US Unemployment Hits 22.5% in Alternate Estimate

Economics / Economic Statistics Feb 06, 2012 - 12:12 PM GMTBy: Jesse

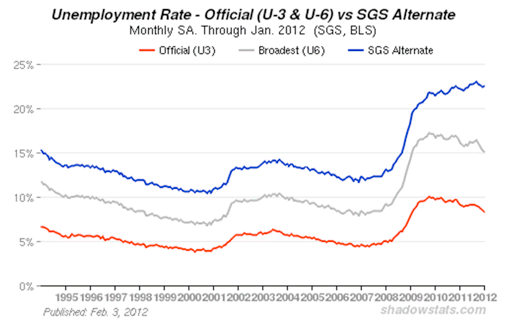

Perhaps this chart will help explain the divergence that Charles Biderman of Trimtabs sees between the official unemployment numbers and the income tax data he has been tracking.

The difference amongst the three measures revolves around the treatment of workers who desire a real full time job, but have to either settle for a part time position and other forms of under-employment that may technically qualify as a 'job' but not as a 'living,' or who have simply been removed from the government's official attention span.

"The seasonally-adjusted SGS Alternate Unemployment Rate reflects current unemployment reporting methodology adjusted for SGS-estimated long-term discouraged workers, who were defined out of official existence in 1994. That estimate is added to the BLS estimate of U-6 unemployment, which includes short-term discouraged workers.

The U-3 unemployment rate is the monthly headline number. The U-6 unemployment rate is the Bureau of Labor Statistics’ (BLS) broadest unemployment measure, including short-term discouraged and other marginally-attached workers as well as those forced to work part-time because they cannot find full-time employment."

Read the rest of John Williams' Shadowstats here.

My own estimation is that the recovery is flat-lining here and is vulnerable to a double dip which, if it does occur, will be blamed on some exterior factor such as slack European demand, problems in the emerging markets, or China. But it is still too soon to tell from the numbers.

In terms of historical perspective, the great reformer Obama is much more like Herbert Hoover or Nelson Rockefeller than a Franklin Roosevelt. He resembles a moderate Republican despite all the hysterical rhetoric from the far right.

The economy has not been reformed, and most of the problems that caused the collapse in the first place are still operating. As the corporate lobbyists were able to weaken financial reform in Dodd-Frank, so they continue to monopolize the conversation and policy discussions with their money.

I do not see genuine change happening until and unless the human misery increases enough to trigger a reaction, mass protests, or some other serious challenge to the status quo and the apathy of the fortunate. And I have quite a bit of confidence that the one percent will continue to obsessively power forward as the economy dries up until they achieve a pyrrhic victory. Winning.

This applies not only to the US but several other western countries, particularly the UK. It is also true for China which despite the gloss of their miracle economy in the western corporate media remains largely a narrow oligarchy sitting on top of a virtual slave labor camp, with a few showcase exceptions. And the western oligarchs love it. As Bill Gates said, 'This is my kind of capitalism.'

By Jesse

http://jessescrossroadscafe.blogspot.comWelcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2012 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.