Roubini Says Greece Will be a Credit Event, Regardless of Debt Deal

Interest-Rates / Global Debt Crisis 2012 Jan 20, 2012 - 11:52 AM GMTBy: Bloomberg

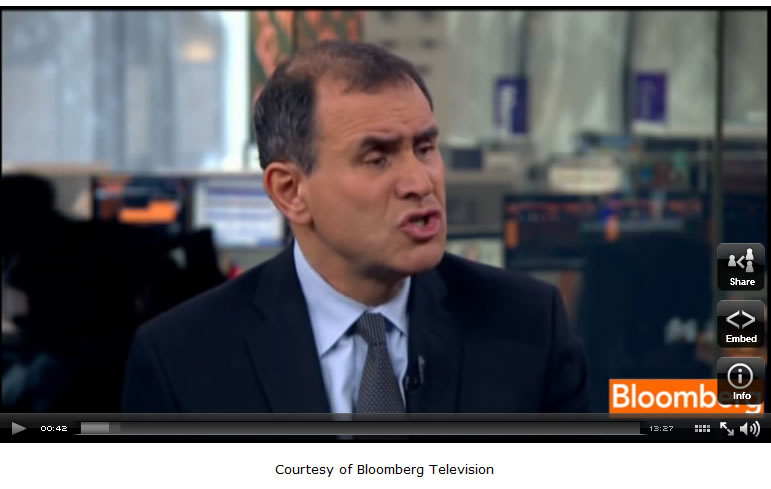

Bloomberg Exclusive: Nouriel Roubini and Ian Bremmer spoke with Bloomberg Television's Margaret Brennan about the state of the global economy.

Bloomberg Exclusive: Nouriel Roubini and Ian Bremmer spoke with Bloomberg Television's Margaret Brennan about the state of the global economy.

Roubini said that the "probability of a recession in the United States is lower than 60 percent right now." On Europe, he said that even if an agreement is reached on Greece, "there are going to be so many holdouts that then they'll have a problem" and "either way you're going to get a credit event."

Roubini on Greece:

"Even if they reach an agreement there are going to be so many holdouts that then they'll have a problem. They'll either pay the holdouts and that becomes expensive, or if they don't pay them you'll have a series of defaults, because they're going to stop paying them. Or the way to avoid the holdouts from being holdouts is then to change domestic legislation, to cram down the terms of the majority on the holdouts. But if that happens then the CDS will trigger and that becomes a credit event. So either way you're going to get a credit event."

"The credit event can be two forms, either a form of default...another one is if there are holdouts and you don't pay them and technically that's a default on the bonds on which you don't pay so there's a series of defaults on which you don't pay. Or three, if you change the terms of the bonds through legislation then that's considered a credit event by ISDA by the event triggering the CDS. And one way or another you get a credit event. One extreme is a default, another one is CDS triggering."

Roubini on the chances of recession in the U.S.:

"I would say latest numbers out of the US have been better for the fourth quarter. I even expect a slowdown so I think the probability of a recession in the United States is lower than 60 percent right now... A lot depends on the eurozone, if the eurozone situation becomes disorderly."

Bremmer on geopolitics:

"The economics are driving the geopolitics and that's after decades when security issues drove the geopolitics, the U.S. talking about geopolitics. U.S. talking about economic statecraft right now about, they've done this not in a proactive way, they've done this because American allies in Asia have been begging for the US to show commitment, whether it's Singapore or Vietnam, whether it's Japan or all the rest."

Bremmer on China's Obama concern:

"The Chinese are very concerned about what the Obama administration defense policy will be in the region, and saying that the Chinese are opaque. This will lead to more confrontation over the South China Sea, over the East China Sea, because the Chinese clearly want to ensure that they're not on the back foot in a part of the world that's utterly critical for their own security sensibilities."

Roubini, Bremmer on China:

Roubini: "I do expect there's going to be a significant slowdown of growth in China this year. We're going to see it already in the Q1 numbers...the Chinese will react by reducing the reserve requirement ratio and interest rates to try and jumpstart the economy...I think it's going to happen in the first half of the year."

Bremmer: "When it comes to the United States and China let's be clear. Structurally these countries are moving towards more conflict. These are the world's two largest economies and that clearly is problematic in terms of economics volatility over the longer term. But as of this year the American economy is dominating, not foreign policy. And there can be a little bit of noise on Iran, a little bit of noise on China. When it comes to currency, the Chinese have been moving at their pace, very slowly, very incrementally, and American politicians have to show they don't like it. But to be clear, American multinational corporations are perfectly happy with it, they manufacture in China. They are on the other side of it. It's American Labor that has the problem with it. And they don't have a lot of influence with the Republicans right now."

Roubini on whether the slowdown in Europe and the United States will spread:

"In the case of the eurozone it's clearly the periphery is not just in a recession but a deepening recession. So the eurozone is in a recession, the UK looks like it's going towards a recession. The data from the United States has been somehow more mixed, positive lately but in my view the process of deleveraging the public and private sector is going to continue that implies slow domestic growth demand and the exports of the United States are not going to improve."

Bremmer on Iran oil sanctions:

"The main implication behind the oil sanctions against Iran is that China will get cheaper oil from Iran, let's be clear about that. But leaving that aside, the Obama administration has actually recently said that purpose of those sanctions is regime change in Iran and they're doing that for domestic reasons because the Republicans have outflanked them a little bit. They said well we might have to engage in military actions. Obama doesn't want to look soft but wants to change his policy. So here's a way of saying same policy, tougher line. Great for domestic policy, not so great for dealing with Iran."

Copyright © 2012 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.