Gold Investor Fantasies Not an Investment Strategy

Commodities / Gold and Silver 2012 Mar 05, 2012 - 04:27 PM GMTBy: Ned_W_Schmidt

While having not read any research into the time devoted by people to fantasizing, we suspect that activity represents a significant portion of the day for many. Morning coffee for men involves the exchange of fantasies surrounding sporting events. We know not what women fantasize about during their coffee, but suspect it might include a discussion of how some man could be made better. While romantic fantasies are beyond our mandate here, we suspect most are more likely to occur than some of the investment fantasies observed in recent years. Fantasies are fine, but they are not investment strategies. Some investment fantasies of recent times have been:

While having not read any research into the time devoted by people to fantasizing, we suspect that activity represents a significant portion of the day for many. Morning coffee for men involves the exchange of fantasies surrounding sporting events. We know not what women fantasize about during their coffee, but suspect it might include a discussion of how some man could be made better. While romantic fantasies are beyond our mandate here, we suspect most are more likely to occur than some of the investment fantasies observed in recent years. Fantasies are fine, but they are not investment strategies. Some investment fantasies of recent times have been:

- Government spending creates prosperity

- Hyperinflation is imminent

- Federal Reserve is running the printing press

- Keynesian economists are better forecasters than airport cab drivers

- QE-1 will produce economic growth

- Inflation is good for Gold and Silver

- Deflation is good for Gold and Silver

- The Sun coming up is good for Gold and Silver

- QE-2 will produce economic growth

- Gold is going to more than $2,000 this year (A perennial favorite)

- Silver is going to more than $100 this year (Another perennial favorite)

- QE-3 is imminent, buy everything

- U.S. dollar is to implode

- Euro is to implode

- Social networking sites are real companies

- CNBC is more informative than the cartoon channel

- Bear market rallies are prices breaking out

- Junior mining stocks are investments

- Apple is a buy at $540, per 54 of 59 analysts

- Iran will not build a nuclear weapon

- Putin is not a threat to world peace

Of the above fantasies, the latter two may be the most important, and most dangerous. Iran, contrary to the fantasies of ruling regime in Washington, seems determined to build a bomb. In first three years after the last U.S. Presidential election, no meaningful effort was expended to reduce the risks to the world of an Iranian nuclear weapon. Only with an election coming in November has the regime taken any substantive action. One has to wonder if the regime is truly opposed to an Iranian nuclear weapon.

Tsar Putin is now in position to start his first six-year term. That peace will reign on the Russian borders for the entire 12 years Putin sits on the throne is probably a fantasy. Putin has already pledged to double defense spending over the next decade.("Putin vows huge boost in defense spending", Financial Times, 21 February) Rarely, if ever, has a nation expended that much on the military without using it.

An Iranian nuclear bomb and the rise of Tsar Putin are indeed reasons to own Gold. Allowing fantasies to dispel the seriousness of these two matters is both naive, and perhaps foolish. Those living in proximity to these two nations and those that live in the potential proximity of the possible radioactive clouds should think seriously about owning Gold. We do, however, recommend holding that Gold in safer locals, such a North America, Hong Kong, or Australia.

While having insurance on our wealth given the above risks is wise, some days may be better than others for buying that insurance. When the hedge fund lemmings are buying madly is certainly not one of those good days to buy Gold. With Silver, which acts like an option on Gold, in a bear market a messages suggesting deferral of purchases for a time might exist for potential buyers of wealth insurance in the form of Gold.

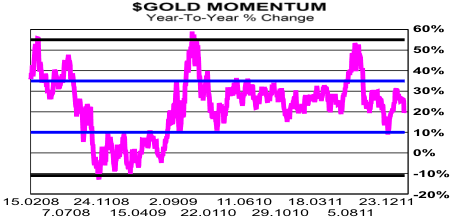

When last we talked Silver's momentum was approaching negative readings, and it will become decidedly negative by the end of this week. $Gold gives a somewhat different picture, and we note a particularly abnormal one. In the above graph is plotted the year-to-year percentage change in the price of $Gold.

$Gold's momentum has moved within two ranges over the past four years. The larger range, solid black lines, is roughly +55% to -10%. The smaller range, solid blue lines, has been +35% to about +10%. In 2008 the larger range was established when $Gold rose more than 50% on the year, and then plunged to 10% below the previous year. That move was fairly natural. Moves as large as +50% in a year are usually followed by some kind of meaningful correction.

Some set of forces has prevented $Gold from correcting in a natural manner. That smaller range, the blue lines, is an abnormality that is setting $Gold up for a correction to remedy those unnatural forces. Should $Gold move down through that smaller range for momentum, the probability of a far more meaningful correction would rise significantly. We may be lucky to see $Gold off only 10% from a year ago.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.