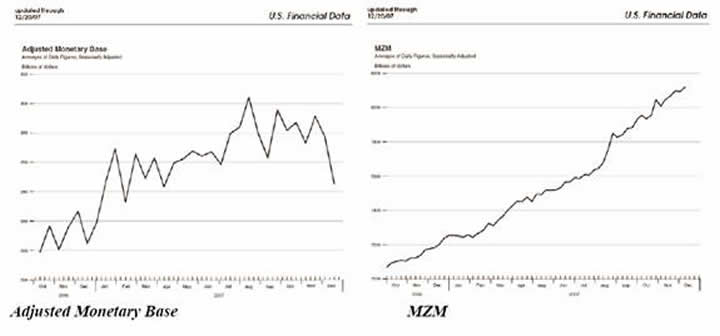

But is it having the desired result? That depends upon which set of data that you look at. Let's look at the monetary supply from the St. Louis Fed (courtesy of Bill King). MZM is the measure of the liquid money supply within an economy. Note that it has been rising rapidly of late. But the adjusted monetary base (AMB), which is basically cash plus bank deposits at the Fed which can be turned into cash, is down over the year. MZM might suggest inflation, but the AMB is suggesting the opposite. There is a major disconnect here.

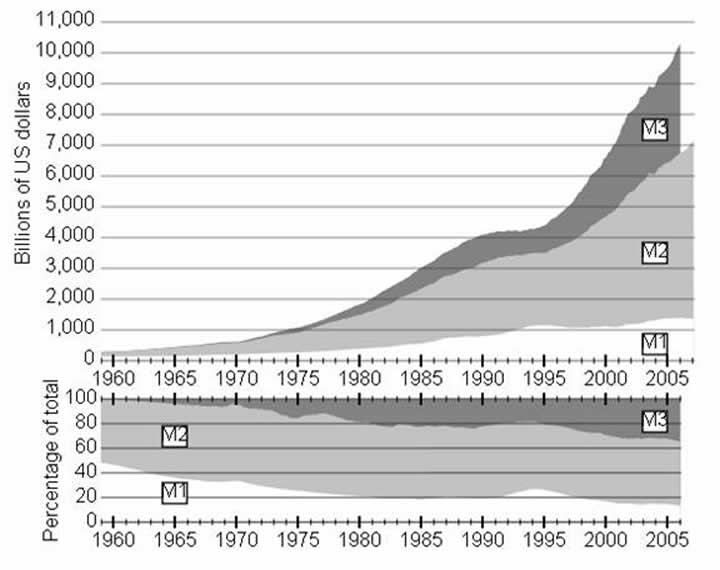

Now look at the chart below. It shows the growth of the various money supply categories. Notice that M3, which the Fed no longer publishes, was rising rapidly through last year. Also notice that M3 is a growing part of the overall money supply. Basically, to get M3, you add Eurodollars, repurchase agreements, CDs to M2. M2 is cash in the banks, savings accounts, money market accounts, etc. What this tells us is that Eurodollars and repos are driving the growth in the money supply.

Can we come to any firm conclusion? Not yet, because the data is still working its way through the system. But the massive actions the central banks are taking plus the growth of the money supply while actual cash is shrinking is a worrisome development. This will be watching.

Consumer Spending is Up? Wait, Is It Down? Consumer spending in November was very strong, the largest rise in two years. So why would Bill Gross of Pimco suggest that the economy probably slipped into recession this month? Because weekly surveys suggest the November spending boom may not be sustained. Holiday sales declined in the seven days ended Dec. 15 for the third straight week, according to ShopperTrak RCT Corp. This year's holiday season may be the weakest since 2002, according to the National Retail Federation. And we were coming off a recession. (Bloomberg)

That would be consistent with a recently published report by Merrill Lynch Chief Economist David Rosenberg suggesting a 100% probability of a recession. Reading from his latest writing:

"We recently unveiled a new recession probability indicator that uses the shape of the yield curve (10-year note/3-month LIBOR) and corporate spreads (Baa) to predict the probability of a recession within the next 12 months. (The model is based on a recent Fed paper, which used the 10/2-year yield curve and Aa spreads.) The results are striking: taking into account corporate spreads, the model is flashing a 100% chance of a recession in the next year, up from 75% in October and essentially zero in the summer. Looking at history, the model did a pretty good job predicting the 1990-91 and 2001 recessions. In December 1989, recession odds jumped to 95%, and by August 1990 an official recession had set in. Similarly, the model was showing 100% recession odds in October 2000; by September 2001, the economy was in an official downturn."

As noted at the beginning, many retailers are telling us that traffic and sales have slowed in December. Consumer confidence numbers which came out today is at the lowest level since 2005, and is continuing to slide.

To repeat a pointy from last week: we are in the midst of the bursting of two major bubbles. Housing is the obvious one, but the second and potentially more worrisome is the credit bubble. Central banks simply do not react the way we are seeing unless they perceive there is a real crisis.

The Presidential Race I keep getting asked about my views on the presidential race and who I am supporting. Full disclosure here: I was on the state executive committee for the Texas Republican Party for years, and was very active during the 80s and 90s. I have met a lot of politicians and worked in a lot of campaigns over the years. Since voting for McGovern in 1972 (I was young and wrong!), I cannot think of a time for almost three decades when I did not have a favorite candidate for president going into an election year, although that candidate did not always win.

Until now. I simply have no idea who I will vote for in just a few months, and I know a lot of friends who are in the same camp. And frankly, if I was a Democrat, I would be confused as well. Undecided is the clear winner in every poll I see. I can see things I like about every candidate, but there is a "but" with every one.

I find the current political show interesting, but the current primary process is a bad one, with each state moving their primary up to the front in order to be "important." We will have nominees by the end of February, and then wait for ten months for the election in November. That is nuts. When this is over, someone needs to get the various state party leaders into a room and force them to rationalize the primary race. Front-loading the race the way it is now is a very bad way to elect the leader of the free world.

We should allow Iowa and New Hampshire to do their thing but not before the middle of February. Then 2-3 states a few weeks later as decided by a one time lottery, and then allow for 10 states at a time to hold their primaries on a Tuesday. The order would be decided by lottery and would rotate with each presidential cycle, so that every state would get their chance to be in the spotlight at some point.

As an aside, I can see a small, but very clear way that the Republican party could end up without a clear winner and the selection goes to the convention floor. I was a delegate to the 1996 National Convention, and it was fun, but it is largely ceremony as everything is scripted. An old-fashioned convention that might actually choose a candidate? Now THAT would be high drama and real excitement.

Family, Christmas, and Home All the seven kids will be in for Christmas, with four of them bringing friends or spouses. No grandkids yet, but that is probably a matter of time. Dad will be doing the cooking again, more or less the same menu as Thanksgiving. Hopefully we can avoid a fire in the building and having to carry my mother down 21 flights again.

As usual, I have procrastinated and have not yet done my Christmas shopping, so tomorrow I get to add my efforts to boost consumer spending. Given the size of my list, that should help.

This will be the last letter of the year. The next letter will be the first week of January and will be my annual predictions letter, where I prove my lack of wisdom and actually make predictions in writing. I spend more time on this letter than I do on any other letter during the year. I spend a great deal of the time over the holidays researching and thinking about this letter.

It has been a very interesting year. In spite of the volatility of the markets, most of the managers and funds we work with have done well. My business is growing quite well, the e-letter readership is growing nicely, and I am simply having a lot of fun.

Let me sincerely thank each of you for allowing me to come into your life. And to my partners and business associates, thank you for making it possible for me to research and write this letter while you work directly with our clients and managers. I am grateful.

Let me close this year by wishing you a very Merry Christmas and a Happy, Healthy, Prosperous New Year. And May God Bless Us, Everyone.

Your ready for some family time analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2007 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.