Mind the Leveraged ETF's 2012, They Might Kill your Portfolio!

Companies / Exchange Traded Funds Dec 30, 2011 - 03:29 AM GMTBy: Willem_Weytjens

In this article I will show you why it's wise to be careful with leveraged products, such as Proshares Ultra ETF's and Direxion 3x ETF etc... as they might KILL your portfolio!

In this article I will show you why it's wise to be careful with leveraged products, such as Proshares Ultra ETF's and Direxion 3x ETF etc... as they might KILL your portfolio!

Proshares states on its website:

Each Short or Ultra ProShares ETF seeks a return that is either 3x, 2x, -1x, -2x or -3x of the return of an index or other benchmark (target) for a single day, as measured from one NAV calculation to the next. Due to the compounding of daily returns, ProShares' returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks. Investors should monitor their ProShares holdings consistent with their strategies, as frequently as daily.

While I like those products for a short term trade, I will never hold them for a long time. Let me explain why...

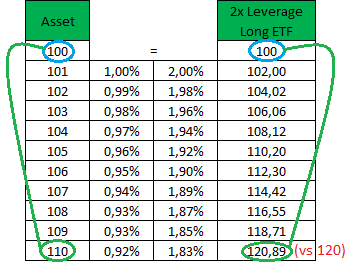

Imagine you have an asset class with a price today of $100. To keep it simple, let's also assume that the 2x Long ETF also trades at $100 today.

From the table below, you can see that if the asset is going in one direction without a lot of volatility, you may actually gain more on the leveraged ETF than initially expected. While the Asset class rose from $100 to $110 (+10%), the Leveraged Long ETF gained +20.89%, although we expected it to be +20% (2 times the % increase of the asset class). This is a favorable situation.

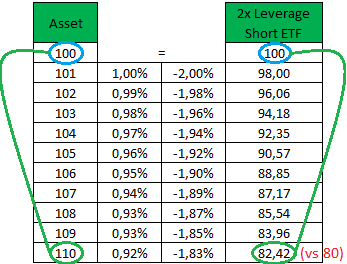

However, imagine we get a situation that works against us. We own a 2x Short ETF, and the market keeps rising.

In this case, we are lucky as well, because we will "only" loose ($100-$82.42)/$100=17.58%, while we would expect a loss of -20%.

The two tables above show us that we might get a favorable situation with leveraged ETF's when volatility is very low.

But what happens when volatility is very high, as it has been recently?

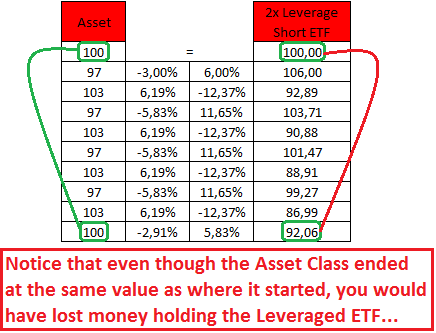

Let's assume again we have an asset class which is priced at $100, and a leveraged Short ETF which is also priced at $100 today.

If the volatility is very high, we might end up loosing a lot of money, as we can see from the table below:

Even though the asset class ended up just where it began (at $100), our 2x Short ETF has lost 7.94%!

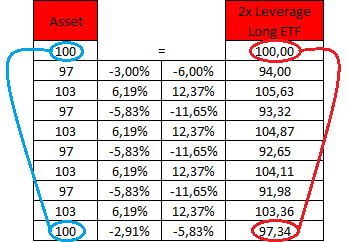

The same would be true if we have a 2x Long ETF:

Even though the asset class ended up just where it began (at $100), we would have lost money with the Leveraged Long ETF...

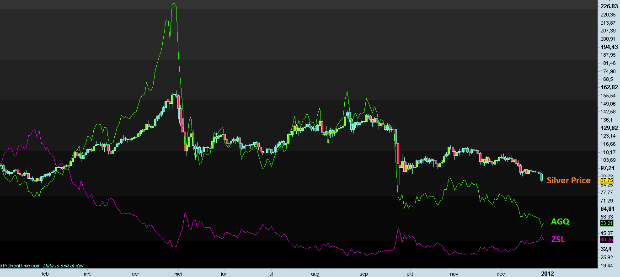

To give you an example, let's have a look at the Silver price, the 2x Leveraged Long Silver ETF (Ticker: AGQ) and the 2x Leveraged Short Silver ETF (Ticker: ZSL).

In the chart below, I set the initial value of each at $100, starting at 01.01.2011.

The candlestick chart is the Silver price, the Green line is AGQ and the purple line is ZSL.

As we can see, silver lost 12.25% this year.

One would expect to have gained 2 x 12.25%=25.50% with ZSL this year, right?

WRONG! ZSL lost 59.75% this year!

One would expect to have lost 2 x 12.25% = -25.50% with AGQ this year, right?

WRONG AGAIN! AGQ lost 46.79% this year!

Oh, and by the way, it also happens with the -1x ETF's, even though they DON'T leverage the price...

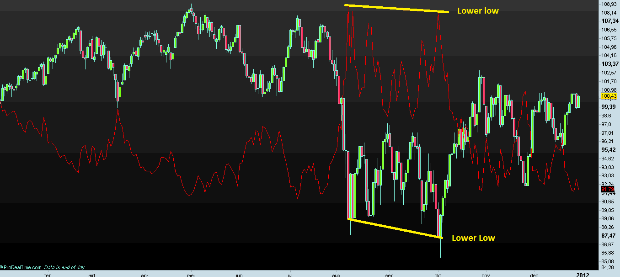

Let's have a look at the SP500 vs Proshares Short SP500 (Ticker: SH) since 01.01.2011.

While the SP500 gained 0.43% since the beginning of the year, SH lost 8.21%!

The correlation may be high, but it's not PERFECT!

That's why you have to mind the leverage products! Buy them to do a short trade, don't buy them to Buy & Hold, unless you would expect price to keep going in one direction, and then still...

For more analyses and trading updates, please visit www.profitimes.com

Willem Weytjens

www.profitimes.com

© 2011 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.