To ECB or Not to ECB?

Stock-Markets / Financial Markets 2011 Dec 08, 2011 - 09:54 AM GMTBy: PhilStockWorld

To bail, or not to bail--that is the question:

To bail, or not to bail--that is the question:

- Whether ’tis nobler in the EU to suffer

- The slings and arrows of outrageous swap rates

- Or to print money against a sea of debt

- And by printing, inflate them. To loan, to bail-- No more

- And by a loan to say we end the illiquidity,

- and the thousand natural shocks

- That economies are heir to.

The ECB may dig deeper Into its crisis toolbox to stimulate bank lending and fight off a recession as Europe’s leaders gather to lay the foundations for a fiscal union.

ECB policy makers meeting in Frankfurt are expected to cut the benchmark interest rate by a quarter percentage point to a record-low 1%. They may ALSO loosen collateral criteria to give banks greater access to cheap cash and offer longer-term loans, said three euro-area officials with knowledge of the deliberations speaking to Bloomberg.

Hours later, Europe’s leaders will convene in Brussels for talks to frame the FIFTH “comprehensive solution" in 19 months to a debt crisis that’s left Germany and France facing the threat of losing their AAA rating from Standard & Poor’s. The ECB says that governments must address the cause of the turmoil as it focuses on getting banks lending again rather than increasing purchases of indebted nations’ bonds.

“It’s yet another date with destiny in the euro area,” said Julian Callow, chief European economist at Barclays Capital in London. “It’s clear there won’t be the ultimate resolution, but the proposals are going in the right direction. The markets seem to have finally understood that in the ECB’s eyes it’s up to governments to solve it, and it’s worth noting that it’s doing a lot on the banking side.”

Fitch says last weekend’s austerity plan put together by Italy’s new government eases near-term pressure on the country’s credit A+ rating, but the outlook still remains negative. Budget savings were made, says the agency, but the question remains on whether this paves the way for economic growth to return.

European options traders, meanwhile are pushing bullish bets on Europe to the highest level since March 2010 as governments work to forge a solution to the two-year-old sovereign debt crisis. The ratio of outstanding calls to buy the Euro Stoxx 50 Index versus puts to sell has climbed to a 20-month high of .92-to-1, according to data compiled by Bloomberg. The open interest for Euro Stoxx call options has risen 6.1% in the last two weeks to 22.3 million contracts, faster than the increase for puts, which rose 3.5% to 24.3 million.

Optimistic investors may be punished as the cuts European economic growth and corporate profits, according to Gergor Smith, a London-based fund manager at Daiwa Asset Management, which oversees $111.3 billion. "It’s a very dangerous position to have. The outlook into 2012, at least for the first half of the year, looks pretty poor." Even with those risks, investors are more concerned about trailing the market should equities climb, according to Lothar Mentel, who manages $3.9 billion as chief investment officer for Octopus Investments Ltd. in London.

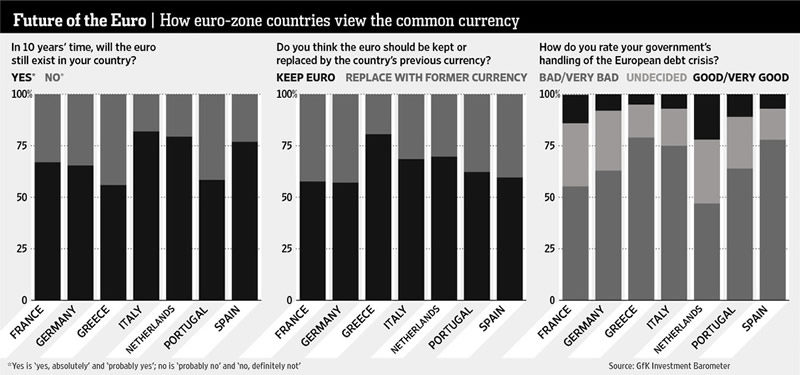

According to the WSJ: "A majority of people in embattled euro-zone countries remain confident that the euro will remain their currency a decade from now", and most say that sticking with the euro is the right path, according to the latest results of the GfK Investment Barometer survey. The survey also found that in all seven euro-zone countries polled, affluent individuals were more optimistic about the euro’s fate, and more likely to support its continued use, than less-affluent individuals.

The survey also polled people in France, Germany and the Netherlands, three countries with triple-A debt ratings at the core of the euro zone. About two in three French and German respondents believe their countries will still have the euro in a decade, while four of five Dutch respondents said the euro would remain. On whether they should keep the euro, 57% of Germans said to keep it, with 43% preferring to drop it and switch back to the mark. In France, 58% said to keep the euro, and 42% said to dump it. In the Netherlands, 70% said to keep the euro, with 30% to exit.

Keep in mind that these are the FACTS versus the constant BS OPINIONS we get from the MSM. Just like if you ask politicians in America for their opinion, it very much matters which one you ask. We have speakers and whips and House majority leaders and Senate majority leaders and a Fed that says one thing when the President says another – JUST LIKE EUROPE. So why is it you take Fox’s word for it when they interview one guy and tell you that the Euro is doomed?

So – if the Euro is not doomed, why is it so cheap? And, if the Euro is too cheap, then isn’t the Dollar too high? And, if the Dollar is too high, then the markets are too low. See – it always comes back to inflation! That’s why, last year, we had our "Secret Santa Inflation Hedges for 2011" that I put out on Christmas Day last year. Those are, of course, hugely successful and we’ll do another round for 2012 at the end of the month but, for now, we need some bullish positions to cover the upside of the market as a "solution" from the ECB to the crisis can send the markets flying.

FAS is still my favorite upside play or the moment. In Member chat yesterday, we added 10 FAS next week $66/67 bull call spreads for .60 ($600) in our White Christmas Portfolio to keep us balanced as we were tilting a bit too bearish after adding an aggressive TZA hedge. We’re trying to stay even into the weekend as we could move violently in either direction in the short run but, long-term – we’re still pretty bullish, with inflation being our main reason for being so. Short-term, it’s all up to the ECB and the EU. We already know what the ECB will do this morning and we can fade any rally off that "news" – what the EU counsel does, however, is a mystery – but it better be BIG or we’re in even bigger trouble.

Already this morning the market spiked up on the official news from the ECB but I warned Members not to chase it and already the whole move up has been erased. Although we got the rate decrease and longer loan terms (triple!) to help kick the can down the road from the ECB, Draghi’s press conference indicated that there will not be a reserve ratio cut until Jan 18th (to 1%). Too little, too late is the sentiment from the doom and gloomers so we’re back to seeing what sticks.

Now the ball is back in the EU’s court and, should they not come up with something FANTASTIC tomorrow – it’s going to be a very scary weekend.

- Phil

Click here for a free trial to Stock World Weekly.

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.