Gold Demand Heightened by Iranian Action in the Strait of Hormuz

Commodities / Gold & Silver Jan 08, 2008 - 10:36 AM GMTBy: Gold_Investments

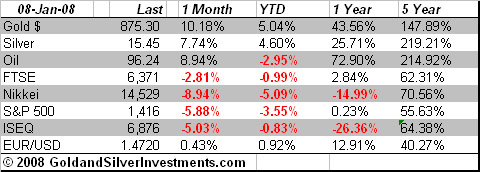

Gold was down $3.70 to $859.30 per ounce in New York and silver was down 14 cents to $15.16 per ounce yesterday. But gold is up sharply in Asia and early European trading and the London AM Fix was at $873.25. While profit taking and consolidation were to be expected gold has continued to surprise to the upside and has reached new record highs. Gold's new historic record beat the previous all-time pinnacle of $868.89 set last Thursday amid unrest in Pakistan, a faltering dollar and as oil struck an historic peak above $100 a barrel.

Gold was down $3.70 to $859.30 per ounce in New York and silver was down 14 cents to $15.16 per ounce yesterday. But gold is up sharply in Asia and early European trading and the London AM Fix was at $873.25. While profit taking and consolidation were to be expected gold has continued to surprise to the upside and has reached new record highs. Gold's new historic record beat the previous all-time pinnacle of $868.89 set last Thursday amid unrest in Pakistan, a faltering dollar and as oil struck an historic peak above $100 a barrel.

At the London AM Fix gold was trading at £441.57 (up from £435.04 yesterday) and €593.81 (up from €580.57 yesterday). Gold thus hit record record all time non inflation adjusted highs in both currencies.

The dollar was marginally weaker and oil was marginally higher and gold's strength is likely due to buying on inflation hedging, credit crisis risk and general macroeconomic and geopolitical risk.

The incident in the strategically vital Straits of Hormuz highlights that geopolitical risk remains heightened. Iran on Tuesday rejected US charges that its naval forces threatened to blow up American ships in the Strait of Hormuz, amid renewed tensions ahead of US President George W. Bush's visit to the region. US defence officials said five speedboats from the naval forces of Iran's Revolutionary Guards menaced three US warships in the strategic waterway on Sunday, radioing a threat to blow them up. US Secretary of State Condoleezza Rice described the incident as "provocative" and "dangerous", amid fears such an insolated encounter could spark a major confrontation between the two foes.

All the major fundamental factors that have resulted in higher gold prices in recent years remain in place and indeed some have intensified and increased. The ETF is the newest mechanism for investors to enter the gold market and this one investment channel alone, the StreetTracks gold ETF, added 300,000 toz (some $261 million) to its position yesterday.

Support and Resistance

Support is at the 50-day moving average at $815.00, the psychological level of $800 and the recent low price in the $775 to $785 range. However, $900 is being cited as a realistic short term target prior to any pullback. Traders like big round numbers (witness $100 a barrel oil) and thus $900 could prove a similar magnet to traders. Even those who have called the market wrong, not understood the fundamentals and been incorrectly bearish on gold in recent months and years are now accepting that gold could reach as high as $1,200 in the near future. "I have to go along with the market trend right now in order to make money." Leonard Kaplan, president of the commodity-trading firm Prospector Asset Management in Evanston, Illinois said that gold "could go to $1,200 an ounce in the short term because of sheer momentum."

Gold's Bull Market Recognised by Major Financial Press

There appears to be a growing realisation internationally that gold's bull market is not a 'flash in the pan' speculative surge but rather a real structural, long term and sustainable bull market. The following very positive gold articles in the FT, the Daily Telegraph and the Wall Street Journal are indicative of this. Some might take these positive articles as a contrary indicator and possibly it could be indicative of a short term top. However given the very strong supply and demand fundamentals and gold's increasing safe haven status and realisation that it is a universal finite currency that cannot be debased by bankers and central bankers any correction will likely be shallow and short.

F T Editorial on Gold

'Gold is the New Global Currency'

"There was a time when gold was money. In today's uncertain world, the yellow metal is back in fashion. Bullion prices rose to a record nominal high after the assassination of Benazir Bhutto in Pakistan added to nervousness about the world economy. Part of gold's allure is its traditional status as a safe haven. It is seen as a store of value when everything else seems risky. . . .

The arguments for further gains in the gold price are compelling. It looks cheap, despite climbing from a low of about $250 a troy ounce in 1999, when central banks were selling reserves. The UK's decision back then to sell 60 per cent of its official holdings looks particularly poor judgment."

Telegraph on Gold

'Flight to gold as investors lose faith in money'

"The last time gold touched $850 an ounce, the world was visibly spiralling out of control. . . . .

In the Middle Ages gold fetched nearly $3,000 an ounce in real terms. The price fell to nearer $550 when Spain flooded the world with Aztec and Inca riches, and there it hovered for three centuries. But the modern era has been an aberration. Supply is exhausted. Perhaps we should now regard the Middle Ages as the proper benchmark price. One thing is certain: gold will outperform paper as long as governments keep increasing the global money supply 15 per cent a year."

Wall Street Journal on Gold

' ETFs Stoke Investors' Gold Fever'

"The single most important thing to understand about the gold price is that it's being driven higher by investment," says Jeffrey Christian, managing director of CPM Group, a commodity-focused financial-services firm in New York. "That investment demand has been pretty broad-based around the world, and it doesn't look like it's close to ending."

Silver

Silver is trading at $15.45/15.47 at 1130 GMT.

PGMs

Platinum was trading at $1540/1544 as per above (1130 GMT).

Palladium was trading at $371/376 an ounce (1130 GMT).

Oil

Oil remains at elevated levels above $95 per barrel and NYMEX light sweet crude oil (FEB08) was trading at $95.76 a barrel. This in conjunction with the surge in commodity prices and particularly food prices is very inflationary.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.