Consumer Price Index, Jobless Claims and Housing Starts All Favourable Aspects

Economics / US Economy Jan 20, 2012 - 04:41 AM GMTBy: Asha_Bangalore

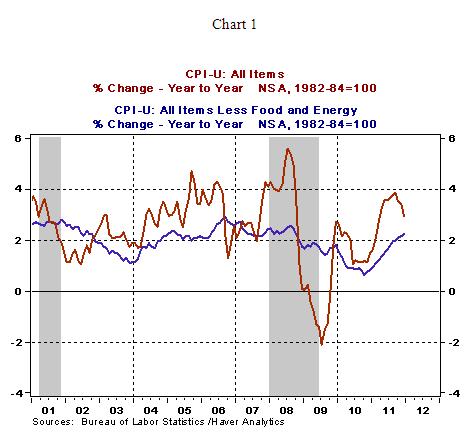

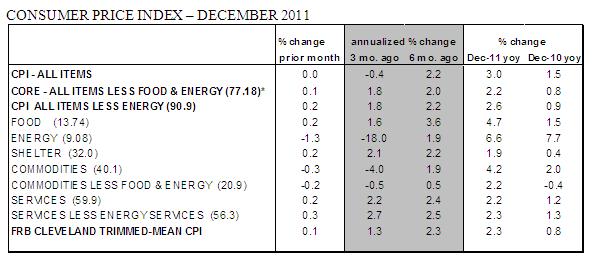

The Consumer Price Index (CPI) held steady in December, after posting a similar reading in November. The energy price index inched down 1.3% in December, marking the third consecutive decline. The recent increase in oil prices should be reflected in the January CPI report. The food price index increased 0.2% in December putting the year-to-year gain at 4.7% vs. 1.5% in all of 2010. The energy price index moved up 6.6% in 2011 compared with a 7.7% jump in 2010. The 3.0% increase in the overall CPI in 2011 reflects these gains as well as an acceleration of the core CPI, which excludes food and energy.

The Consumer Price Index (CPI) held steady in December, after posting a similar reading in November. The energy price index inched down 1.3% in December, marking the third consecutive decline. The recent increase in oil prices should be reflected in the January CPI report. The food price index increased 0.2% in December putting the year-to-year gain at 4.7% vs. 1.5% in all of 2010. The energy price index moved up 6.6% in 2011 compared with a 7.7% jump in 2010. The 3.0% increase in the overall CPI in 2011 reflects these gains as well as an acceleration of the core CPI, which excludes food and energy.

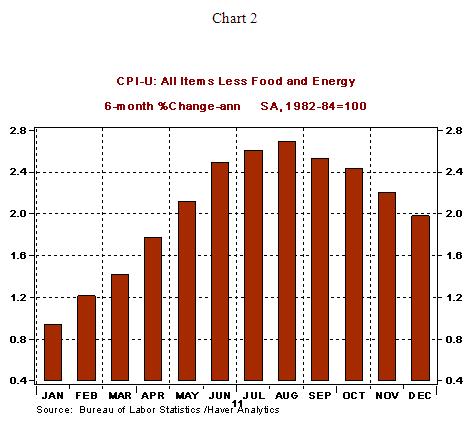

The core CPI, which excludes food and energy, increased 0.1% in December, amounting to a 2.2% increase in 2011 vs. a 0.8% increase in 2010. The core CPI accelerated faster in the first-half of 2011 (+2.5%) compared with the second-half of the year (+2.0%). In December, shelter costs (+0.2%), medical care (+0.4%) and recreation costs (+0.4%) were a few of the large increases, while prices for clothing (-0.1%) fell.

As we have mentioned in several recent commentaries, the Fed has a dual mandate of full employment and price stability to satisfy. In this context, inflation data are contained and the Fed has more or less met the price stability aspect of the mandate but the Fed falls short on the full employment front with 8.5% unemployment in December 2011 after ten quarters of economic growth. Moreover, 42.5% of the unemployed have been unemployed for over six months. The Fed, with new voting members on the FOMC, is unlikely to take action at the January 24-25 meeting. This meeting will be marked with more information from Fed in view of increasing transparency. The Fed will publish its own forecast of the fed funds rate as part of economic projections at the close of the January 25 meeting.

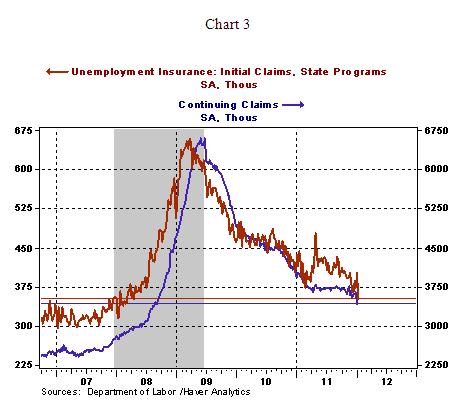

In other related economic news, initial jobless claims fell 50,000 to 352,000 during the week ended January 14. This is the lowest mark since March 2008. Continuing claims, which lag initial jobless claims by one week, fell 215,000 to 3.432 million, the lowest since September 2008. The main message is that firms are not shrinking their payrolls anymore.

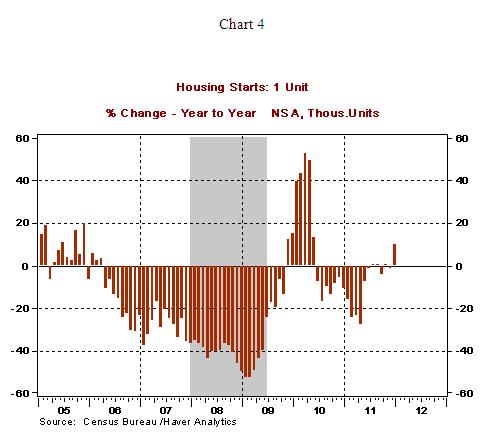

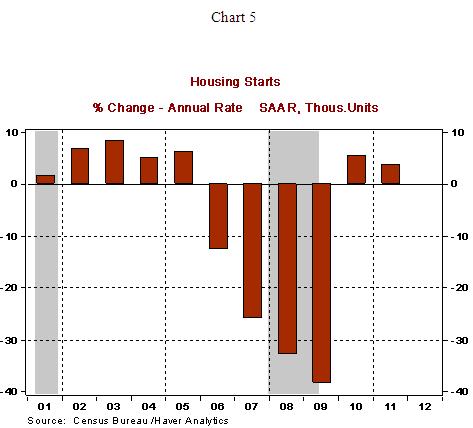

Total housing starts fell 4.1% in December to an annual rate of 657,000, reflecting a 20.4% decline in construction of multi-family units and a 4.4% increase in single-family starts. On a year-to-year basis, single-family starts posted a sharp 10.2% increase, this occurrence is a first in a long time without support from special programs such as the first time home buyer program (see Chart 4); it is a noteworthy development and bears close watching. Housing starts have moved up in 2010 and 2011, after four annual declines.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.