Look at What 'Worked' in the Great Depression

Economics / Economic Depression Feb 05, 2012 - 07:16 AM GMTBy: Jesse

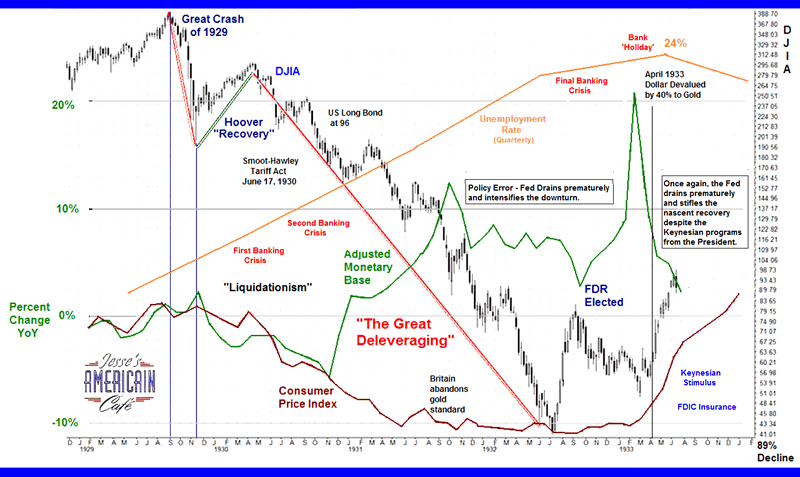

Here is a fairly simple picture of some of the major metrics during the Great Depression. Too simple yes, but it tracks most of the major indicators.

Here is a fairly simple picture of some of the major metrics during the Great Depression. Too simple yes, but it tracks most of the major indicators.

Hoover followed a policy of 'deleveraging,' that is, allowing for the economy to liquidate its prior excesses without changing much else. The Fed did respond to this crisis by expanding the monetary base fairly significantly as you can see.

The recovery began under Roosevelt, who declared a 'bank holidy' and struck at the heart of the problem, clearing the banking system. But he also followed through with a major currency devaluation, stimulus programs, and significant financial reform.

And that last point is the most important. Hoover's Fed supplied stimulus, but there was really nothing done to fix the system that had caused the Great Crash of 1929 in the first place. And I suspect that if Roosevelt had not taken strong steps to clean up the fraud in the stock market and the banking system, his own stimulus would have fluttered and failed.

Now the common knee jerk reaction to this from those who study the schoolbook given by the monied interests is twofold.

First, that Hoover simply did not go far enough, and if they had only allowed the Depression to continue to deepen, eventually it would have bottomed and things would have improved. I think the answer is clear, in the examples of Italy, Germany and Japan. When an economy is tortured to that extent, the people do not continue to endlessly suffer in silence. They react, badly, and take matters into hand one way or the other.

They say you cannot fix debt with debt. And I say that like most simplistic slogans it is intended to mislead. The real issue is reform and how the debt is used and the gains distributed.

Secondly, they say that the Roosevelt recovery did not last. And it did not continue on a steady trajectory. The Fed engaged in some policy errors and caused a secondary slump in the late 1930s. And the world economy remained troubled. Roosevelt also faced an obstructionist Congress, and a Supreme Court that overturned many of his New Deal programs.

He also faced an attempted military coup d'etat funded by a few of the monied interests who also busy doing business with Mussolini and Hitler, as testified by one of its more decorated war heroes, but the history books don't like to talk about that. Just another nut job.

Globally, the monied interests seemed to have choose amongst three options: 1. Go along grudgingly with reform and accept a smaller percentage of the overall economy (Roosevelt), 2. Fund an oligarchic takeover of the government and seek to control it (Hitler), 3. Sew your wealth into the dresses of your children, and die with them in a basement (Russia).

The US, like all other nations, has plenty of its own dirty little secrets that no one likes to talk about.

The point of this is that austerity following a financial collapse based on fraudulent imbalances does not work and almost always leads to civil disorder. And that stimulus alone does not heal the damage, although it does help to ease the pain if applied correctly.

No, the most important ingredient for a sustained recovery is to reform the abuses that allowed for such a spectacular bubble of excess to exist in the first place. It was all about the misallocation of productive capital and the negative effects of monopolies and financial frauds on the real economy.

At some point this lesson will be burned into our minds by the continuing stagnation of the unreformed economy, even if it is sold as 'the new normal' and not so bad on paper. It will be a living hell for many, and they will eventually push back, and then things will be resolved, one way or the other.

I hope that the new school of economic thought that rises out of the ashes of what we have now is more serious and mature and thoughtful, if not wise. But I have not found many economists capable of such original thinking, even among those who claim to carry the progressive banner.

And certainly not among the ideological schools, who start with an a priori set of premises and then beat reality and torture the market participants to death with them and their supporting statistical and logical fallacies. Since these schools are based on top down principles and assumptions, they are notoriously slow to change and adapt, but often most vociferous and extreme in their arguments, with adherents whose allegiance is less informed by the intellect and an actual understanding of things, and more like a belief system based on stubbornly held slogans and prejudices.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2012 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.