The U.S Debt Crisis, A Look Beyond the Paradigms

Interest-Rates / US Debt Dec 11, 2011 - 03:50 AM GMTBy: Andy_Sutton

Co-Authored by Gregory Olson, CEO – GRO Enterprises : One of the traps all analysts fall into from time to time is their inability to see the forest through the trees. We are all guilty of this from time to time, and those who would deny this simple reality only set themselves up to miss important changes in the paradigms in which they operate. Perhaps the most famous example of this happened in the life and times of Christopher Columbus. We’re sure you recall the mental model of that time; that the Earth was flat. Many very wise people in Columbus’ day felt he was going to sail the Nina, the Pinta, and the Santa Maria right off the edge of the Earth. And there are many other classic examples as well.

Co-Authored by Gregory Olson, CEO – GRO Enterprises : One of the traps all analysts fall into from time to time is their inability to see the forest through the trees. We are all guilty of this from time to time, and those who would deny this simple reality only set themselves up to miss important changes in the paradigms in which they operate. Perhaps the most famous example of this happened in the life and times of Christopher Columbus. We’re sure you recall the mental model of that time; that the Earth was flat. Many very wise people in Columbus’ day felt he was going to sail the Nina, the Pinta, and the Santa Maria right off the edge of the Earth. And there are many other classic examples as well.

Today, we might call such a condition extreme dogmatism, which is essentially the clinging to a belief or set of beliefs despite overwhelming evidence to the contrary. These days we find the same type of dogmatism in our world. The belief that we can spend our way to prosperity is one. The belief that we can do so with borrowed money is another. However, even within the knowledge that both of these positions are completely reliant on fantasy, there is the danger to just pin our trust on the opposite side of the argument without really taking the time to consider what exactly we are espousing.

So one of the questions we obviously need to ask ourselves constantly is ‘what are we missing here?’ In looking at the current debt situation, we tend to focus on the ‘national debt’ and its continuing rise, but in truth, the national debt or public debt as it is also called is only a very small part of the total picture. The truth is it goes way beyond that. We have focused several times on consumer debt, and even that is only another small portion of the overall picture. Back in 2008, leverage was the word of the day and everyone was wrapped up in talking about which bank was leveraged the most. Guesstimates of 100:1 were flying around with regard to certain of the biggies that eventually would require an adrenaline shot to the heart in the form of the commitment of years of future GDP just to keep them alive.

The truth is that the debt problem is systemic. For the purposes of this paper, we are not going to even look at the future in terms of unfunded liabilities. Most understand that bleak picture fairly well. Instead we’re going to look at current information as reported by the (non)USFed and USTreasury. And when we’re done, we’re going to float the all-important question. Sorry, but you’ll need to read the rest of the paper to find out what that is. The balance of this essay is going to be from email conversations between Greg and Andy on this issue. The reaches were far and wide, but hopefully this will help readers to expand their thinking even further. Those that recognize the problems are becoming greater in number on a daily basis. Our goal is to enhance that understanding and hopefully to motivate people to action in their own lives where real reforms can take place. Starting at the top and working our way down has proven to be almost totally ineffective, and frustrating on top of it. Many people who have gone to ‘End the Fed’ rallies have come home euphoric, but that energy has dissipated quickly as they’ve seen the bankers just wave it all off and continue to sell our children and grandchildren into…. yes, debt slavery. So a bottom up fix it must be. And if you’re in a good spot, chances are you know a lot of people who aren’t. Encourage them to throw down the proverbial chains and dare to be free.

Here are some of the quotes from our email discussions. We only ask that you use/distribute this to enhance understanding of the reality of the current situation.

[Gregory Olson] “I'm not an economist, and in a way I'm glad I'm not. I can look at the numbers with fresh open views without being forced into pre-defined boxes learned in college. For example, after looking at the GDP, mortgages, and interest rates over 40 years, I don't believe the interest rates have anything to do with the economy, but the Federal Reserve sets them for their own agendas. The Fed slipped that fact out by their declaring the rates will not be raised for two more years. The statement proves they are in complete control of the rates, not the markets. Otherwise, they would not have said it so confidently. In fact, if you look at the prime rate for the last 40 years, it changes direction like clockwork on average about every 5.5 years. This leads one to believe on the surface that there are "cycles" in the economy, when the GDP is not affected significantly by the changes.

Over the summer when I saw this pattern (or should I say no causal relationship), I pegged that the next year of change of the interest rates is about 2013. One month later, sure enough, that is the exact time they are going to change the rates. Basically, it means the Fed is full of BS, and they have deliberately lowered the rates, added debt, and then they will claim the market is raising the rates, when indeed, they are planning on doing it themselves to bankrupt the United States and set up an one world government. The data does not support the Keynesian views at all in terms of the impact of inflation and interest rates. Indeed, though it can't be proven, I believe the spike in rates in 1970 was the Fed's way to get us conditioned to ridiculously high interest rates on credit cards, which were being introduced into the economy at that time. The prime rate decreases in the 1980s, but the credit card rates did not.

The strategy was extremely successful. I believe this is the correct answer based on the law of supply and demand. There is no "economic law" when it comes to a fiat system, because the money supply is unlimited, removing the natural laws of the universe. The Fed actually knows how the "real laws" work, but they lie about it and use the system to steal and cheat, profiting from the deception. They deliberately lie, so they can control the rate. So they (the Fed) feed the university economists and Ph.Ds junk ideas, based on their man-made system, claiming it follows the universal law of supply and demand, when it does not.

So I'm glad I'm not an economist, and I can look at the data and think out of the box like this. The "stagnation" idiot ideas of the 70s to explain the "inflation" that didn't fit into the Keynesian models is simply a way to force fit an explanation that hides the more accurately and simple explanation, which is, the Fed raises and lowers the interest rate at its own bidding, to secretly promote their own hidden agendas.

If I'm wrong about the interest rates, then prove it from the data over 50 years to me; I'm all ears. The data does not support a free market economy at all! It supports a manipulated one. The bottom line is the fiat system does not follow demand and supply laws because the money supply is unlimited, circumventing natural law.

We've been duped. That's what I've concluded so far, among other things.

At first I thought everyone should know about this, or that the government should take control of the rate itself to prevent it from rising in two years according to the Federal Reserves' hidden strategy. (They will raise it 2 or 3 points to bankrupt the US and say it’s market forces driving it, doing the famous double-talk). Then I realized the Fed has us over a barrel. If we now let that idea gain traction, the credibility of the United States will be shot, and the whole globe will blame us and our greedy Fed for the world's financial problems, and nobody will want our dollars. So down goes the United States by telling the truth.

On the other hand, maybe telling the truth is better, and we should take the world's rejection and transition slowly to a better system after being thrown into bankruptcy and poverty.”

[Andy Sutton] “I agree 100% there; the Fed has clearly used interest rates and the money supply to manipulate the economy. The irony is that the Fed was allegedly created to eliminate the prior boom-bust cycles, bank panics, and other financial and economic dislocations. It has done nothing but take those cycles and amplify them by an order of magnitude. Then when it all goes bad, the consumer is blamed – aka the ‘roaring 20s’ and the housing ‘crisis’. Sure, consumers signed the dotted line in both instances and so they’re ultimately responsible, but there was a good deal of misinformation propagated by the banking syndicate and the media to entice people to make bad decisions. Terms weren’t properly disclosed, nor were conflicts of interest. There was little due diligence on either part, but the bankers knew something the consumers didn’t. They knew (because of history) that when push came to shove that they would be made whole – at the consumer’s expense. Want proof? Just take a look at the government’s actions with regard to the scads of bank failures back in the early 1800s. Every time the banks over issued scrip and precipitated a run, the government bailed them out by allowing them to default rather than forcing them to come up with the silver that was owed to the depositors. Save Andrew Jackson, every instance of bad behavior resulted in a ‘bailout’. This is common knowledge in banking circles, but not consumer circles. A classic case of imperfect information. Would consumers have cared? I’ll give you two guesses, but you’ll only need one. So there is plenty of blame to go around on this one.

As to your comments about being an ‘economist’, I have been called one many times, but it is a title/label I really bristle at to be honest, mostly because of guilt by association. I reject all of Keynesianism out of hand, but that is a subtlety that many people don’t pick up on because all they know is Keynesianism. It is the prevailing thought process taught at all levels of education, with very few exceptions.

I think a final point here is that this is not ‘our’ Fed. That institution is owned by and large by 12 large banks that have no loyalty to any flag or other sovereign power including God Almighty. I have said this before, that they are men without a country, but seek to conquer all countries. I was having a conversation with a client yesterday and he mentioned a quote and I can’t attribute it to the author, but it is a very good one – Give a man a gun and he can rob a bank, but give a man a bank and he can rob the world.”

[Gregory Olson] “ I appreciate your attention to this important topic. Bernanke let the cat out of the bag by his declaration of holding interest rates stable for two years. I have vacillated over the solution of turning the setting of the rate to the government, rather than to a private banking cartel, wondering if it’s too late or not. Your thoughts will be helpful to hear.

Indeed, these people are not stupid, and Bernanke's comment appears to be a threat of sorts, in an extremely subtle manner, to those who are paying attention. Those who want the United States to go down must be celebrating right now. He is communicating congratulations to those who are on his side. Their victory is only two or three years away. That is the message to them. After working on the destruction of the freedom of the United States for more than one hundred years, they no doubt are delighted to see the end in sight.”

[Andy Sutton] “That said, the interest rate conundrum is an interesting one because for a long time, there were two rate markets really - the manipulated short end (Fed Funds / Discount Rate) and the 'free market' long end from about one year out. So in theory, the USFed could drive the short end, but not the long end. I have opined and others have demonstrated that the USFed has been messing with the long end for a while now according to its own agenda. Those in charge certainly couldn't give a rip about the US economy beyond its ability to further enrich them.

This said, I am not sure there is much to be gained by debating out the minutia of economic manipulations. We know the basic principles. Nobody borrows their way to prosperity, etc. There is no free lunch. These are facts. We can base what we do around them and leave the rest to the quants. I enjoy playing with the numbers just to try to understand a little deeper what is really going on and I suspect you're the same way. In either case, if you know the trend, it is your friend. I think the biggest problem with returning monetary policy to the Congress at this point is that those people are also bought and paid for by the same people that own Bernanke, et al. So it really doesn't matter. Congress certainly isn't equipped to deal with this complex a monetary environment and that was done intentionally in my opinion to make it harder to dissolve the banking cartel.

As evidence of the inability of Congress to manage a complex environment, I’ll present several policy gaffes, namely the stimulus, which just prolonged the inevitable, the TARP mess, which further unequally yoked us to this corrupt system, and a complete failure to bring ANYONE to justice over the 2008 mess, and more recently the MF Global blowup. Although to be fair, the subpoenas just started flying and the denials by Corzine and others have only begun. I have zero confidence in Congress, given the fact that they allow Bernanke to testify on a regular basis and blatantly lie, refuse to provide information, and obfuscate without nary a word of protest. Congress would have a hard time managing a lemonade stand in my view, let alone interest rates. The only real answer there is to return rates to an unencumbered free market and take what comes with it. It certainly can’t be worse than what we’re dealing with now.”

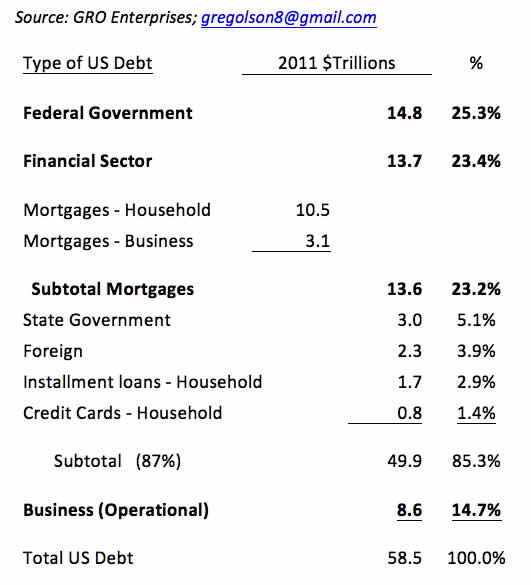

The US Debt Mix

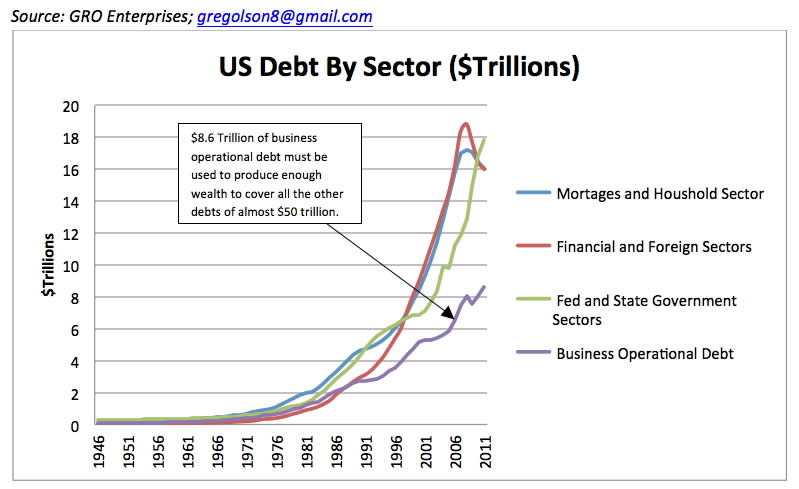

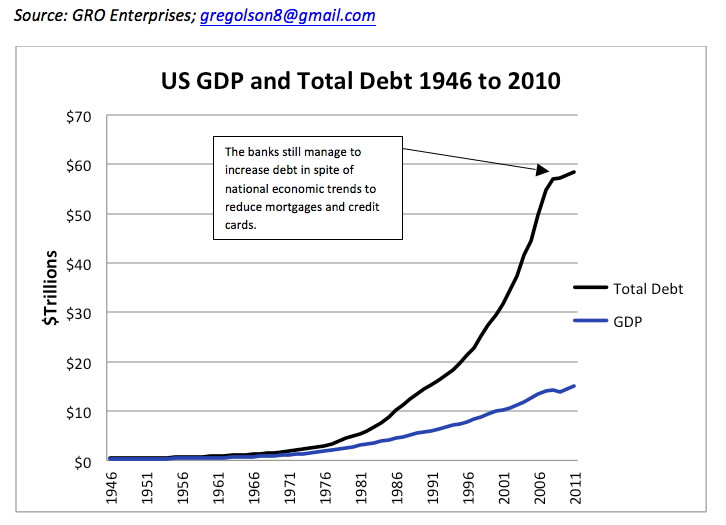

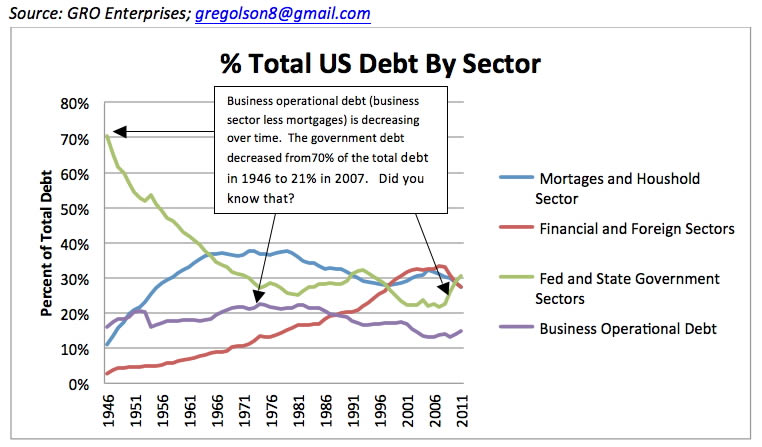

[Gregory Olson] The following numbers and graphs show the root cause of the financial problems of the US economy today and how we got there. The Federal Reserve, or whoever had responsibility for the debt mix of the United States from 1946 to 2008, decided to reduce the % of government debt in favor of rapidly increasing debts in the financial sector, mortgages, the foreign sector, and the household sector, while simultaneously decreasing the business operational debt. Only the business sector produces real wealth in the economy. It is clear the economy has been manipulated by man to create cash from nothing, producing multiple bubbles in the economy as the fabricated cash changed into different forms over time. The business sector cannot sustain the debt trends, and thereof, the economy has hit its financial limits. Trading financial paper and flipping a home mortgage 4 times in 30 years does not create real wealth. Rather, it inflates home prices.

Please note, rather than the banks losing interest income due to decreasing debt after 2008 in mortgages, the household sector, and the financial sector, they have opted to increase government borrowing, swapping one debt for another one. Otherwise, the total debt would actually have decreased after 2007. Credit cards and mortgages decreased, for example. The banks are not motivated to allow the total debt to decrease. Thus, in spite of the economic troubles of the United States of America, the banks still have managed to keep the debt growing to sustain their income. Tilt. Game over.

[Andy Sutton] Whether people want to admit it or not, the above chart shows a definite separation between debt and GDP in the 1970s, starting around 1974. Most conventional logic would tie this divergence into the abandonment of the gold standard, and for the most part, that is correct. It is very applicable, especially when considering the discipline that even the pseudo-gold standard imposed on the system at that point in time. Our external debts were still settled in gold prior to August 15, 1971. But there is likely a lot more at work here, and that is the agenda of the international bankers and their policy tool, the USFed. When considering the big picture, it becomes fairly obvious that the gold really didn’t go to other countries per se, but rather into the pockets and vaults of the banking syndicate. They knew all along that eventually the US would run out of gold to settle foreign trade deficits. It wasn’t an accident, like most conventional sources of news and history books will try to assert. This was all part of the agenda, from the very beginning. It reeks of incrementalism, which is the signature of most subversive movements in history.

[Andy Sutton] The above chart is really a paradigm buster, when you think of all the emphasis that has been placed on the last several years and the massive ramp-up of America’s public debt. That ramping up can be seen clearly in the chart, but the debt profile has become much more even, with all areas of the system coming under equal pressure and more and more parties ‘making payments’ on various expenditures. This is a fiat money system’s dream come true: everyone making payments. These payments require real labor and other inputs to pay back something that was created from nothing.

The $56 Trillion Question

With all of this information out there, the obvious question becomes this: who exactly is all of this ‘money’ owed to anyway? The quick answer would be the banks, but if you look at them, they’re in hoc too. Sure, Ma and Pa Kettle owe the commercial banking side of BofA $150,000 for the mortgage, and another $25,000 in credit cards, while the investment banking side of BofA owes untold billions to who? Who exactly is the counterparty to all this debt? Who exactly are we committing at present count roughly 4 years of aggregate economic output to pay off? This debt is claiming our country, our families, our kids, and our way of life and we don’t feel that we’re overstating this in the least. Since we can’t even effectively answer this question in a specific manner, wouldn’t it seem prudent to rid yourself of as much of the ‘making payments’ mentality as humanly possible?

Andy Sutton received international honors in the field of Economics at the graduate level and is the Chief Market Strategist for Sutton & Associates, LLC, a Registered Investment Adviser in the Commonwealth of Pennsylvania. For more information about the company, its products and services, or contact information, please visit our website. Please feel free to distribute, copy or otherwise disseminate this information.

Greg Olson is the CEO of GRO Enterprises; a company devoted to helping people spend money at optimal levels, removing all debts in 12 years or less, including the home mortgage. His company develops software solutions to unleash the power of spending money. He has an Accounting degree and a MBA and has worked in finance for companies such IBM, CBS, Fox, and Paramount before changing his career focus to personal finances.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.