European Banking Exposure to Bankrupt PIIGS Will Weigh on Financial Markets 2012

Stock-Markets / Financial Markets 2012 Nov 26, 2011 - 11:41 AM GMTBy: Capital3X

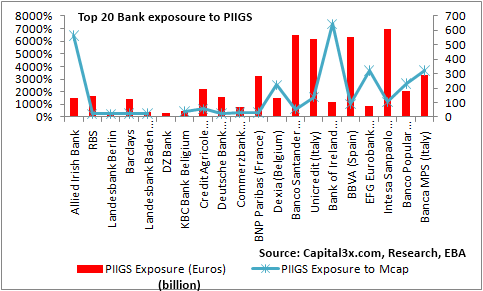

We took a list of the largest European banks by assets and compared their market cap, common equity, and total exposure to PIIGS debt (thank you for the bank statistics, EBA!). Then we calculated exposure to PIIGS debt (sovereign and private) as a percentage of the banks’ common equity.

We took a list of the largest European banks by assets and compared their market cap, common equity, and total exposure to PIIGS debt (thank you for the bank statistics, EBA!). Then we calculated exposure to PIIGS debt (sovereign and private) as a percentage of the banks’ common equity.

In terms of Banks, the Bank of Ireland, already having access to ECB credit line has the maximum exposure to PIIGS sovereign bonds with a 102.4 bn euros exposure with a mere 1.39 bn market cap and 7.4 bn shareholder equity. If not for a bailout, Irish banks should have eaten dust by now.

Bank PIIGS exposure wrt to Market Cap

Unicredit (Italy), Bank of Ireland (Ireland), BBVA (Spain), EFG Eurobank Ergasias (Greece), Intesa Sanpaolo Group (Italy), Banco Popular Español (Spain), Banca MPS (Italy) and Dexia (Beligum) are leading the way in leverage in terms of market cap. Clearly there is a lot more for the price to fall if leverage in terms of market cap has to be in greater rational order.

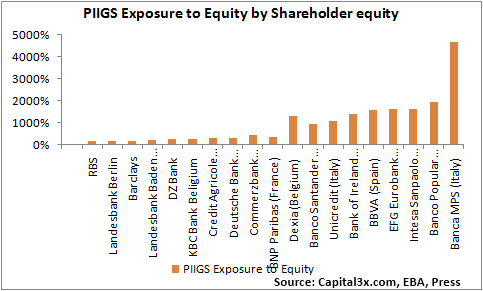

TOP 20 bank PIIGS bond exposure wrt shareholder Equity

The sheer weight of the leverage can be analysed when you consider that for each shareholder dollar, the bank has leveraged it over 10 times to take on assets which are clearly depreciated over the years and this resulting in massive holes on the balance sheet. Dexia and Unicredit has already seen their spreads widen. Unicredit has already announced a massive 10 bn euro writedown which we believe is only the beginning in a series of writedowns to happen over the next 12 months. Intesa Sanpaolo Group (Italy), Banco Popular Español (Spain) and Banca MPS (Italy) are all very ripe for picking up on the short side with exposure to PIIGS rising over 1000% over the shareholder equity.

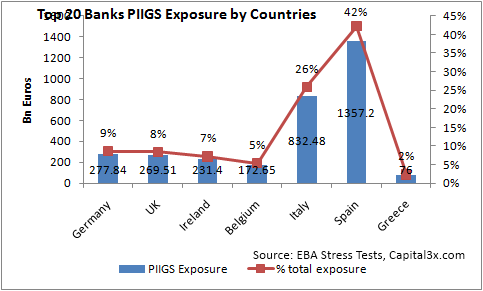

PIIGS exposure by country

Spain has the maximum PIIGS sovereign bond exposure and nearly accounts for 42% of the 3.2 trillion euros held by the top 20 banks. Banco Popular Español (Spain) and Banco Santander (Spain) are two main banks holding the baton in case there is a write down which looks increasingly possible.

We continue to believe that the series of write down to begin Q1 2012 will keep risk on its toes and expect at a 20% correction in risk assets in the first half of 2012.

We continue to watch the price action and will update our premium subscribers with new analysis and charts. Our trade portfolio (Forex, SPX Emini, Crude, Gold, Silver) is visible to our premium subscribers

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2011 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.