Gold, Eurodollars, and the Black Swan That Will Devour the US Futures and Derivatives Markets

Stock-Markets / Financial Markets 2011 Dec 04, 2011 - 10:24 AM GMTBy: Jesse

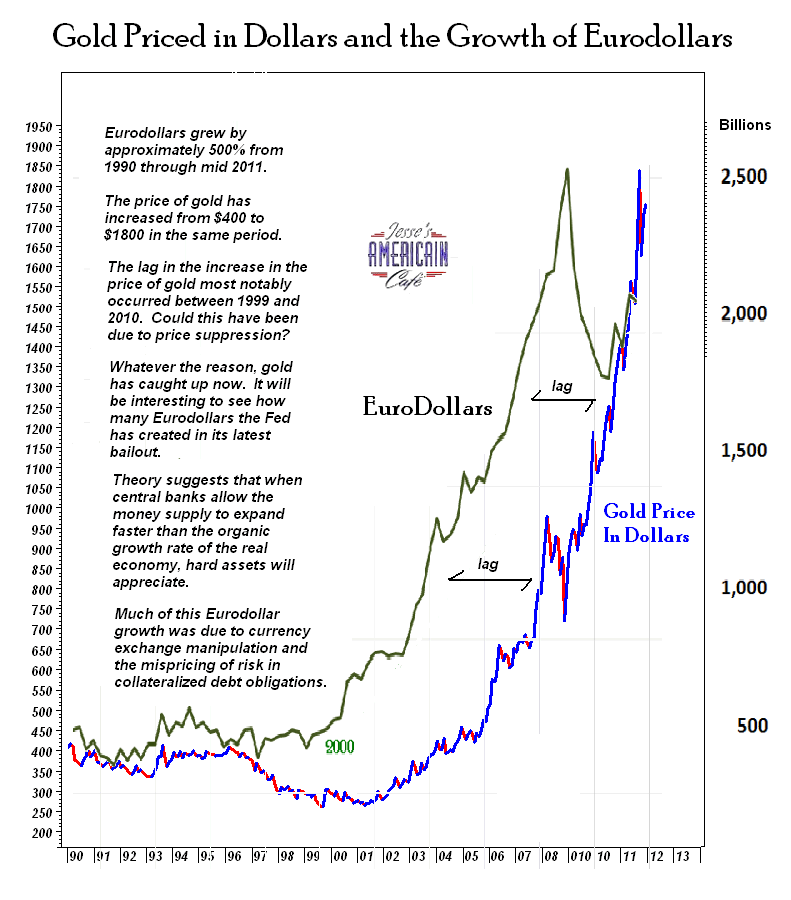

The Eurodollars estimate in the chart below is based on the BIS Banking Statistics from Commercial Banks and may not include official reserves held by Central Banks.

The Eurodollars estimate in the chart below is based on the BIS Banking Statistics from Commercial Banks and may not include official reserves held by Central Banks.

As you know the Federal Reserve stopped reporting Eurodollars some years ago, with the consequence that it also stopped reporting M3 money supply.

I like to think of Eurodollars and banking system derivatives as the Fed's off-balance-sheet method of monetization and policy implementation, with plausible deniability.

Swap lines are provided to other Central Banks, and they in turn make the loans to their member banks, and from there to their customers. So this eurodollar creation is made outside the real domestic economy, and therefore has no immediate effect on domestic money supply and prices at the end of the money chain. But the effect is there, and the smart money closer to the financial system sees it coming.

I do not know if the Fed's swap line activity actually shows up immediately in their Balance Sheet and therefore the Adjusted Monetary Base. But I think it is fairly obvious that if swaps are used to create dollars by foreign central banks, who in turn loan those dollas to their own members, the impact of that broader dollar creation will only be felt with a significant lag in the domestic US economy. But it will be felt at some point.

When the Fed was tracking Eurodollars, I believe that they were not counting certain assets, or liabilities from the banks point of view, as money. What exactly those assets might be and how liquid they are is a open question. How much of them were held in Agency debt, and how much in Treasury debt? Is a liquid obligation held by a foreign source part of the broad money supply, or not? Since it can be quickly converted into dollars, and then into another currency, leaves little question that it is potential money at least.

At least part of the problem being faced by Europe in this crisis is the sharp point of the deleveraging of US assets underlying dollar denominated debt. And if foreign confidence in the US dollar debt breaks, the losses would be daunting for the holders of that debt, so there will first be a rush into Treasuries and away from Agency debt and CDOs. This will be like the ocean retracting, causing people to flock to the shore in wonder at the cheapness of the debt. But eventually the returning tsunami of US dollars may very well swamp the Fed's Balance Sheet and the domestic US economy and the savings of many.

The hyper-inflation of financial paper is happening quietly and off the books. The growth rate in derivatives held by the Banks is mind boggling. And how it will manifest in the real world is not fully known. A good sized chunks of the financial system will simply vaporize. And I suspect that the policy makers will heavily allocate the damage to the least powerful members of the private sector. And ownership of the real economy will continue to concentrate in fewer and fewer hands.

Speaking of lags, I think the unusually long lag between the growth in Eurodollars and the price of Gold can be attributed to the gold sales programs by the Western Central Banks. Once those programs were suspended, and the Banks turned again into net buyers, the gold price rose dramatically.

The most recent Eurodollar operation of the Central Banks in relieving the Dollar short squeeze in euro is not yet in the totals.

It should also be noted that there are other correlations one can use in determining the gold price, most notable 'real interest rates.' However, there are linkages amongst all the variables, given a non-organic increase in the money supply and artificially low interest rates for example being among them.

So, when will the price of gold stop rising? Most likely when the Central Banks stop printing money, and return to transparently set market based interest rates and a productively reformed financial system.

'Not on the horizon' does come to mind.

I do not know if it will happen in gold or silver first, but the price management schemes that have been in place for a few decades now in the metals markets are reaching a tipping point.

To paraphrase what Kyle Bass recently said, 'There is $80 billion in open interest in gold futures and options, and there is $2.4 billion in deliverable gold at the exchange. The exchange is a fractional reserve system, and they plan for a one percent redemption. In the event of a greater demand for redemption, they assume that price will take care of it. The decision for a fiduciary is simple; take your billion in gold out now.'

And the situation in the silver market is even worse. It is a disaster waiting to happen.

At some point a 'black swan' event, or perhaps something the classical world would have simply called 'nemesis,' is going to knock the US futures market off its foundations. The government and exchanges will seek to force a solution on market participants through the de facto seizure of positions and accounts, with a settlement dictated by the Banks. MF Global looks like a dry run for that much larger default.

They will say once again that 'no one could see it coming.' And the truth will fall into the same credibility trap that has swallowed all the other financial scandals, cover ups and bailouts since the S&L crisis.

"Why is surprise the permanent condition of the U.S. political and economic elite? In 2007-8, when the global financial system imploded, the cry that no one could have seen this coming was heard everywhere, despite the existence of numerous analyses showing that a crisis was unavoidable.

It is no surprise that one hears precisely the same response today regarding the current turmoil in the Middle East. The critical issue in both cases is the artificial suppression of volatility -- the ups and downs of life -- in the name of stability. It is both misguided and dangerous to push unobserved risks further into the statistical tails of the probability distribution of outcomes and allow these high-impact, low-probability "tail risks" to disappear from policymakers' fields of observation...

Complex systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks. In fact, they tend to be too calm and exhibit minimal variability as silent risks accumulate beneath the surface.

Although the stated intention of political leaders and economic policymakers is to stabilize the system by inhibiting fluctuations, the result tends to be the opposite. These artificially constrained

systems become prone to “Black Swans” — that is, they become extremely vulnerable to large-scale events that lie far from the statistical norm and were largely unpredictable to a given set of observers.

Such environments eventually experience massive blowups, catching everyone off-guard and undoing years of stability or, in some cases, ending up far worse than they were in their initial volatile state. Indeed, the longer it takes for the blowup to occur, the worse the resulting harm in both economic and political systems."

Nassim Taleb, The Black Swan of Cairo, Foreign Affairs

It is not yet clear when, or exactly how, but it seems inevitable that this scheme of the Anglo-American banking cartel will founder on the hard rocks of gold, silver, and the will of the people to be free, if they have but the mind to use it.

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.