Debt Champions and Eurozone Bailout Fund, Another $670Bn Not Enough?

Stock-Markets / Global Debt Crisis Dec 08, 2011 - 04:28 AM GMTBy: PhilStockWorld

I titled yesterday’s post "More Stimulus Please" and, as expected, we did indeed get another $670Bn (500Bn Euros) rumored around noon yesterday as the word is the EFSF is going to either double or eliminate it’s lending cap. This action was backed up by our own little Timmy Geithner, who backed the play, saying: "We’re encouraged by the progress [Europeans] are making, not just to put in place economic reforms across Europe to create the conditions for stronger growth in the future, but to try to build a stronger architecture for a fiscal union … and try to make sure there’s a sufficiently strong firewall in place to support those efforts."

I titled yesterday’s post "More Stimulus Please" and, as expected, we did indeed get another $670Bn (500Bn Euros) rumored around noon yesterday as the word is the EFSF is going to either double or eliminate it’s lending cap. This action was backed up by our own little Timmy Geithner, who backed the play, saying: "We’re encouraged by the progress [Europeans] are making, not just to put in place economic reforms across Europe to create the conditions for stronger growth in the future, but to try to build a stronger architecture for a fiscal union … and try to make sure there’s a sufficiently strong firewall in place to support those efforts."

It took 12 hours after the close but it seems to have finally occurred to market participants that the only reason we NEED a "sufficiently strong firewall" is BECAUSE EUROPE IS ON FIRE! Not only is the prospect of doubling down on the EFSF less than a month after it’s passed kind of worrying but the real concern in the markets this morning is that – another $670Bn is not enough!

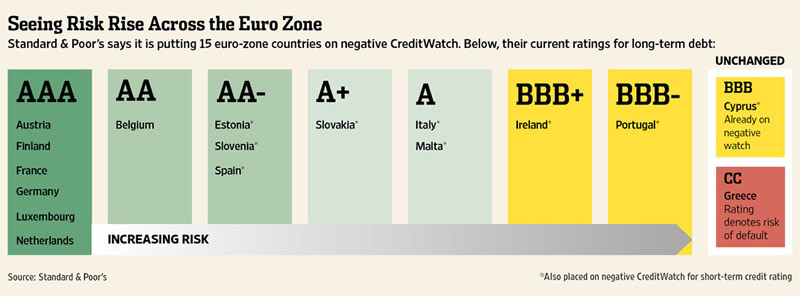

If we assume both Ireland and Portugal are essentially junk and that Italy, Malta and Slovakia are next – assuming the S&P goes from "negative watch" to actual downgrades – how big does the EFSF really have to be? Well, it’s all about Italy (GDP $2Tn), who are about $2.5Tn in debt – about the same as Germany, who have a 60% bigger economy (GDP $3.3Tn).

Spain (GDP $1.5Tn) is a relatively mild $800Bn by comparison and only 55% in debt so if they lose their AA rating – on what basis do the big boys get to keep their AAAs?

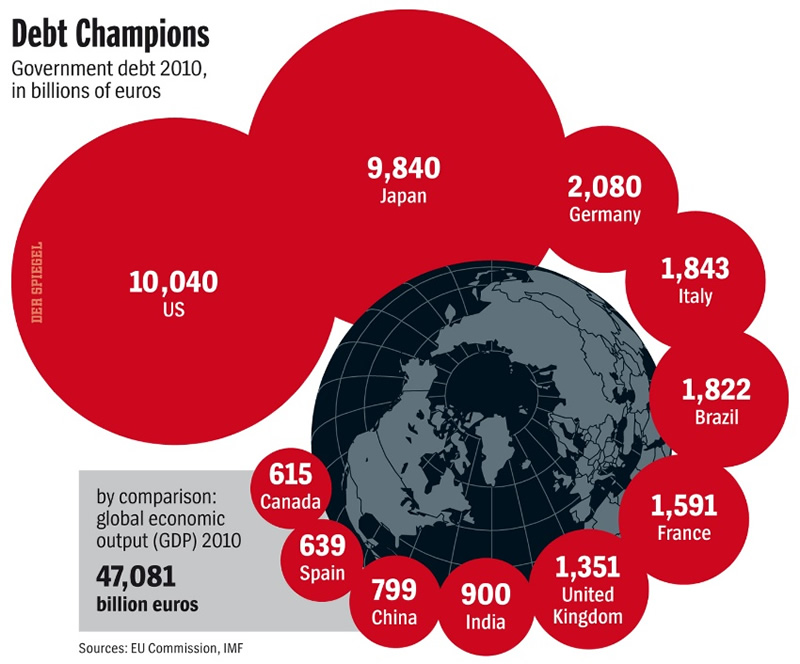

We were discussing the Global Debt situation in Member Chat this morning and Jthoma asked how long this can go on and I said you have to think of this a a Global game of musical chairs – only there are 7 Nations (the G7) dancing around just one, very rickety-looking chair. Since no one thinks they are likely to find a safe seat when the music stops – not even China – no one is going to stop the music and call an end to the came and they will all keep dancing and dancing until they collapse. THAT’s the Global Economy at the moment!

That’s why we flipped more…

- Phil

Click here for a free trial to Stock World Weekly.

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.